Blog Posts

5 Key Trends in Legal Entity Management and Compliance in 2025

As we enter 2025, several new trends are taking shape in the world of legal entity management and compliance—and treasurers must be prepared to adapt. Driven by digital transformation, changing regulations, and an evolving global business environment, legal entity management and compliance have never been more complex—or more critical. Staying ahead of these developing trends…

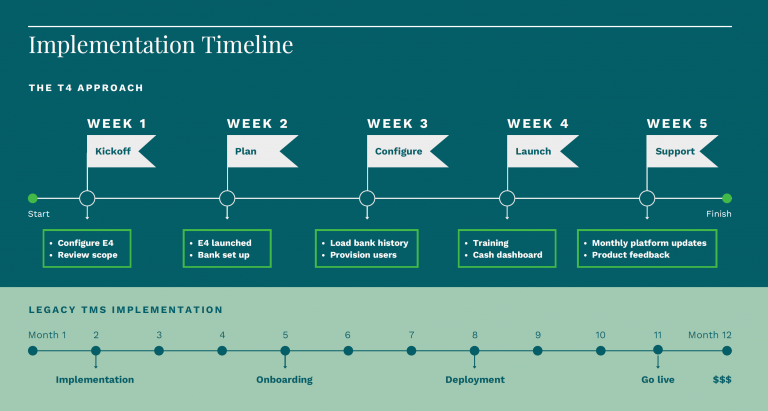

Read MoreQuick Implementation of Treasury Software Without Spending Hefty $$$

Treasury management is the backbone of an organization’s financial health. The treasury team is responsible for optimal cash flow, risk management, and operational efficiency. However, quick implementation of treasury software often feels like an uphill battle. Legacy systems demand months, if not years, of customization, integration, and training—not to mention exorbitant costs. In today’s fast-paced business…

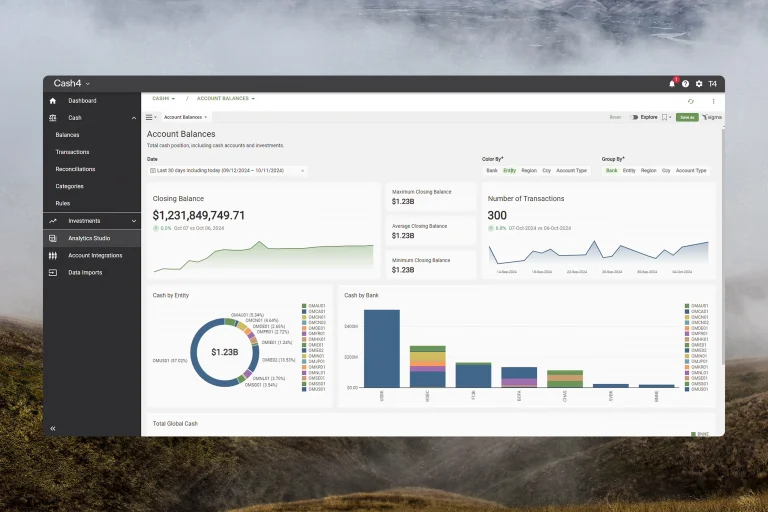

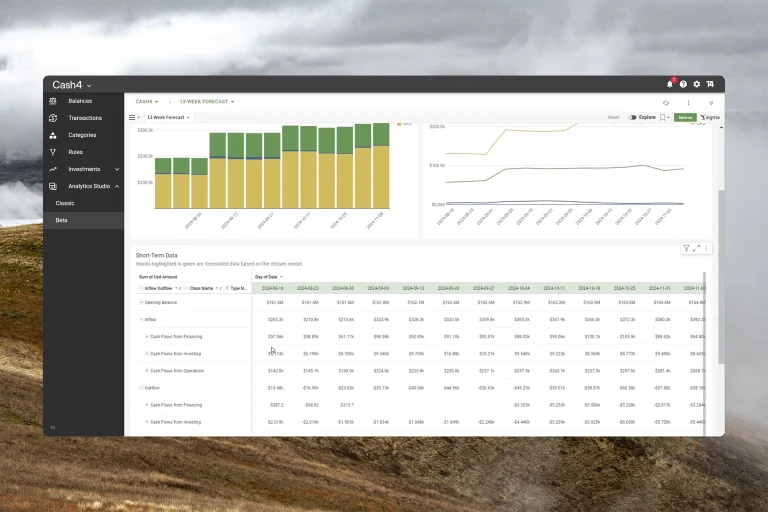

Read MoreSelecting a Cloud Treasury Management System: Checklist and Q&A with Industry Experts

In today’s modern treasury landscape—where companies are looking for efficient, scalable ways to manage global cash flow, liquidity, and financial risk—traditional treasury management system(TMS) no longer cut it. Instead, finance leaders are moving toward cloud-native treasury management solutions. Unlike traditional TMS, these cloud-based platforms provide access to real-time financial data, streamline workflows, and improve decision-making. …

Read MoreModern Treasury Management: Key Insights for Today’s Treasury Leaders

Understand the core challenges in treasury operations and how to address them effectively in this quick Infographic. Modern treasury management has become increasingly more complex, with increasing demands for accurate cash visibility, accurate reporting and analytics. Our infographic breaks down the key challenges finance leaders face and provides practical steps to: Gain better oversight of…

Read MoreBuilding a Resilient Global Cash Management Strategy

As more and more businesses scale into foreign markets, treasurers’ responsibilities have expanded significantly as organizations prioritize global cash management. According to Harvard Business Review, between 1990 and 2016, “the total assets of multinational corporations increased 25-fold to $112 trillion, and the number of people employed by foreign affiliates quadrupled to 82 million.” Unsurprisingly, that…

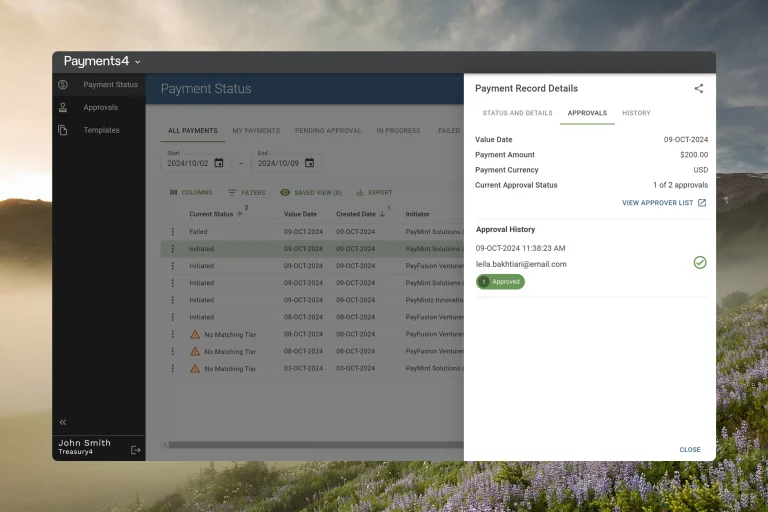

Read MorePayments4: A Complete Treasury Solution

As financial operations become more complex, treasury teams face growing challenges in managing payments. Traditional payment processes often fall short of addressing these challenges. Outdated systems lack the transparency, speed, and security required to manage low-volume, high-value transactions—leading to inefficiencies, manual errors, and increased fraud risks. Modern treasurers need modern solutions. That’s where Payments4 comes…

Read MoreHow Legal Entity Management Can Transform KYC Regulation and Client Onboarding

In my decades of experience in treasury professional, handling KYC regulations and smoothing the client onboarding process were some of the greatest challenges I encountered — in large part due to the siloed and disparate nature of legal entity data. Gathering relevant entity information is vital to both processes, but with the data spread between…

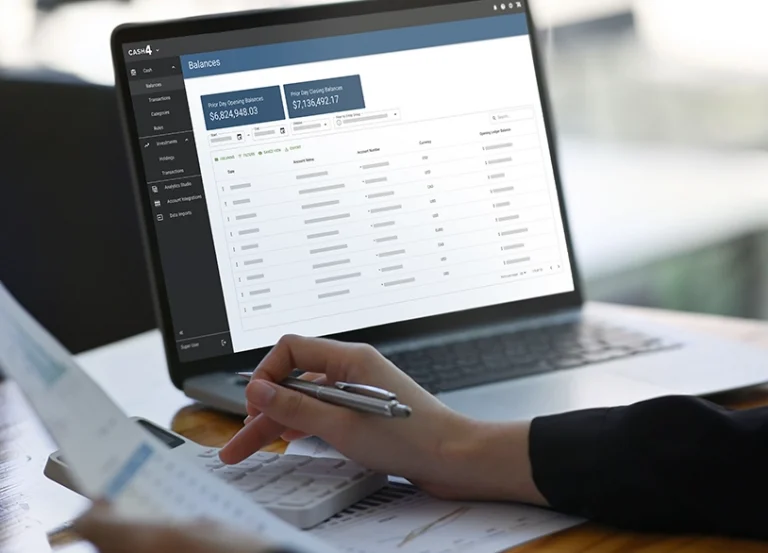

Read MoreHow to Reduce Your Cash Reconciliation Process to Minutes Per Day

Of all repetitive processes that most treasurers are familiar with, cash reconciliation is by far the most time-consuming, according to the Process Automation in Accounting and Finance study completed by the IMA. What’s worse: because reconciliation is often such a manual process, the end result can be riddled with errors. In fact, nearly a third…

Read MoreModernizing Treasury: The Hidden Costs of Sticking with Legacy Tools

Legacy Treasury Tools get the job done … for the most part. What does it take to get there and what are you missing out on? Is there enough value in modern tools to motivate early adoption? The Long Road of Legacy Technology Legacy treasury tools are built to be flexible, but that flexibility…

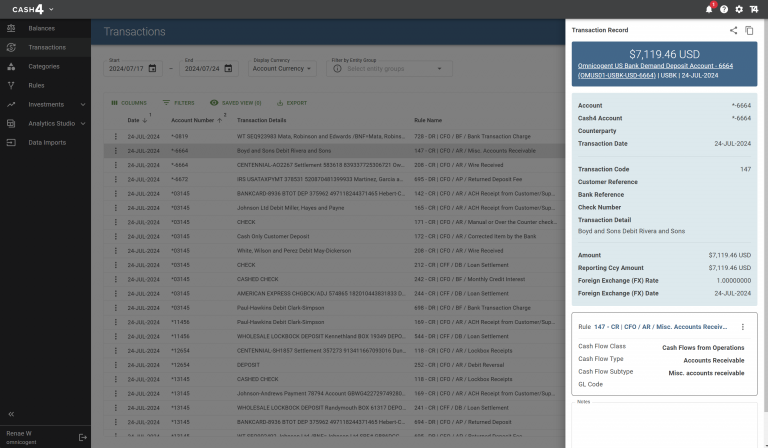

Read MoreWhy Automatic Transaction Categorization Is Vital for Your Treasury Management

For treasury professionals and finance leaders alike, transaction data makes up the foundation for many of their key decisions. It’s why we spend so much time and effort on cash reconciliation, generating cash flow reports, and calculating cash forecasts. These vital tasks are often made challenging by disorganized categorization. This can be due to inconsistencies…

Read More