5 Benefits of Implementing Cash Management Software

71% of finance professionals cited manual exposure identification and capture processes as a major challenge due to inefficiency, according to Deloitte's Global Corporate Treasury Survey.

Manual data capturing via spreadsheets or other basic cash management software can mean that it takes hours of work just to get a clear picture of cash flow for the business — making well-informed financial decisions challenging and slow. And as your business grows, manual processes only make effective treasury management slower and more difficult.

Cash management software can help significantly reduce the amount of manual labor required to gather, monitor, and visualize transaction data from multiple accounts in one place.

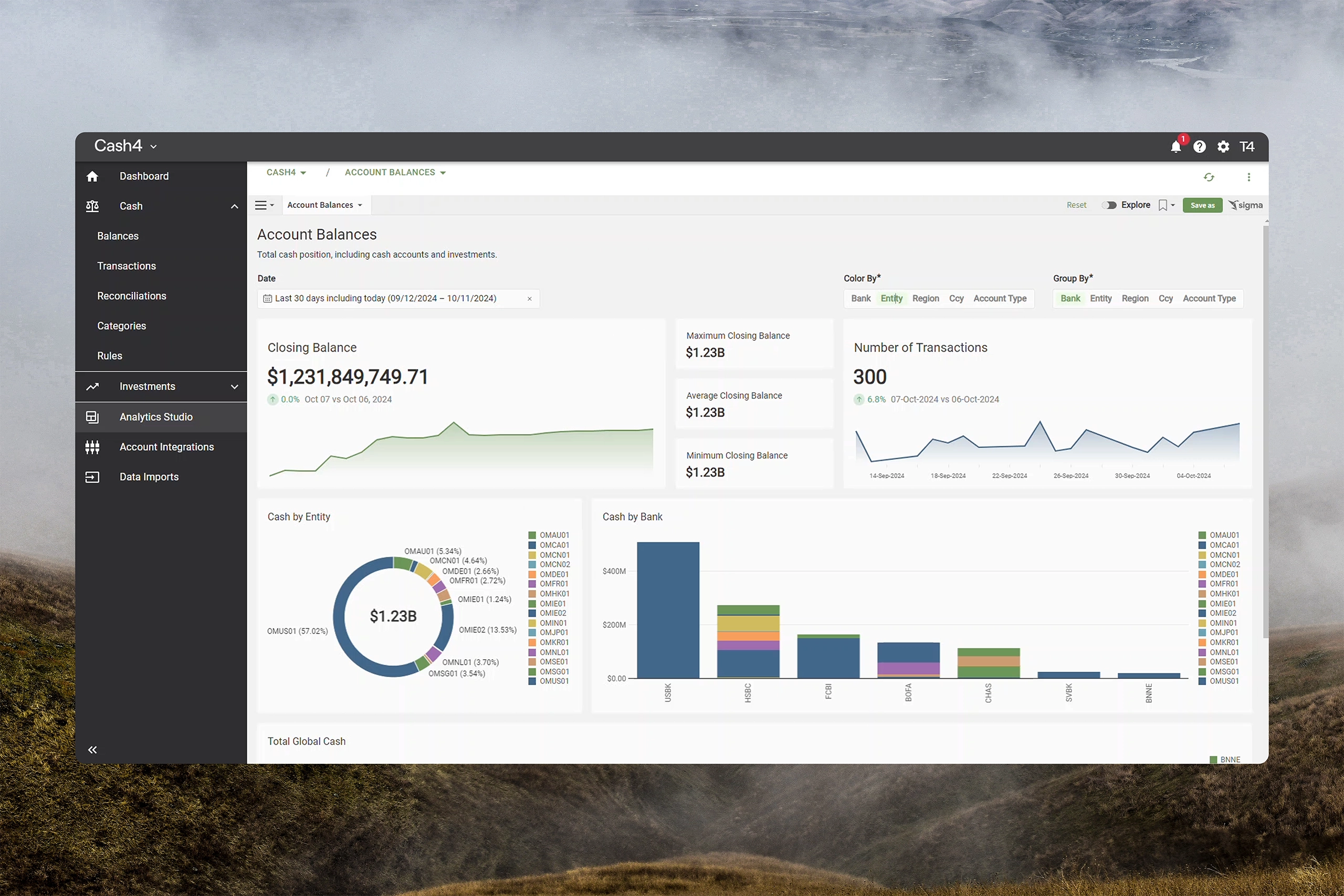

In this article, we’ll explore how cash management software like Cash4 can help your finance team streamline key treasury processes, boost cash visibility and forecasting, improve liquidity management, accelerate growth with advanced analytics, and keep your financial data secure.

#1 Streamline your treasury processes with a cash management software

When every one of your financial processes, from cash and liquidity management to debt, investment, and even compliance and reporting management, requires consulting a distinct set of spreadsheets, it can result in confusing data silos — even if all your financial data is managed by one department.

These fractured processes and data management methods can also make it a real challenge to get a comprehensive idea of your business’s cash flow and liquidity. Worse, reliance on multiple manual processes greatly increases the risk of human error and slows down decision making.

Implementing cash management software can streamline these processes, offering a centralized platform for managing cash and liquidity positions across multiple entities, accounts, counterparties, and currencies. By consolidating data from various sources, cash management software provides finance teams with a comprehensive view of their organization's cash flow, enabling them to make fast, informed decisions and optimize their working capital.

By automating and simplifying traditionally complex, manual workflows, cash management software accelerates treasury professionals’ day to day work while significantly reducing human error that naturally occurs with manual data entry and reconciliation processes. Finance professionals can quickly access up-to-date information, enabling them to respond promptly to changing market conditions or operational requirements.

#2 Improve cash visibility and forecasting

Cash flow forecasting is an indispensable process for finance teams as it offers a comprehensive view of an organization's future cash position. Accurate forecasting allows businesses to anticipate potential cash shortfalls or surpluses, enabling teams to make informed decisions about investments, borrowing, or implementing cost-cutting measures.

With traditional spreadsheet-centric processes, cash forecasting can be time-consuming, and often inaccurate. As with any process that requires manual data input, forecasting with spreadsheet data can be outdated and fail to reflect the latest financial data or changes in business conditions. Manual forecasts are also much less frequently completed simply due to the time and effort required.

Using a cash management software solution with built-in analytics tools, such as Cash4, can address these challenges and facilitate more accurate financial planning. With automated data aggregation from various sources, your team can be assured that cash forecasts are based on the latest information.

Cash forecasts can also be generated quickly and frequently, turning them into more reliable tools for finance leaders. Solutions that offer more advanced analytical capabilities, such as scenario analysis and predictive modeling, will also enable finance teams to generate more reliable cash flow projections based on historical data and future assumptions.

Even better, cash management software often integrates with other financial systems, providing a holistic view of an organization's cash position across multiple entities, accounts, banks and currencies. This level of visibility allows finance teams to identify potential cash flow issues proactively and take necessary actions to mitigate risks or capitalize on opportunities.

#3 Keep cash accessible with better liquidity management

Maintaining liquidity is paramount for businesses to ensure the smooth functioning of daily operations and seize growth opportunities as they arise. Adequate liquidity allows organizations to meet their financial obligations, invest in new projects, and navigate through economic fluctuations.

Successful liquidity management is dependent timing — excess cash should be appropriately invested to earn return, and teams must be able to convert funds into cash when the need arises.

With manual financial processes, treasury teams often lack real-time visibility into an organization's cash positions across multiple accounts at various financial institutions. This fragmented view can lead to inaccurate liquidity assessments, potentially resulting in missed investment opportunities or cash shortfalls.

Manual data entry and reconciliation processes via spreadsheets are also prone to errors, further compounding the challenge of maintaining reliable liquidity insights.

Cash management software should provide a comprehensive streamlined solution to address these challenges. By consolidating financial data from various sources, these solutions offer a centralized view of an organization's liquidity position across multiple accounts, currencies, banks, and entities.

By investing in a solution that offers advanced analytics and forecasting capabilities, finance teams can also better project future cash flows and liquidity positions based on historical data and projected scenarios. This proactive approach empowers businesses to anticipate potential liquidity issues and take corrective actions, such as adjusting investment strategies or securing more sources of funding.

#4 Employ advanced analytics to accelerate treasury operations

Data analysis is a key component for optimizing any business operation, and finance processes are not exempt. Advanced analytics can help treasury teams uncover new opportunities for investments, cost-savings, and revenue streams, all of which can have drastic effects on long-term growth and profitability.

Performing these analyses with your finance and cash flow data stored on various spreadsheets, however, can be slow at best and incomplete and inaccurate at worst.

The cash management software you choose should address these challenges by providing finance teams with powerful analytical tools and streamlined workflows. They can easily integrate Cash4 with various data sources, automating the process of data aggregation and ensuring that analyses are based on accurate and up-to-date information. It also offers easier, faster paths to more advanced analyses such as predictive analytics, and data visualization, allowing finance teams to explore different scenarios, identify patterns and trends, and communicate insights effectively.

Cash4 also offers built-in collaboration and reporting features, which empower finance teams to securely share their analyses and insights seamlessly with stakeholders across the organization. This collaborative approach fosters informed decision-making and facilitates the implementation of strategic initiatives based on data-driven insights.

#5 Secure your treasury data

Data leaks and breaches are a nightmare scenario for any business. When it comes to financial data, security is essential to any processes and solutions you implement.

Mishandling this data can result in major financial losses, regulatory penalties, and more. Treasury teams that rely on spreadsheet-driven processes can put their data at risk simply by storing it on an unsecured device or emailing the wrong file to the wrong person.

Utilizing cash management software, such as Cash4, can significantly reduce the risks of a data leak. In addition to industry-standard encryption protocols, users will only have access to the data they need based on the role they’ve been assigned, so sensitive information will always be inaccessible to unauthorized parties.

Cash4 and Treasury4 also provide audit tracking and dual control, which requires approvals from a secondary role for certain changes. With all data transmissions securely automated and encrypted, storing and moving data poses far less risk to your organization.

By implementing cash management software, finance teams can achieve a balance between security and accessibility, ensuring that financial data remains secure while enabling authorized personnel to access the information they need to perform their duties efficiently.

Transform your treasury management with Cash4

Cash management software can help finance teams reduce their reliance on disparate spreadsheets and processes, elevate cash forecasting and liquidity management, provide advanced analytics, and ensure the security of your sensitive financial data.

Does your treasury team need to level up its cash management? With Cash4, you can:

- Eliminate bank portal downloads

- Leverage automated rule-based categorization

- Research transactions in just one click

- Create interactive cash flow reports

- Get integrated investments reporting

- Visualize cash flow data

With Cash4, you can have a robust cash management solution live with production data in days, and get it connected to your banks for automated data feeds in as little as a week.