7 Tricks of the Trade to Enhance Your Cash Reconciliation Process

Treasury professionals know that cash reconciliation is an essential part of cash flow management for any organization. It shows the company’s cash position, identifies errors or fraud, and allows management to make informed, strategic decisions based on the most up-to-date information.

Unfortunately, the cash reconciliation process comes with several common hurdles that CFOs and treasurers must constantly deal with. And if you’re not careful, these issues can quickly snowball into larger financial risks.

Today, we’ll share several actionable tips to improve your cash reconciliation process.

First, let’s look at the most common pain points of the cash reconciliation process—and how they can create even larger problems.

Key Challenges in Cash Reconciliation

Cash reconciliation is the process of making sure your company’s financial records match up with actual bank balances. And it can come with several challenges, including:

- Manual errors: Many treasurers rely on manual data entry for their cash reconciliation. But this increases the risk of mistakes—including typos, incorrect balances, and missed steps—which can lead to major discrepancies in the results.

- Time-consuming processes: Manual reconciliation processes can take hours or even days to complete—especially if there are many transactions or data is spread across different systems.

- Lack of real-time data: Treasurers are often forced to rely on outdated reports and spreadsheets, which limits their ability to make prompt, informed decisions.

The good news is that there are strategies to overcome these challenges. Let’s look at some of the most effective ones.

1.Use Automation

Automating your cash reconciliation is one of the most effective ways to optimize the process. It minimizes the manual workload, reduces errors, and accelerates the entire workflow.

Here’s how automation can transform your process:

- Integrated data: Automation tools can integrate your bank accounts, accounting systems, and financial records into a single platform, giving you a centralized view of all your data.

- Reduced errors: With automation, there's no need to manually match transactions or reconcile balances, reducing the chances of mistakes and inconsistencies.

- Faster results: Automation speeds up the reconciliation process dramatically. Tasks that used to take hours to complete can now be done in minutes.

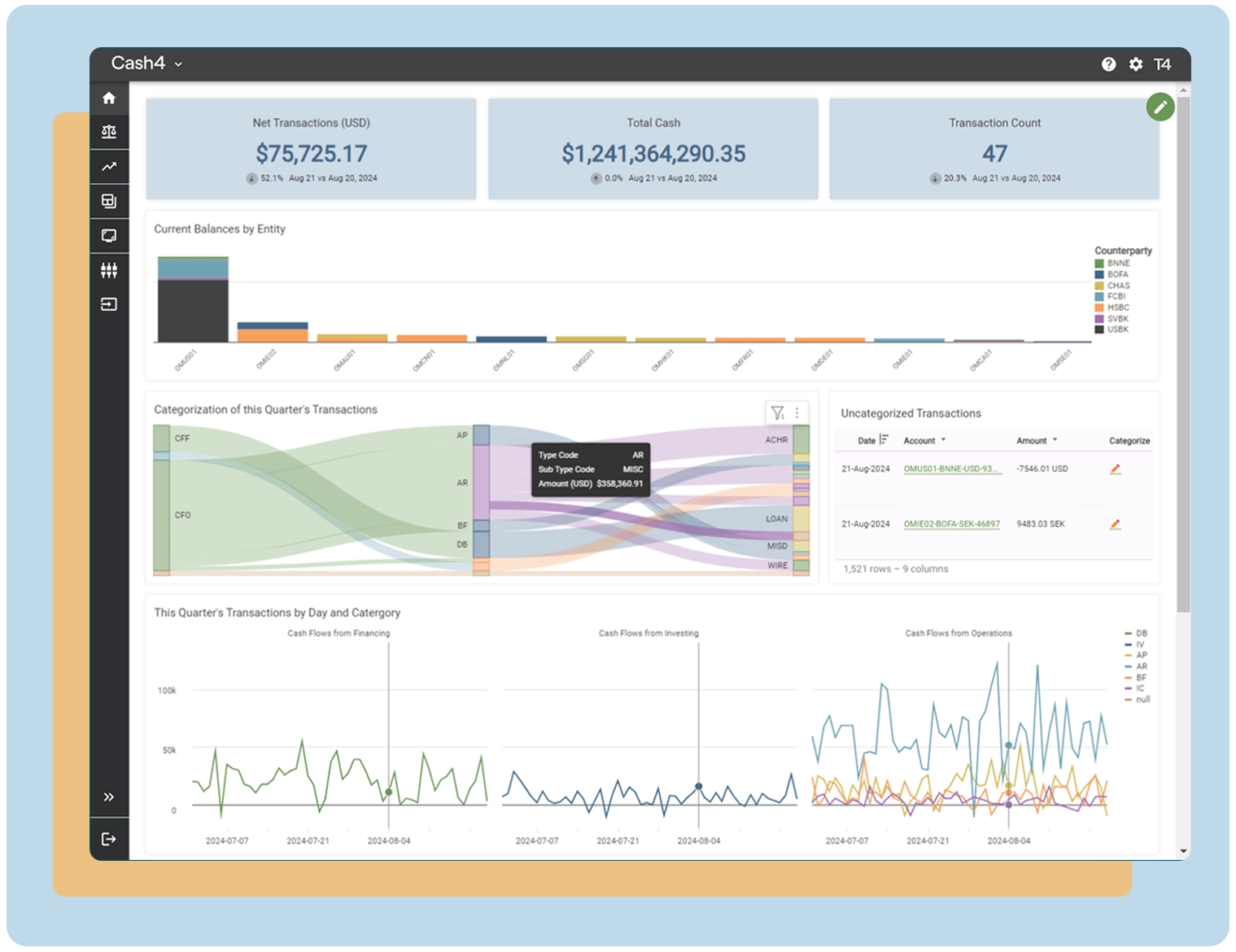

Treasury4’s automation features provide near real-time visibility into your cash position, ensuring better accuracy and freeing up your finance team to focus on more important duties.

Scalability is another key feature of Treasury4. As your business grows, so does your financial transactions. With a scalable solution, your reconciliation process evolves effortlessly—and automatically—alongside your operations.

Gain an unparalleled, multi-dimensional view of your financial position with Treasury4’s entity-based approach

2. Create Clear Guidelines

Inconsistent practices across departments can lead to confusion and errors in your reconciliation process.

Consider creating a step-by-step guide that clearly defines the reconciliation process. Include which systems to use, how to verify transactions, and how to resolve discrepancies. Make sure this guide is used by any team member involved in the process.

Treasury4 can help standardize your cash reconciliation process by enabling custom workflows so that everyone follows the same procedures. Having a structured, repeatable process ensures consistency and reduces the risk of errors or discrepancies.

3. Use Templates to Ensure Nothing Is Overlooked

Using standardized templates for various parts of the reconciliation process ensures every step is being carried out properly.

Types of templates to consider:

- Checklists: A checklist of steps can help guide users through the reconciliation process, from initial data matching to final approval.

- Transaction-specific templates: Develop templates tailored to several types of reconciliations (for instance, daily cash transactions vs. monthly account balances).

- Discrepancy resolution templates: Having a template specifically for addressing discrepancies ensures that these issues are tackled systematically and consistently.

Treasury4’s customizable templates allow you to create tailored solutions for your organization’s unique needs, ensuring every task is completed to satisfaction.

4. Move to Daily or Weekly Reconciliations

Monthly reconciliations can create a backlog of discrepancies that pile up over time. By moving to daily or weekly reconciliations, you can catch errors early and resolve them before they grow into larger issues.

Keeping your accounts reconciled more often reduces stress (and bottlenecking) at the end of the month.

Treasury4’s user-friendly interface improvises the reconciliation process, making it easy to manage as often as you want.

5. Monitor Key Accounts Closely

Not all accounts require the same level of attention. Make sure you give particular focus to accounts with high transaction volumes or frequent fluctuations. This way, you can make sure they're reconciled accurately and efficiently.

Treasury4 offers advanced reporting capabilities that allow you to set up custom alerts and track key accounts in real time. By watching these accounts closely, you can find issues before they escalate.

Analyze Discrepancies and Trends to Refine Your Process

Discrepancies will inevitably arise, but tracking and analyzing these issues over time can help you spot patterns, identify root causes, and implement preventive measures.

Here are some best practices for analyzing discrepancies:

- Determine whether certain accounts or types of transactions are more prone to errors and address these trends.

- Perform root cause analysis. Don’t just resolve discrepancies—investigate why they occurred in the first place. Understanding the root cause allows you to fix underlying issues and refine your process, rather than reacting to problems after they’ve occurred.

With Treasury4’s detailed, customizable reporting features, finance teams can track discrepancies, show recurring issues, and gain valuable insights into their root causes.

6. Analyze Discrepancies and Trends to Refine Your Process

Discrepancies will inevitably arise, but tracking and analyzing these issues over time can help you spot patterns, identify root causes, and implement preventive measures.

Here are some best practices for analyzing discrepancies:

- Determine whether certain accounts or types of transactions are more prone to errors and address these trends.

- Perform root cause analysis. Don’t just resolve discrepancies—investigate why they occurred in the first place. Understanding the root cause allows you to fix underlying issues and refine your process, rather than reacting to problems after they’ve occurred.

With Treasury4’s detailed, customizable reporting features, finance teams can track discrepancies, show recurring issues, and gain valuable insights into their root causes.

7. Use Accurate Documentation to Simplify Audits

Documenting every step of the reconciliation process is crucial—both for day-to-day operations and to be prepared for audits.

For one thing, it enhances transparency and allows stakeholders to feel confident in the data.

For another, properly documenting discrepancies—including their root causes and how they were resolved—makes audits more efficient and ensures compliance with regulatory requirements.

Take Control of Your Cash Reconciliation Process

Accurate cash reconciliation is crucial for every organization. The tips in this article can help address your pain points and refine your cash reconciliation process.

With a centralized platform that integrates with your bank accounts, accounting systems, and financial records, Treasury4 offers near real-time updates and data transparency. This minimizes errors and ensures more reliable cash management across the organization.

Start automating your cash reconciliation with Treasury4. Schedule a demo today and discover how our TMS can help you save time, reduce errors, and enhance your cash management strategy.