Blog Posts

Solving Treasury Complexity in Healthcare

When you think of critical roles within healthcare organizations, you probably think of doctors, nurses, and other medical staff. Treasury teams might not be the first thing to come to mind. But behind the scenes, the treasury plays a pivotal part within the organization’s operations. In an industry under enormous financial pressure, maintaining a healthcare…

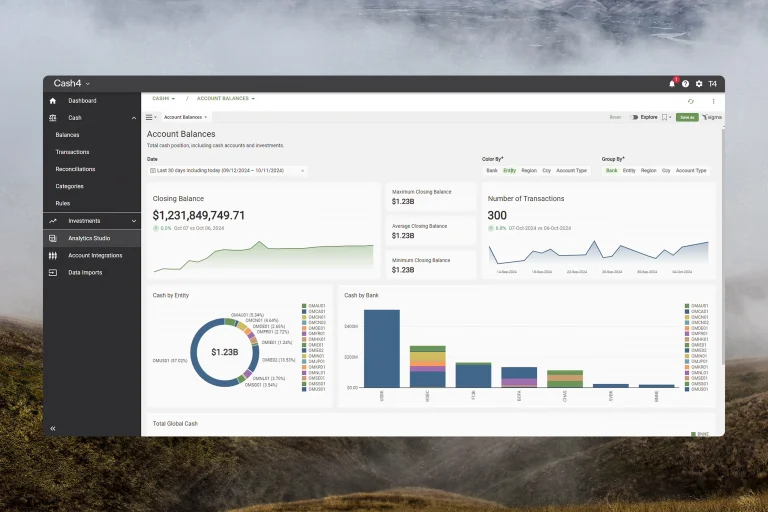

Read MoreHow Advanced Cash Reporting Powers Smarter Treasury Decisions

Webinar Treasurers are tasked with managing vast amounts of data—from disparate data sources– and making critical decisions that impact the company’s financial health. However, traditional reporting tools can no longer keep up with the growing complexities of modern treasury. In this webinar, we’ll demonstrate how Treasury4’s advanced cash reporting and analytics overcome these challenges. Learn how…

Read MoreBest Practices for Accurate Cash Flow Forecasting

Accurate cash flow forecasting is a cornerstone of business success. Without a reliable forecast, businesses may struggle with cash shortages, excessive borrowing costs, or missed investment opportunities. In fact, according to SCORE.org, 82% of small businesses fail due to problems with cash flow management. By improving forecasting accuracy, treasurers can optimize working capital, reduce financial…

Read MoreOvercoming Common Challenges of Cash flow Forecasting

If you were to view almost any industry poll of CFOs and corporate treasury teams about their top challenges, you’d see that challenges of cash flow forecasting is consistently in the top 3 concerns for treasury professionals. According to a study by Censuswide, nearly half (49%) of financial executives are concerned inaccurate cash flow data…

Read MoreLeveraging Data for Treasury Decisions: A Single Source of Truth

Treasury operations are more complex than ever before. Treasurers must deal with everything from cash and liquidity management to compliance and risk reduction—all across multiple global entities. Adding to these challenges is the issue of siloed data. With accounts across multiple banks, departments, and entities, treasurers are often tasked with tracking down, compiling, and comparing…

Read MoreTreasury as Value Creator: Insights From WestCap’s founder Laurence Tosi

The WestCap founder joins Joseph Neu and Treasury4 co-founder Ed Barrie to discuss the importance of a treasury mindset. Many modern treasury teams are being challenged to move beyond traditional roles and embrace new opportunities to create value. In a video clip from the session, Mr. Tosi responds to a NeuGroup member who asked how…

Read MoreThe Digital Transformation of Treasury: From Static Reports to Dynamic Insights

The treasury function has historically been defined by static reporting—in other words, periodic snapshots of financial data that offer a backward-looking view of an organization’s financial health. Digital transformation of treasury is inevitable in this day and age. Businesses are grappling with volatility, regulatory shifts, and globalization, making static reports an outdated tool in an…

Read MoreEffective Legal Entity Management: Revolutionizing Corporate Treasury with Entity4

The Importance of Legal Entity Management Treasury practitioners navigate a complex world of legal entities, including parent companies, holding companies, subsidiaries, joint ventures, and other types of entities. These entities, along with their intercompany relationships, agreements, and flows of funds and data, significantly impact our daily operations and responsibilities. Discover Better Legal Entity Management Integration…

Read MoreHow to Choose the Right Cash Management Software for Your Treasury Team: The Buyer’s Guide

Transform Your Treasury Our buyer’s guide is designed to help you choose the right cash management software for your unique treasury needs. Written by treasury leaders with over 30 years of experience, it offers step-by-guidance on finding a platform built to simplify your work and enhance your financial performance. Your Cash Management Software Should Include…

Read MoreThe Evolution of Treasury KPIs: 6 Metrics That Matter in 2025

Business and financial landscapes are constantly evolving—and with them, the function of the treasurer’s office. In years past, the treasurer’s responsibilities focused primarily on cash management and liquidity oversight. But today, the modern treasurer role has developed into one of a strategic partner responsible for driving business growth. As the treasurer’s responsibilities have grown, so…

Read More