Blog Posts

Why Practitioners Struggle to Answer Basic Cash Questions—and What to Do About It

If you’re a treasurer, you’ve probably had one of those mornings. You’re building a cash forecast, pulling together a liquidity snapshot, or prepping for a board review—and suddenly, you’re stuck. Not because you don’t know what to do, but because the entity data won’t cooperate. No time to read? Here’s what you need to know.…

Read MoreThe Forecast That Collapsed in 12 Seconds—and the Structural Fix You Shouldn’t Wait to Make

The cash model looked clean. 13-week cash flow forecast? Built. Global liquidity dashboard? Refreshed. Intercompany schedules? Squared away. Board pre-read? Uploaded with time to spare. Then the CFO asked: “Do we actually have control over that entity?” Twelve seconds later, the model was in question. Forty minutes later, tax and legal were looped in. By the…

Read MoreMatchup: Spreadsheets vs Treasury Platforms—Which Can You Rely on for Compliance Data?

Compliance is the broccoli of finance. You know it’s good for you, but it’s not exactly a Friday night craving. And managing it with spreadsheets? That’s like trying to run a commercial kitchen with a toaster oven and a dream. Excel is fast, flexible, and feels like home. But when you’re juggling cash visibility, audit…

Read MoreThe Anti-Burnout Reporting Playbook for Treasury Teams

Reporting Isn’t the Problem. Burnout Reporting Is. Most treasury teams aren’t lacking skill—they’re constrained by process. The real issue isn’t just “too many reports.” It’s the time spent reconciling mismatched data, re-explaining logic, and stitching together tools that were never built for modern cash management. A quick update to the Cash Position Report becomes a…

Read MoreChecklist: Is Manual Reporting Slowing Down Your Cash Strategy?

A 6-Point Gut Check for Treasury and Accounting Teams The report wasn’t late, but it wasn’t early. The spreadsheet opened with a warning—something about links. One tab said “FINAL_v2,” another said “USE THIS ONE.” Someone changed the numbers, but didn’t say which ones. It was 5:07 PM. You sent it anyway. If that felt familiar,…

Read MoreChecklist: 5 Questions to Ask Before You Commit to a Treasury Management System

A tactical read for treasury practitioners who keep the reporting engine running—and are ready for a system that actually works for them. You’re the one reconciling mismatched transactions, making sure the Cash Position Report is accurate across every account, and updating the 13-Week Cash Forecast—again—because someone moved a vendor payment. You’re also the one who…

Read MoreSolving Treasury Complexity in Healthcare

When you think of critical roles within healthcare organizations, you probably think of doctors, nurses, and other medical staff. Treasury teams might not be the first thing to come to mind. But behind the scenes, the treasury plays a pivotal part within the organization’s operations. In an industry under enormous financial pressure, maintaining a healthcare…

Read MoreHow Advanced Cash Reporting Powers Smarter Treasury Decisions

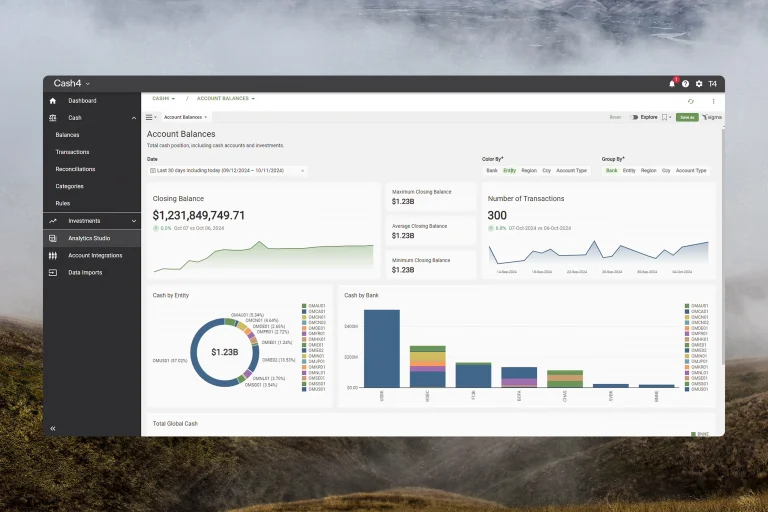

Webinar Treasurers are tasked with managing vast amounts of data—from disparate data sources– and making critical decisions that impact the company’s financial health. However, traditional reporting tools can no longer keep up with the growing complexities of modern treasury. In this webinar, we’ll demonstrate how Treasury4’s advanced cash reporting and analytics overcome these challenges. Learn how…

Read MoreBest Practices for Accurate Cash Flow Forecasting

Accurate cash flow forecasting is a cornerstone of business success. Without a reliable forecast, businesses may struggle with cash shortages, excessive borrowing costs, or missed investment opportunities. In fact, according to SCORE.org, 82% of small businesses fail due to problems with cash flow management. By improving forecasting accuracy, treasurers can optimize working capital, reduce financial…

Read MoreOvercoming Common Challenges of Cash flow Forecasting

If you were to view almost any industry poll of CFOs and corporate treasury teams about their top challenges, you’d see that challenges of cash flow forecasting is consistently in the top 3 concerns for treasury professionals. According to a study by Censuswide, nearly half (49%) of financial executives are concerned inaccurate cash flow data…

Read More