Best Practices for Accurate Cash Flow Forecasting

Accurate cash flow forecasting is a cornerstone of business success. Without a reliable forecast, businesses may struggle with cash shortages, excessive borrowing costs, or missed investment opportunities.

In fact, according to SCORE.org, 82% of small businesses fail due to problems with cash flow management.

By improving forecasting accuracy, treasurers can optimize working capital, reduce financial risk, and support strategic decision-making.

But accurately forecasting cash flow is easier said than done—treasurers face several challenges in creating an accurate forecast.

Fortunately, by implementing forecasting best practices and leveraging technology, treasurers can overcome these hurdles.

In this article, we’ll examine several strategies and tools that can enhance cash flow forecasting accuracy.

But first, let’s take a closer look at the importance of cash flow forecasting and the most common challenges in creating an accurate forecast.

Understanding cash flow forecasting

Cash flow forecasting involves projecting a company’s future financial position by analyzing expected cash inflows and outflows over a specific period.

The primary purpose of cash flow forecasting is to ensure sufficient liquidity to meet financial obligations, optimize the use of surplus cash, and mitigate risks associated with cash shortages or excess reserves.

To develop an accurate cash flow forecast, treasurers must monitor several key financial metrics, including:

- Cash inflows: Revenue from sales, accounts receivable collections, investment income, and external financing.

- Cash outflows: Operating expenses, supplier payments, payroll, debt repayments, and capital expenditures.

- Net cash position: The difference between total inflows and outflows, indicating whether a company has sufficient liquidity.

- Working capital: The difference between a company's current assets and liabilities, representing the funds available for day-to-day operations.

Common Challenges in Cash Flow Forecasting

When it comes to creating an accurate cash flow forecast, treasurers face a slew of challenges, from the organizational level to the macroeconomic level. Here are some of the most common issues:

Market volatility and economic uncertainty

Market conditions can shift rapidly due to inflation, geopolitical events, or global supply chain disruptions.

The resulting volatility can create uncertainty in cash flows, making it difficult for treasurers to produce reliable forecasts.

Companies with global operations must also account for currency fluctuations that can impact cash reserves and financial planning.

Data accuracy and integration issues

The accuracy of a forecast depends on the quality of the financial data it’s based on.

Many organizations struggle with fragmented systems. Critical data is often siloed across various departments or stored in spreadsheets that must be manually updated. This can lead to outdated, inconsistent, or erroneous data.

What’s more, tracking down and integrating all the necessary data can delay the forecasting process.

All of this can impact forecast accuracy.

Changing interest rates and regulatory factors

Fluctuations in interest rates directly impact borrowing costs, investment returns, and overall liquidity.

What’s more, evolving financial regulations, such as tax law changes and banking compliance requirements, can affect cash flow management strategies.

Best Practices for Accurate Forecasting

To enhance the accuracy of cash flow forecasts, consider the following best practices:

1.Leverage historical data

- Use past trends to predict future cash flows: Examining historical cash flow trends can provide insights into revenue patterns, expense cycles, and other financial behaviors that impact liquidity planning.

- Identify seasonal patterns and anomalies: Many businesses experience seasonal variations in cash flow. Recognizing these trends allows treasurers to anticipate periods of high or low liquidity and adjust cash reserves accordingly.

2.Utilize Advanced Analytics & AI

- Predictive modeling and machine learning: Advanced analytics tools can incorporate historical data, external market conditions, and statistical models to improve forecasting accuracy. Machine learning algorithms refine predictions over time by continuously learning from new data.

- Scenario planning and stress testing: Treasurers can simulate various economic scenarios (for instance, a recession, supply chain disruption, or regulatory change) to assess their potential impact on cash flow. Stress testing helps organizations prepare contingency plans and mitigate financial risks.

3.Enhance data integration

- Centralize data from multiple sources: Integrating financial information from disparate sources and systems into a single source of truth allows treasurers to get a complete picture of the company’s financial health.

- Real-time data updates for better accuracy: Using real-time data feeds helps ensure forecasts are based on the latest financial information, allowing for quick strategic decision-making and timely adjustments as business conditions change.

4.Cross-departmental collaboration

- Work closely with finance, procurement, and sales: Treasury forecasts are more accurate when they incorporate input from multiple departments. For example, procurement teams can provide insights into supplier payment schedules, while sales teams can contribute projections on revenue growth.

- Align treasury forecasts with corporate strategy: By incorporating long-term business objectives into the forecasting process, you can align cash strategies with corporate goals.

Tools and Technologies for Cash Flow Forecasting

Advancements in financial technology have significantly improved cash flow forecasting capabilities. Some of the most effective tools include:

Treasury Management Systems (TMS)

A TMS can automate cash flow forecasting by aggregating data from multiple sources, tracking financial transactions, and generating real-time reports. These systems improve efficiency, reduce manual errors, and enhance visibility into liquidity management.

AI-driven forecasting tools

Artificial intelligence solutions can analyze large datasets to identify patterns and predict future cash flows. These tools continuously learn from new data inputs, improving forecast accuracy over time.

ERP and banking data integration

Linking ERP systems with banking data gives treasurers a complete view of an organization’s financial transactions. This ensures consistency across financial records and allows for more accurate forecasts.

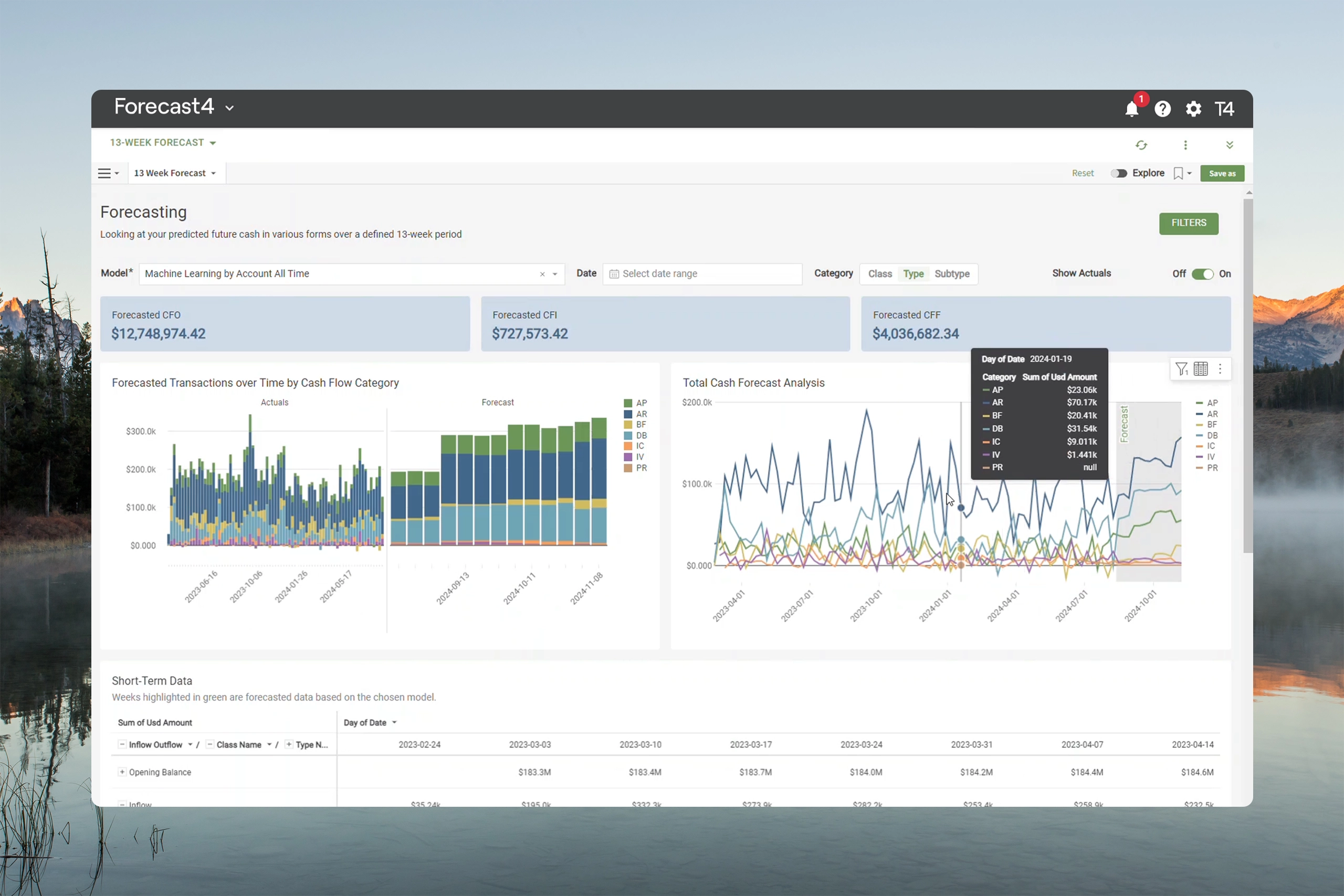

Treasury4 provides all of these solutions in one easy-to-use platform. Watch the demo to see how it works.

Conclusion

Accurate cash flow forecasting is essential for organizations to navigate financial uncertainties, optimize liquidity, and achieve growth goals.

By adopting the best practices and leveraging the technology mentioned above, treasurers can significantly enhance cash flow forecasting accuracy.

Learn how Treasury4 can help your business achieve more accurate forecasts.