Posts by Dona Bhattacharjee

Best Practices for Accurate Cash Flow Forecasting

Accurate cash flow forecasting is a cornerstone of business success. Without a reliable forecast, businesses may struggle with cash shortages, excessive borrowing costs, or missed investment opportunities. In fact, according to SCORE.org, 82% of small businesses fail due to problems with cash flow management. By improving forecasting accuracy, treasurers can optimize working capital, reduce financial…

Read MoreOvercoming Common Challenges of Cash flow Forecasting

If you were to view almost any industry poll of CFOs and corporate treasury teams about their top challenges, you’d see that challenges of cash flow forecasting is consistently in the top 3 concerns for treasury professionals. According to a study by Censuswide, nearly half (49%) of financial executives are concerned inaccurate cash flow data…

Read MoreLeveraging Data for Treasury Decisions: A Single Source of Truth

Treasury operations are more complex than ever before. Treasurers must deal with everything from cash and liquidity management to compliance and risk reduction—all across multiple global entities. Adding to these challenges is the issue of siloed data. With accounts across multiple banks, departments, and entities, treasurers are often tasked with tracking down, compiling, and comparing…

Read MoreThe Evolution of Treasury KPIs: 6 Metrics That Matter in 2025

Business and financial landscapes are constantly evolving—and with them, the function of the treasurer’s office. In years past, the treasurer’s responsibilities focused primarily on cash management and liquidity oversight. But today, the modern treasurer role has developed into one of a strategic partner responsible for driving business growth. As the treasurer’s responsibilities have grown, so…

Read More5 Key Trends in Legal Entity Management and Compliance in 2025

As we enter 2025, several new trends are taking shape in the world of legal entity management and compliance—and treasurers must be prepared to adapt. Driven by digital transformation, changing regulations, and an evolving global business environment, legal entity management and compliance have never been more complex—or more critical. Staying ahead of these developing trends…

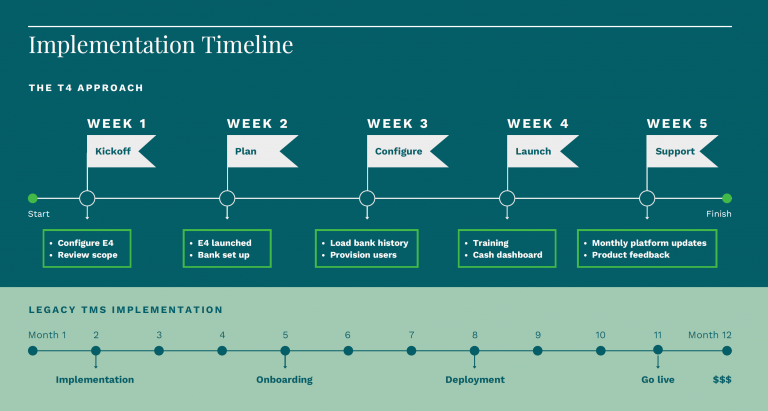

Read MoreQuick Implementation of Treasury Software Without Spending Hefty $$$

Treasury management is the backbone of an organization’s financial health. The treasury team is responsible for optimal cash flow, risk management, and operational efficiency. However, quick implementation of treasury software often feels like an uphill battle. Legacy systems demand months, if not years, of customization, integration, and training—not to mention exorbitant costs. In today’s fast-paced business…

Read MoreSelecting a Cloud Treasury Management System: Checklist and Q&A with Industry Experts

In today’s modern treasury landscape—where companies are looking for efficient, scalable ways to manage global cash flow, liquidity, and financial risk—traditional treasury management system(TMS) no longer cut it. Instead, finance leaders are moving toward cloud-native treasury management solutions. Unlike traditional TMS, these cloud-based platforms provide access to real-time financial data, streamline workflows, and improve decision-making. …

Read MoreBuilding a Resilient Global Cash Management Strategy

As more and more businesses scale into foreign markets, treasurers’ responsibilities have expanded significantly as organizations prioritize global cash management. According to Harvard Business Review, between 1990 and 2016, “the total assets of multinational corporations increased 25-fold to $112 trillion, and the number of people employed by foreign affiliates quadrupled to 82 million.” Unsurprisingly, that…

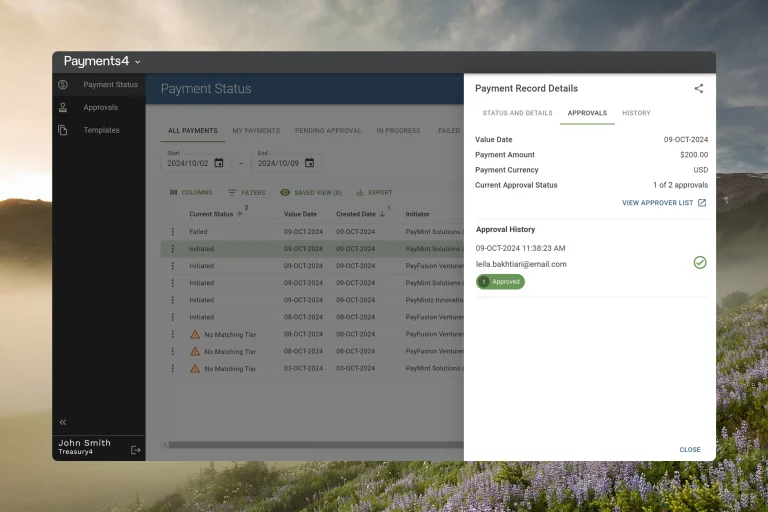

Read MorePayments4: A Complete Treasury Solution

As financial operations become more complex, treasury teams face growing challenges in managing payments. Traditional payment processes often fall short of addressing these challenges. Outdated systems lack the transparency, speed, and security required to manage low-volume, high-value transactions—leading to inefficiencies, manual errors, and increased fraud risks. Modern treasurers need modern solutions. That’s where Payments4 comes…

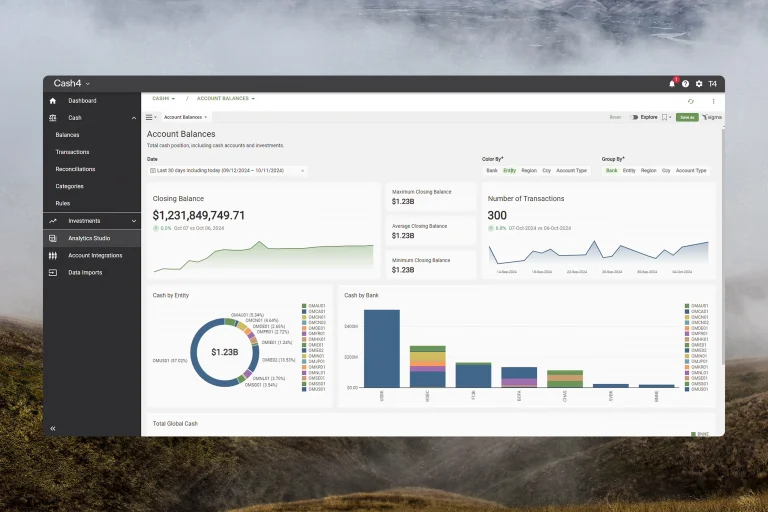

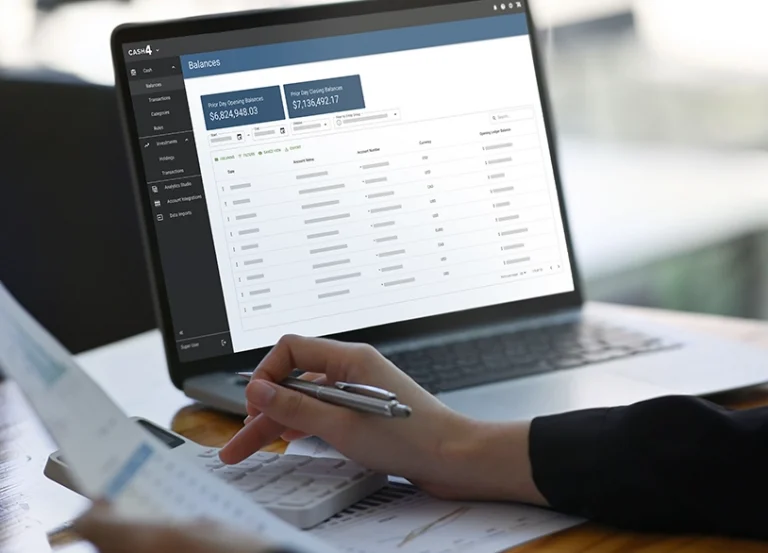

Read MoreCash Management with Powerful Cash4 reporting

When it comes to traditional cash management tools, treasurers face a slew of challenges. Manual processes and static spreadsheets create inefficiencies, are prone to errors, and lack real-time insights. These obstacles make it difficult to get a comprehensive picture of the organization’s financial position and make informed, strategic decisions. Treasury teams need modern, dynamic tools…

Read More