Building a Resilient Global Cash Management Strategy

As more and more businesses scale into foreign markets, treasurers’ responsibilities have expanded significantly as organizations prioritize global cash management.

According to Harvard Business Review, between 1990 and 2016, “the total assets of multinational corporations increased 25-fold to $112 trillion, and the number of people employed by foreign affiliates quadrupled to 82 million.”

Unsurprisingly, that means cross-border transactions are also on the rise. According to Statista, the total value of cross-border payments is predicted to rise from $190.1 trillion in 2023 to $290.2 trillion by 2030.

However, as organizations expand into international jurisdictions and cross-border transactions continue to rise, cash management becomes increasingly complex.

Treasurers for multinational businesses face several challenges, including navigating fluctuating currency exchange rates, meeting various (and changing) regional regulatory requirements, and mitigating risks from global economic volatility.

With these complexities comes a heightened need for a resilient cash management strategy. Resilience isn’t just a safeguard; it’s a driver of sustainability, agility, and long-term success.

Without a resilient cash management approach, companies risk heightened exposure to market volatility, disruptions in cash flow, and potential compliance penalties. An agile, well-designed cash management strategy ensures that treasury teams can adapt swiftly to unexpected changes and maintain a competitive edge.

In this post, we’ll dive into the trends reshaping global cash management and explore best practices to help treasury professionals build a resilient cash management approach. This includes tapping into available tools, like Treasury4’s Cash4 platform, to gain real-time visibility and maintain compliance across borders.

But first, let’s take a closer look at the meaning and importance of resilience in global cash management.

Understanding Resilience in Global Cash Management

In the context of treasury operations, resilience is the ability to manage cash flow efficiently and sustainably across multiple regions with diverse economic conditions.

Resilience in cash management goes beyond just stability; it’s about adaptability, continuity, and efficiency. A resilient strategy ensures that companies maintain liquidity, reduce exposure to risks, and optimize working capital, even in the face of disruptions like currency fluctuations or regulatory changes.

This adaptability allows treasurers to manage their global cash positions efficiently, ensuring strategic flexibility.

Core challenges

Building a resilient cash management strategy means overcoming significant challenges, including:

- FX volatility: Foreign exchange (FX) rates can vary significantly, particularly in emerging markets. Treasury teams must mitigate these risks through effective FX risk management strategies to protect profit margins and preserve cash.

- Cross-border transaction costs: Cross-border transactions come with their own set of fees, which can erode profit margins. The other challenging aspect of funding across borders is timing. In many cases, settlement takes a day before funds are available. A resilient cash management strategy identifies opportunities to minimize these costs and delays through efficient structuring.

- Compliance with local and global regulations: Compliance with both local and international regulations is essential but often complex, as standard regulatory requirements like anti-money laundering (AML) and know-your-customer (KYC) are updated frequently and vary across jurisdictions.

Resilience indicators

Measuring resilience in your cash management strategy involves monitoring key metrics like:

- Cash burn rate: This is the rate at which a company uses its cash reserves over time. The burn rate assesses how long available cash will last based on current spending levels. Treasury teams use this metric to monitor liquidity, ensuring there's enough cash to meet obligations without risking shortfalls.

- Liquidity ratios: These are metrics used to determine whether a company has enough capital to pay off its short-term debt obligations without needing to raise cash from external sources.

These indicators provide critical insights for treasury teams. Tracking them closely allows you to assess and adjust your cash flow management as needed and ensures your organization can weather economic fluctuations without compromising financial health.

Key Trends Shaping Global Cash Management

Now that we’ve examined the importance of resilience in cash management, let’s look at some of the key trends shaping the global treasury landscape. This way, treasurers can create a cash management strategy honed to manage these specific factors.

- Digital transformation and automation

Digital transformation is revolutionizing treasury operations. According to the European Association of Corporate Treasurers Survey, 60% of treasurers say that technology enhancements are one of their key strategic priorities over the next couple of years.

And HSBC’s study, “Global Connections: Connecting Southeast Asia and the World,” showed that 29% of respondents believe digital payments would be “transformative for their businesses.”

What’s more, according to J.P. Morgan’s report, “Digital Transformation of Treasury,” 80% of companies have either already implemented or are planning to implement application programming interfaces (APIs) to automate some of their treasury duties. And according to PWC’s 2023 Global Treasury Survey, 48% of treasury teams are utilizing robotics process automation (RPA) tools to automate workflows and reduce manual tasks.

Machine learning and artificial intelligence are also revolutionizing the treasury landscape. According to the same J.P. Morgan report, just 10% of treasurers believe these technologies won’t provide a “significant benefit.”

- Data-driven decision-making

Data analytics is emerging as a major priority for treasury teams. According to JPMorgan’s report, 40% of treasurers are actively looking to enhance their treasury management through data insights. And 24% of treasury teams cite data accuracy and access as one of their biggest challenges.

Plus, according to a 2022 study by Deloitte, 41% of treasurers list improving their cash forecasting as a top priority.

Real-time data insights and predictive capabilities allow treasurers to make data-driven decisions quickly.

- Decentralization vs. Centralization in Treasury Operations

Decentralization has historically been the standard treasury structure for multinational corporations.

But that trend has been changing in recent years, as more companies have shifted to centralized treasury. According to PwC’s Global Corporate Treasury Benchmarking Survey 2017, 83% of respondents said they’d moved to a centralized treasury.

Centralization offers significant benefits, including improved organizational cash visibility, mitigation of local economic risks, and better corporate control of financial health.

- Environmental, Social, and Governance (ESG) goals

Increasingly, treasury teams are aligning their practices with corporate ESG goals. According to HSBC’s Corporate Risk Management Survey, 56% of senior finance leaders “are very concerned about their ability to meet ESG reporting requirements,” and 69% are “somewhat concerned about ESG visibility into their suppliers.”

And according to the Economist Impact’s 2022 report, “Treasury’s ESG Evolution,” 51% of treasurers surveyed “are factoring ESG into their long-term investments and over 40% into bank deposits.”

Treasurers are incorporating these values by prioritizing green investments and responsibly managing cash, which adds resilience to cash management by aligning with broader corporate goals.

Best Practices for Building a Resilient Global Cash Management Strategy

To build resilience, treasury teams must implement strategies that allow them to manage cash effectively while anticipating and responding to changes. Here are six best practices to bolster your global cash management strategy:

1. Ensure real-time cash visibility

Real-time visibility across global accounts is essential for making timely, informed decisions. Treasury teams managing cash across multiple time zones must ensure they have a consolidated view of liquidity so they can respond to urgent cash needs anywhere in the world.

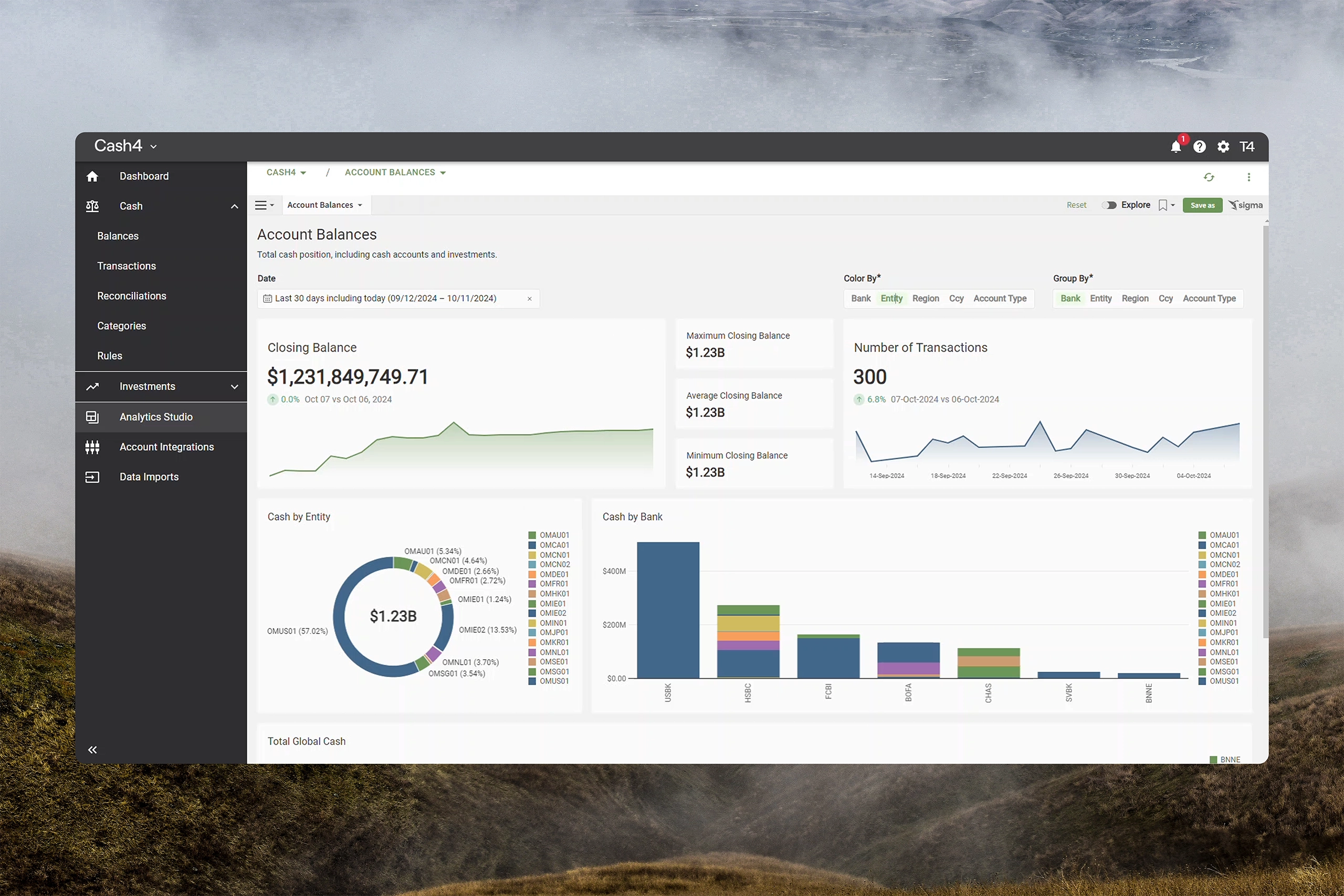

Leverage modern treasury technology to gain instant insights into liquidity positions across regions. For instance, real-time dashboards, like those provided by Cash4, offer a continuous view of global cash positions, helping treasurers improve liquidity even in volatile markets.

2. Implement a strong FX risk management framework

An FX risk management framework is vital to manage currency fluctuations. Treasurers can employ various hedging techniques, such as forward contracts, options, and swaps. Each of these hedging vehicles is suited to different market conditions. For instance, forward contracts provide fixed exchange rates, which are ideal for companies seeking predictability.

Treasury technology can automate FX risk management processes, helping treasurers maintain efficiency while managing FX exposures across global accounts.

For instance, Cash4 allows you to connect to your organization’s bank accounts, automatically pull the various balance data, and combine it into a single report. You can then view this data by entity, region, or currency. This feature reduces the need for manual oversight and mitigates risks related to currency fluctuations.

3. Optimize liquidity management and cash pooling

Cash pooling is the practice of combining the cash from your organization’s different entities into a single pool, allowing it to leverage surplus funds more effectively and reduce dependency on external credit. This allows your company to maximize liquidity, reduce borrowing costs, and enhance working capital.

Depending on the organization’s cash needs, treasury teams can choose between physical pooling—where funds are actually moved from various accounts into a single account—and notional pooling, which doesn’t involve fund movement.

Notional pooling may be a better option for multinational companies, as it minimizes the need for complex cross-border transfers, reduces currency conversion costs, and helps avoid regulatory or tax complications. However, it can involve a more specialized banking structure.

Physical pooling might be preferable for centralized cash control and simplified accounting.

Treasury professionals should track key metrics like working capital ratios, current ratios, and cash burn rate. These indicators help gauge liquidity levels and inform decisions on allocating and managing cash, building resilience into daily operations.

4. Strengthen compliance and regulatory adherence

Staying compliant across multiple jurisdictions is essential—but challenging. When it comes to anti-money laundering (AML) regulations, for instance, different jurisdictions have unique requirements. Here are a few examples:

- European Union: Under the EU’s Anti-Money Laundering Directive, companies must comply with strict customer due diligence and reporting requirements, which can impact cash pooling if transactions appear unusual.

- United States: The Bank Secrecy Act mandates rigorous reporting of large cash transfers to prevent money laundering, and financial institutions are required to report suspicious transactions.

- Switzerland: Switzerland has stringent AML regulations, and companies must provide transparency on cross-border transactions, especially for cash pooling or high-value fund transfers.

The same holds true for various other types of regulations, reporting, and tax requirements.

Integrated treasury solutions like Cash4 can help improve your regulatory compliance processes by providing built-in compliance checks for KYC (Know Your Customer), Anti-Money Laundering (AML), and other regulatory requirements across jurisdictions.

Audit trails are also critical for maintaining transparency. Automated treasury solutions generate detailed reports, ensuring that treasury activities remain compliant, audit-ready, and transparent, which is crucial for both regulatory adherence and internal risk management.

5. Leverage data analytics and forecasting tools

Treasurers can use a variety of tools for cash forecasting, from trend analysis and time-series analysis to machine learning-based models. Each of these tools has unique strengths. For instance, machine learning models are particularly effective for identifying complex patterns in cash flow data, helping predict future cash needs, and allowing treasury teams to make more informed, strategic decisions.

Market conditions are constantly shifting, making it crucial to adjust forecasts as new data becomes available. With analytics tools like those offered with Cash4, treasurers can monitor variances in real time and adjust as needed to keep cash flow aligned with operational needs.

6. Establish robust cybersecurity protocols

Cybersecurity is a top concern for treasury teams, especially in cross-border transactions. Advanced techniques like multi-factor authentication (MFA), tokenization, and end-to-end encryption provide extra layers of security. For example, MFA requires users to authenticate their identity through multiple steps, significantly reducing the risk of unauthorized access.

Training treasury staff on cybersecurity best practices to reduce fraud risk. By equipping teams with knowledge on recognizing phishing attacks and other threats, companies can minimize their exposure to cyber risks, ensuring that treasury functions remain secure.

Conclusion

In today’s complex and rapidly evolving global market, a resilient cash management strategy is not merely beneficial—it’s essential.

By embracing digital transformation, adopting data-driven decision-making, improving liquidity, and strengthening compliance and cybersecurity, treasury teams can build a robust cash management approach that supports both stability and growth.

With solutions like Cash4, treasurers are empowered to gain real-time insights, manage compliance more easily, and mitigate risks more effectively.

For multinational organizations, resilience in cash management is a cornerstone of operational success and a powerful tool for navigating an unpredictable financial landscape.