Cash Management with Powerful Cash4 reporting

When it comes to traditional cash management tools, treasurers face a slew of challenges. Manual processes and static spreadsheets create inefficiencies, are prone to errors, and lack real-time insights.

These obstacles make it difficult to get a comprehensive picture of the organization’s financial position and make informed, strategic decisions.

Treasury teams need modern, dynamic tools to solve these problems.

That's where Cash4 comes in. This state-of-the-art platform offers a suite of advanced solutions to transform cash management.

Let's dive into how Cash4’s key reporting features are a game changer in your treasury tech stack.

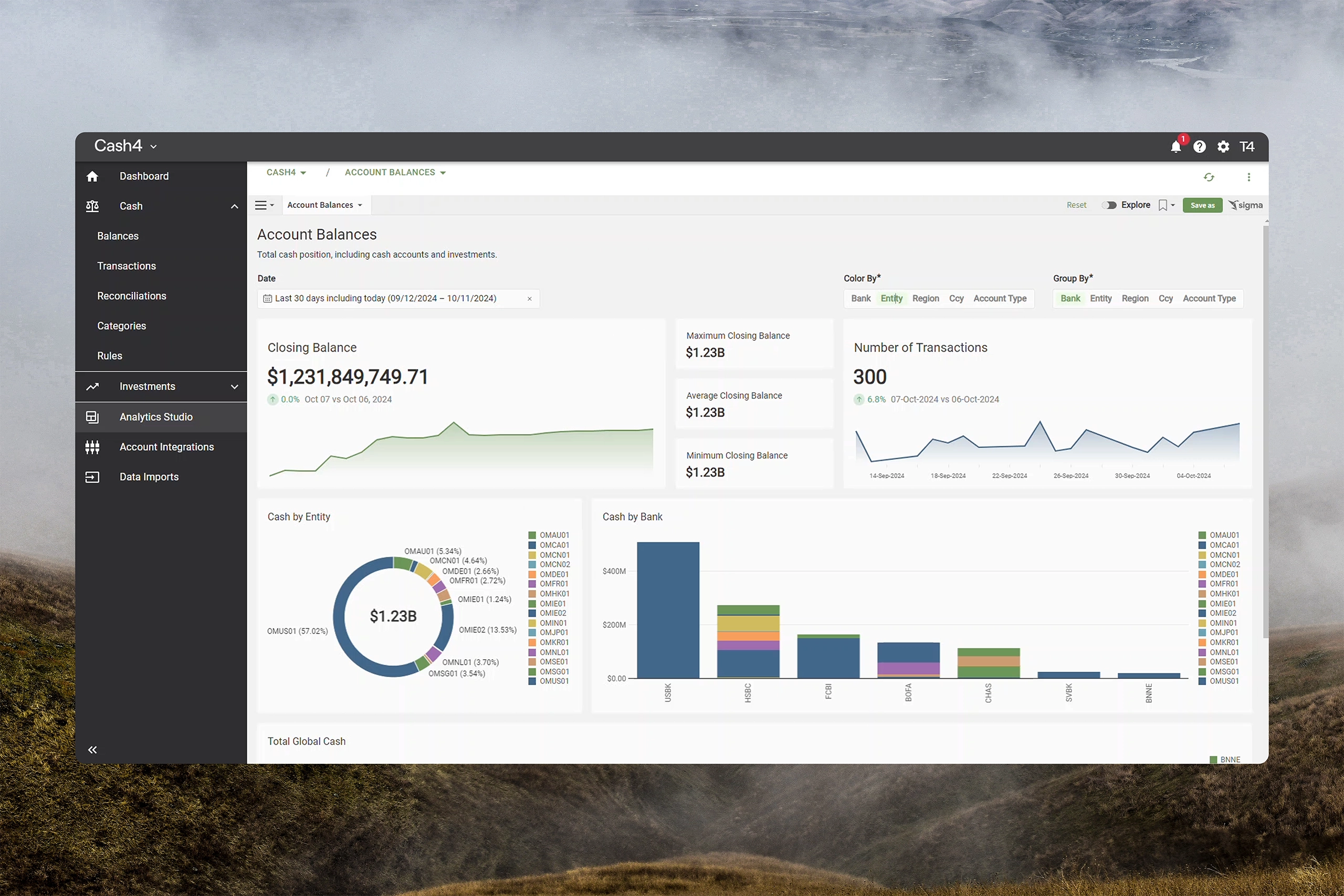

Full Cash Position at Your Fingertips

One of the biggest problems treasurers face is consolidating investment and liquid asset data. You must import and reconcile data from multiple sources across departments to create a complete picture of the company’s cash position. This process is not only time-consuming, but also prone to oversight, which can lead to significant mistakes.

Cash4 allows you to instantly calculate your full cash position by automatically combining investments and liquid assets into a single, comprehensive picture.

With Cash4’s automated feeds and integrations, your cash position is always up to date, removing the need for manual data entry. This frees up time and ensures you’re making decisions based on real-time, accurate data.

This empowers the treasury team to be more strategic and proactive rather than spending hours consolidating data.

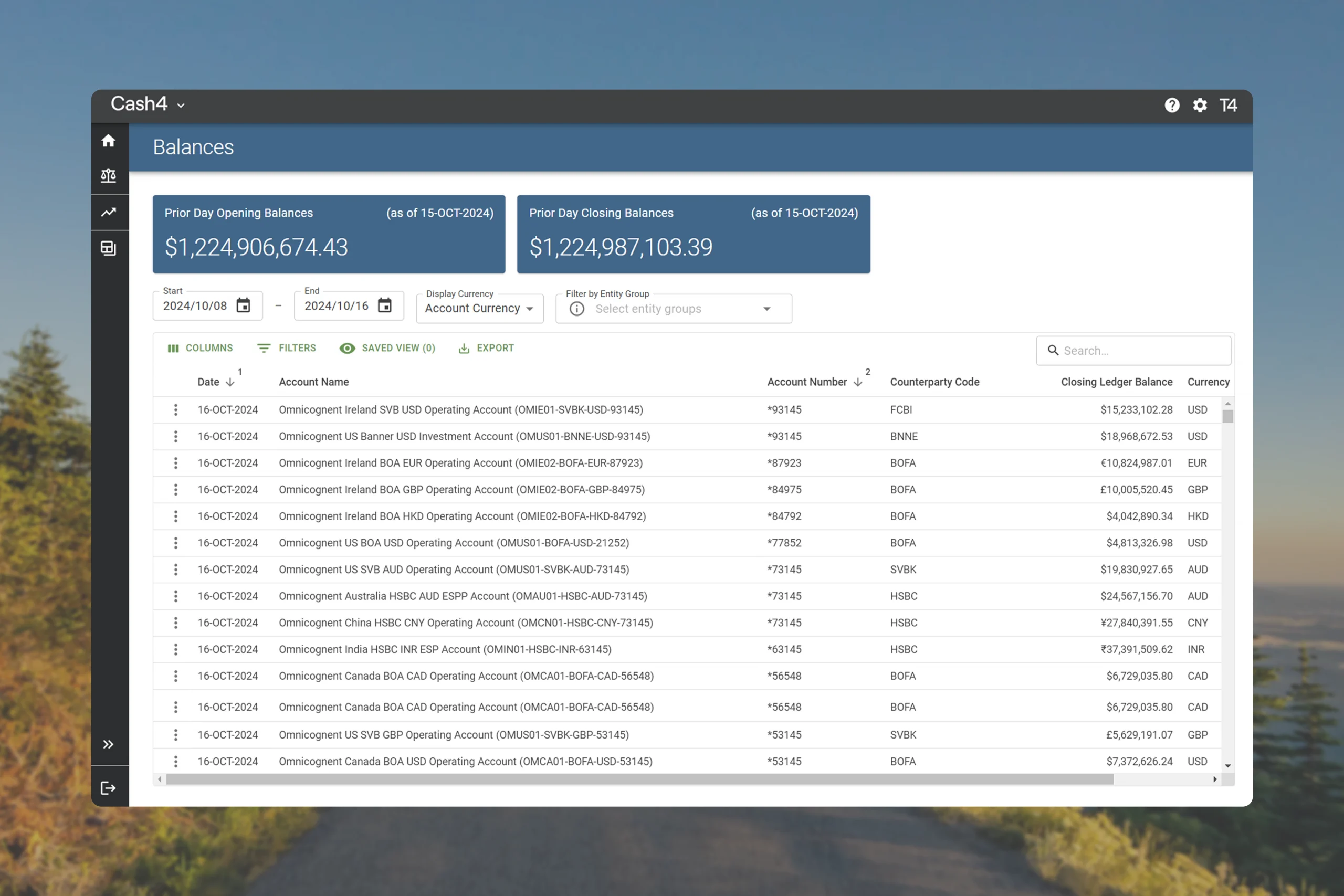

Past, Present, and Future Cash Visibility

Traditional cash management often feels like trying to navigate with an outdated map. You are relying on historical data to forecast future needs, leaving you vulnerable to unexpected cash shortages or missed investment opportunities.

Cash4 changes this paradigm. With its sophisticated forecasting feature, Cash4 provides a panoramic view of your cash position across time.

Not only does this allow you to pull up historical data easily, but it also lets you make data-driven decisions today based on transactions that have not yet taken place. You can anticipate cash needs, optimize investments, and manage liquidity with agility and precision.

Cash4 also lets you break down your cash position by entity, region, division, account, institution, or currency to provide actionable insights.

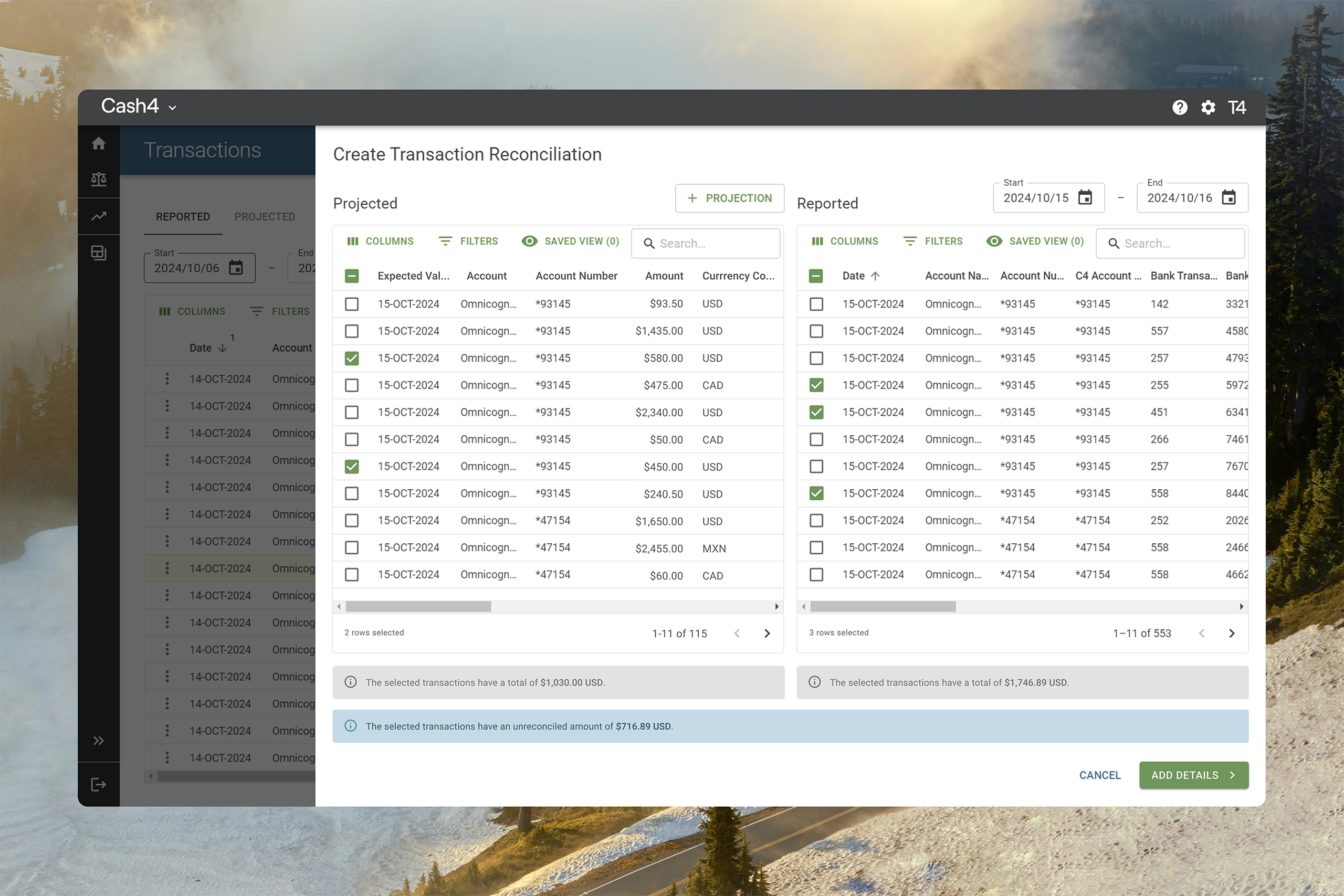

Granular Insights for Reconciliation

Traditional reconciliation processes can be a recipe for frustration and errors. They involve comparing daily transaction activity across multiple bank accounts and ledgers. Complex formulas and manual inputs increase the risk of errors.

Cash4 provides solutions to these problems.

The advanced rules engine allows for precise and deeply layered categorization. This feature enables treasurers to drill down into specific transactions with minimal effort, diagnose cash positions, and understand transaction activity at a more detailed level—without relying on cumbersome spreadsheets.

The prior-day reconciliation capabilities offer a level of detail and accuracy that will transform how you approach this critical task.

A Full Suite of Reporting Options

When it comes to cash reporting, Cash4 offers an extensive range of pre-built reports that cater to the diverse needs of treasury, accounting, and finance teams. These include Cash Flow by Category, Balances by Entity, Region, or Currency, and Daily Cash Reconciliation. Each report has been carefully crafted based on practitioner expertise and customer feedback. All these reports provide automated solutions to reduce traditionally manual workloads. Let’s take a closer look.

Cash Flow by Category:

This report automatically pulls and categorizes your organization’s transaction activity based on a predetermined set of rules. Common categories include “Operating Expenses,” “Capital Expenditures,” and “Revenue.” However, you can break it down into even more specific subcategories like "Raw Materials" or "Software Subscriptions.”

This feature allows treasury teams to quickly see the nature and purpose of each transaction without manually reviewing every entry. This allows treasurers to better understand the company’s overall financial health and make more informed decisions.

Balances by Entity, Region, or Currency:

This feature allows you to connect to all your organization’s various bank accounts, automatically pull the various balance data, and combine it into a single report. You can then view this data by entity, region, or currency.

Customizable Reports for Cash Management

However, what really sets Cash4 apart from other financial reporting tools is the ability to create custom reports. With our new analytics studio, you have the flexibility to tailor-make reports that align perfectly with your organization’s unique needs and strategic goals. No more static, pre-built templates.

You can apply custom rules and create dynamic, real-time dashboards that allow you to build, modify, and visualize data sets in whatever way you want.

This level of customization means you're not just adapting to a system; the system is adapting to you. It lets you ask the questions that matter most to your organization and get answers in real time.

Whether you're preparing for a board meeting, analyzing investment opportunities, or optimizing working capital, you have the tools to create reports that speak directly to your needs.

The Treasury4 Difference: Integration that Works for You

Cash4’s biggest differentiator is that it’s one component of a broader holistic approach to treasury management.

Treasury4’s comprehensive platform seamlessly integrates entity management (Entity4), payment management (Payments4), and cash management (Cash4) into one comprehensive platform. This integrated approach means you no longer have to reconcile data from various, separate sources or switch back and forth from one platform to another.

With Cash4, all the data you need is housed in one single source of truth, creating a unified experience that allows for more agile decision-making, and enhances your treasury operations.

What’s more, Treasury4’s portal access links offer a single, centralized access point for all your critical resources, tools, and financial data.

No more juggling with data or struggling to remember data. With portal access links, everything you need is easily accessible.

Conclusion: The Future of Treasury Management Is Here

The future of treasury management is here—and it's more powerful, flexible, and insightful than ever before.

Cash4 is not just another financial tool; it's a comprehensive solution designed to revolutionize how you manage your organization's treasury.

From real-time cash positions and multi-dimensional visibility to granular reconciliation and customizable reporting, every feature is crafted to empower you with the insights and flexibility you need in today's dynamic financial landscape.

The future of treasury management is about more than just tracking numbers; it's about unlocking insights, anticipating needs, and making informed decisions with confidence. With Cash4, you're not just keeping up with that future—you're leading the way.