Why Automatic Transaction Categorization Is Vital for Your Treasury Management

For treasury professionals and finance leaders alike, transaction data makes up the foundation for many of their key decisions. It’s why we spend so much time and effort on cash reconciliation, generating cash flow reports, and calculating cash forecasts. These vital tasks are often made challenging by disorganized categorization.

This can be due to inconsistencies of bank data from various institutions, countries or owners with differing goals for the categorization often, resulting in confusing, non-standardized transaction data for businesses.

Categorizing this data is key to many vital analyses and forecasts for finance departments, so investing in a treasury management platform that provides automated categorization of each transaction, based on rules that your team can determine, can be game changing for your organization.

What is Transaction Categorization?

Transaction categorization is a systematic approach to automatically classify financial transactions into predefined categories based on specific criteria or rules. This method uses a set of predefined conditions to analyze transaction details such as descriptions, amounts, dates, and other metadata to assign each transaction to the most appropriate category.

Automated categorization provides essential context to transaction data by organizing it into meaningful groups. This context allows treasury teams and finance leaders to quickly understand the nature and purpose of each transaction without manually reviewing every entry.

For example, transactions can be categorized into groups such as:

- Operating Expenses

- Capital Expenditures

- Revenue

Some treasury teams may add more specific subcategories like "Raw Materials" or "Software Subscriptions” to add further context. By delivering this context, automated categorization significantly enhances the ability to make informed decisions and gain deeper insights into a company's financial standing. Here's how:

- Improved cash flow analysis. Categorized data enables more accurate and detailed cash flow forecasting, helping teams identify trends and patterns in spending and revenue.

- Enhanced budgeting and planning. With transactions properly categorized, it's easier to compare actual expenses against budgets and make necessary adjustments.

- Faster financial reporting. Automated categorization streamlines the process of generating financial reports, reducing manual work and potential errors.

- Better expense management. Finance leaders can quickly identify areas of high spending and opportunities for cost optimization.

By leveraging automated transaction categorization in their treasury management platform, treasury teams can gain the full story of their cash flows from viewing transaction data — that is, not just information on how much was spent or earned, but why. This additional level of insight leads to more informed strategic decisions and a clearer understanding of the company's financial health.

Why Transaction Categorization is the Key to Better Cash Forecasting

Transaction categorization in a treasury management system significantly enhances the accuracy and depth of cash forecasting by providing structured, consistent data. When transactions are automatically categorized, patterns and trends in cash flows become more apparent, allowing for more precise predictions of future financial positions.

This categorization process creates a standardized dataset where similar transactions are grouped together, reducing noise and highlighting meaningful financial movements. For example, recurring expenses like rent or regular revenue from key customers can be easily identified and projected forward.

This structured approach enables treasury teams to develop more nuanced forecasting models that account for the specific behaviors of different cash flow categories.

Categorized data also allows for more granular analysis of cash flows. Instead of looking at aggregate inflows and outflows, treasurers can examine forecasts for individual categories such as accounts payable, payroll, or specific revenue streams.

This detailed view enables the identification of potential cash shortfalls or surpluses in particular areas of the business, enabling more targeted and effective cash management strategies.

When it comes to training machine learning models for forecasting purposes, categorized transaction data proves far more effective than raw, uncategorized data. Machine learning algorithms thrive on structured, consistent data, and automatic categorization provides exactly that.

Each category of transactions becomes a distinct feature that the model can learn from, allowing it to identify complex patterns and relationships within the data. With categorized data, machine learning models can more easily detect correlations between different types of cash flows.

For example, a model might learn that an increase in marketing expenses typically leads to a rise in sales revenue after a specific time lag. These insights, which might be difficult to spot in uncategorized data, can significantly improve forecast accuracy.

Categorized data also enables the creation of more sophisticated ensemble models, where separate forecasts are generated for each category and then combined for an overall prediction. This approach often yields more accurate results than trying to forecast total cash flow as a single entity.

Accurately categorized transaction data is key to producing high-quality cash forecasts — but manually categorizing every transaction is tedious. While treasury teams can often download categorized transaction data from individual bank portals, data from different accounts are likely to be categorized differently and can require just as much manual work to standardize into a dataset usable for machine learning.

With a treasury management platform that automatically categorizes transaction data across all accounts according to a single set of rules, treasury teams can automatically collect the high-quality data they need for forecasting.

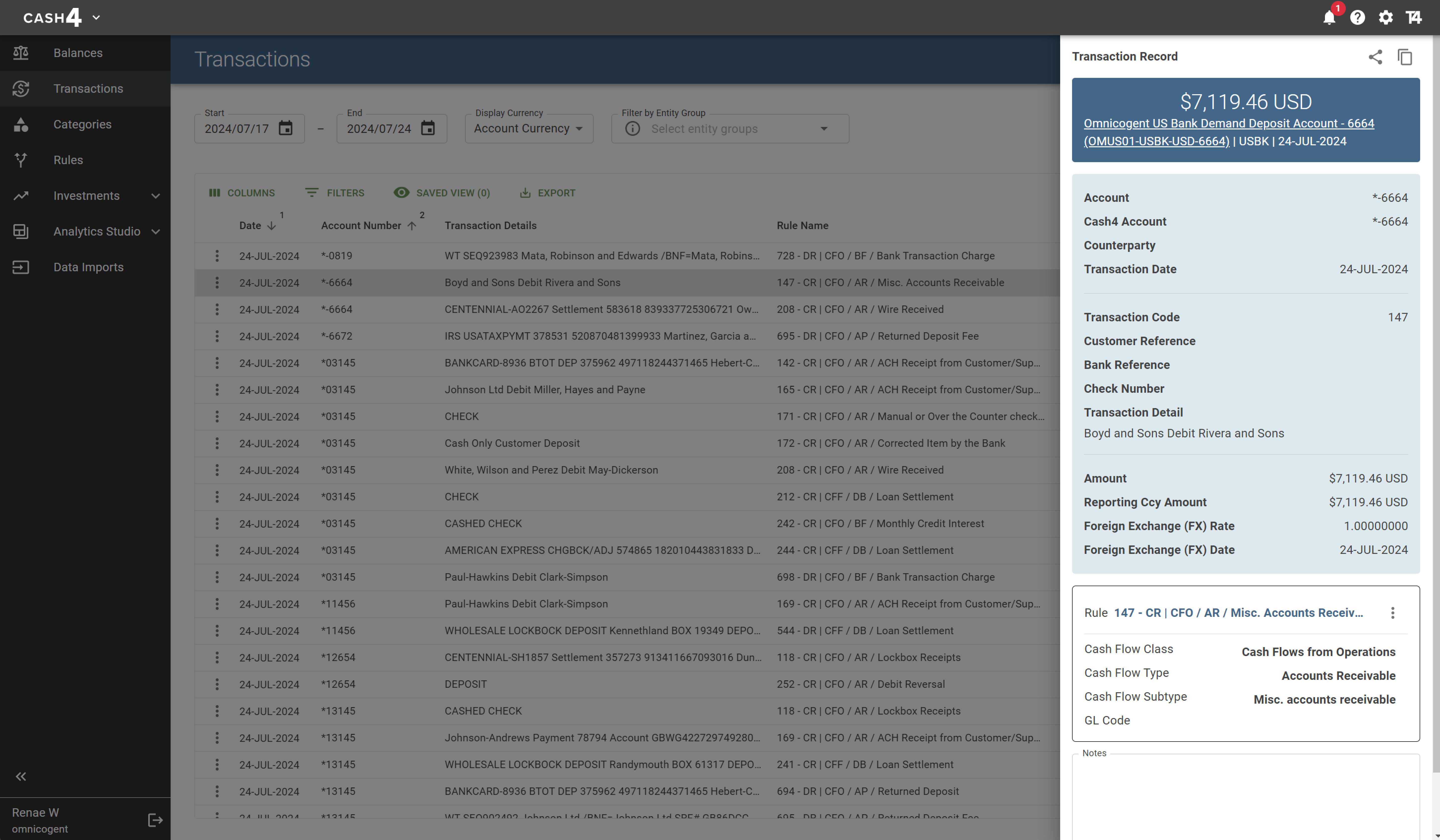

How Transaction Categorization Works in Treasury4

Many traditional TMS platforms have the concept of transaction categorization, but it’s often limited to one or two categories and not constructed as a hierarchy. While this simple categorization can help treasurers make sense of their transaction data at a basic level, it’s often not detailed enough for forecasting or more complex analysis.

Treasury4 was built by and for treasury professionals and finance leaders — and as such, provides automatic transaction categorization as a matter of course to its users. Every transaction posted to a bank or other financial account is assigned to a particular business definition that aligns to the accounting Statement of Cash Flows.

This categorization:

- Enables precision reporting and analytics at treasurers’ fingertips

- Providing vital financial context for decisionmakers

- Makes transaction reconciliation to the general ledger more efficient and effective

- Uncovers patterns and outliers in transaction data

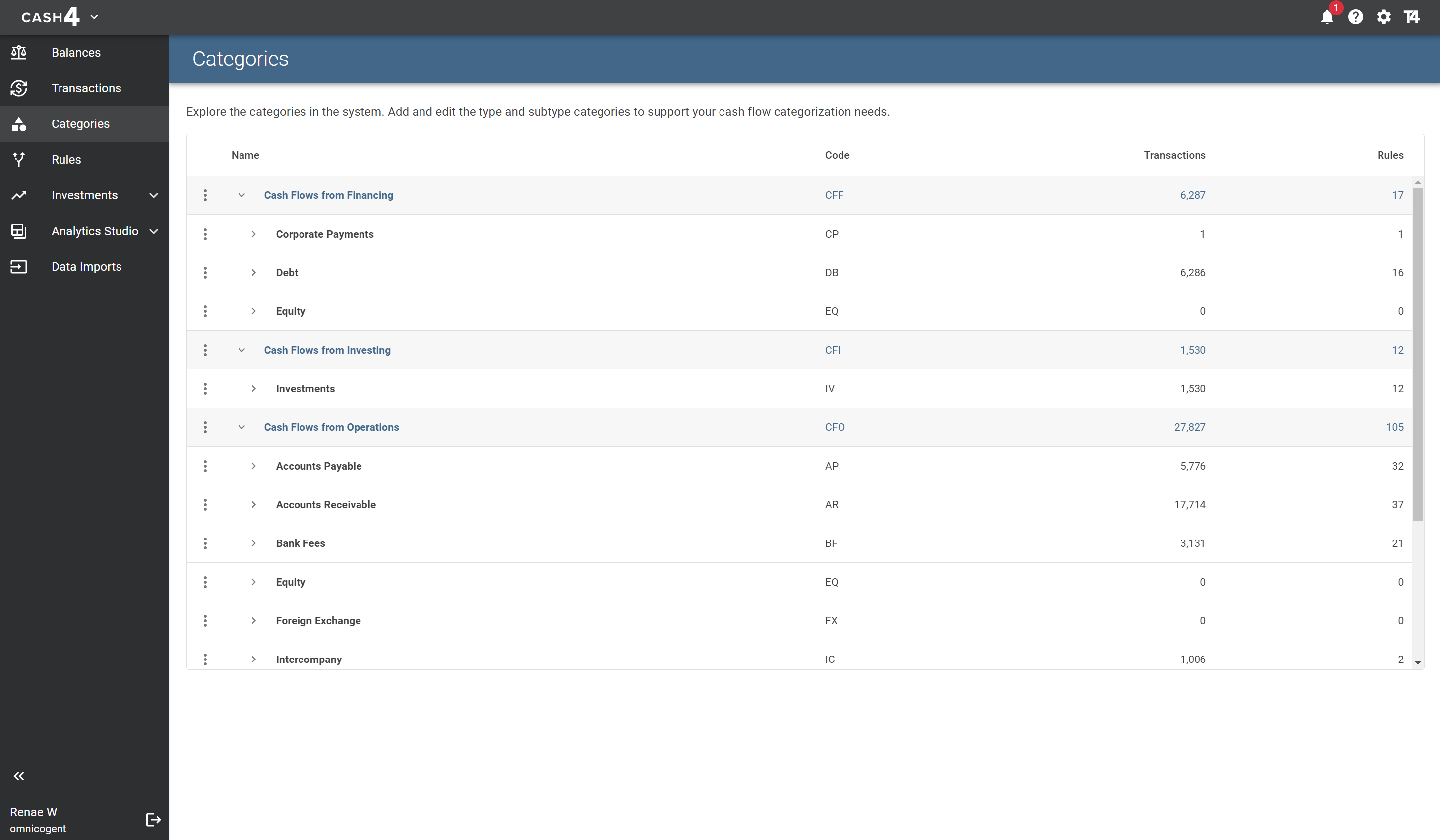

Treasury4’s categorization engine assigns a four-level hierarchy definition to every transaction reported on a bank statement.

Level 1: Cash Flow Class (CFC)

This category type identifies whether the transaction is an Operating (CFO), Investing (CFI), or Financing (CFF) cash flow which aligns to the accounting Statement of Cash Flows (SoCF). Assigning cash flow class allows treasurers to calculate Operating Cash Flow (OCF) and Free Cash Flow (FCF) on a pure cash basis. The CFC is unique to Treasury4’s platform, and not provided by any other treasury management platforms.

Level 2: Cash Flow Type (CFT)

The cash flow type is usually a major category type such as:

- Accounts payable

- Accounts receivable

- Payroll

- Taxes

- Intracompany

- Intercompany

- Debt issuance/borrowing

- Equity issuance/repurchase

- Capital expenditures

Level 3: Cash Flow Subtype (CFST)

This is typically a subcategory of a CFT type. For example, a Payroll CFT would have subcategories such as:

- Net Payroll

- Payroll tax

- 401K

- Employee benefits

Level 4: General ledger account

This category ties the transaction to the general ledger account that a transaction is reconciled to in the accounting or ERP system.

With Treasury4, you can also create your own categorization rules so that all transactions are labeled according to your business’s specific standards and requirements. To learn more, request a demo today.