Entity4: An Essential Tool for Entity Management and a Strong Treasury Tech Stack

The role of the treasurer has grown and evolved significantly in recent years. In addition to managing the company’s bank accounts and maintaining accurate financial reporting, treasurers are now also responsible for legal entity management, regulatory compliance, data-driven forecasts, strategic decision-making, and more.

To manage these various, complex duties, it’s crucial to build a strong tech stack, which includes entity management as well.

The most important piece of your tech stack is your treasury management system (TMS). It should include features like financial databases, reporting and analytics tools, APIs, and more.

But not all TMS are created equal—and many lack critical components to offer you a centralized view of your data.

For instance, most TMS don’t offer entity management solutions.

That’s where Treasury4’s Entity4 comes in.

In this blog, we'll explore why Entity4 is an essential component of a robust treasury tech stack and how it addresses some of the most pressing challenges faced by corporate treasurers today.

What is Entity4?

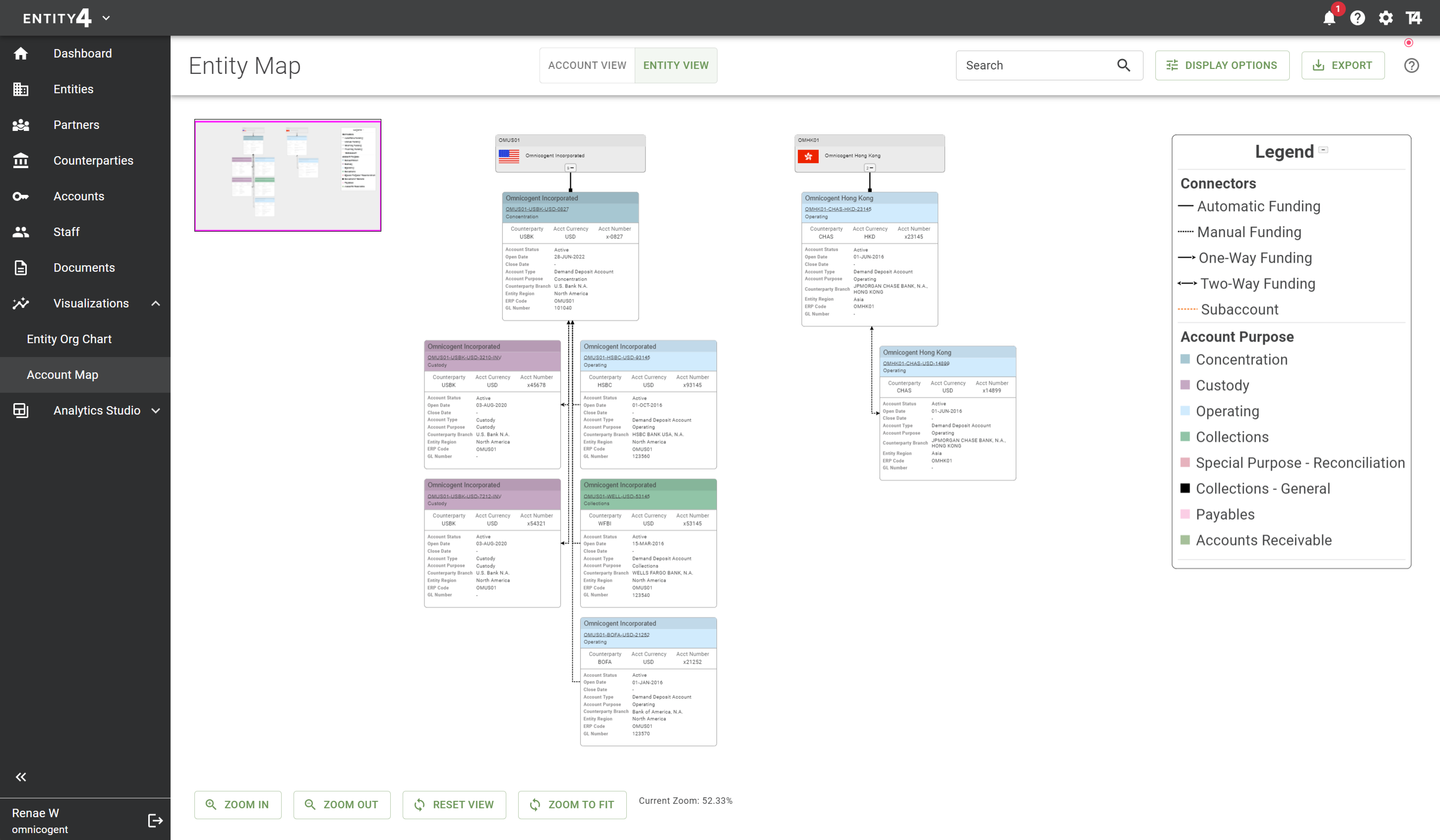

Entity4 is a powerful, award-winning cloud solution. It offers comprehensive legal entity management and bank account management within a single location. With data centralization, near real-time reporting, and compliance automation, Entity4 is designed to meet the evolving needs of modern treasury departments.

Treasury teams often struggle with siloed data scattered across departments, outdated systems, and manual processes that leave room for errors.

Entity4 solves these challenges by consolidating all legal entity data—ownership details, signatories, subaccounts, counterparty information, and more—into a single source of truth.

Its comprehensive features include:

- Centralized data management: A unified view of all legal entities and bank accounts.

- Custom reports and dashboards: Tailor your reporting needs to quickly access critical data.

- Compliance management: Automate your processes for filing deadlines and renewals, ensuring compliance with constantly evolving regulations.

- Document management: Store, access, and share all relevant documents securely within the platform.

The Importance of Centralized Data Management

One of the biggest challenges treasury teams face is fragmented data. As companies expand, financial data often becomes siloed across multiple systems, departments, and locations. This lack of integration creates inefficiencies, makes reporting time-consuming, and increases the risk of mistakes.

Entity4 solves this problem by centralizing all treasury data in one place. By acting as a single source of truth for legal entity and bank account information, it provides a unified view of the organization’s financial health.

This allows treasurers to get a comprehensive picture of the organization’s cash positions, investments, and liquidity across all entities.

With a 360° view of your company’s finances, you can improve accuracy, reduce errors, and ensure that all stakeholders have access to the most up-to-date information.

Entity4’s robust dashboards allow you to monitor key metrics in real time, making it easier to identify potential issues and take corrective action before problems escalate.

Let’s look a little closer at the specific benefits of centralized data:

- Improved decision-making: Having all data in one place enables treasury teams to make more strategic, data-driven decisions. Rather than piecing together fragmented reports from different systems, Entity4 allows for real-time visibility across all legal entities and bank accounts. This improves decision-making and increases confidence in the accuracy of the data being used.

- Operational efficiency: Centralized data management eliminates the need for manual processes and reduces redundancy. Treasury professionals can spend less time tracking down data and more time focusing on strategic initiatives that drive value for the organization.

- Risk mitigation: With fragmented data, it’s difficult to get a clear picture of your organization’s financial risks. Entity4 offers enhanced visibility into cash flows, bank accounts, and compliance, allowing treasurers to identify and mitigate potential risks more effectively.

- Enhanced compliance: Centralizing data ensures that compliance obligations are met across the organization’s various entities. Entity4’s automation of filing and reporting processes reduces the risk of missed deadlines and ensures that all legal entity requirements are up to date.

One of the biggest benefits of Entity4 is its regulatory compliance solutions.

Managing compliance across multiple entities can be a major challenge for treasury teams. It involves keeping track of filing deadlines, renewals, and regulatory changes.

Even small errors put you at risk of non-compliance, which can result in severe financial penalties (not to mention it could harm your company’s reputation).

Entity4 simplifies compliance management by automating the filing and renewal processes. The platform ensures timely compliance with key regulations like the Corporate Transparency Act, helping treasury teams avoid missed deadlines and reduce the risk of non-compliance.

With Entity4’s calendaring feature, you can keep track of important dates, filings, and renewals, ensuring nothing falls through the cracks.

For legal entity management, Entity4’s one-touch reporting simplifies complicated regulations like Foreign Bank Account Reporting (FBAR) and Know Your Customer (KYC).

Entity4 also tracks changes in regulations, keeping your team informed of upcoming obligations and deadlines.

Automating these processes not only reduces the risk of errors, but it also frees up valuable time to focus on higher-level tasks.

Read the Entity4 fact sheet >>

Entity4’s compliance features include:

- Automated compliance tracking: Entity4 automatically tracks compliance deadlines and regulatory requirements, reducing the manual effort required for tracking filing deadlines and renewals.

- Custom reporting: Generate detailed reports with just a few clicks to ensure accurate and timely compliance filings.

- Data Security: Entity4 uses advanced security features to store and protect sensitive financial data, ensuring that sensitive information is accessed only by those authorized to do so.

- Periodicity: Entity4 lets you compare current data against historical records to help identify and analyze trends, create forecasts, and make data-driven decisions.

Enhance your tech stack with Entity4

In today’s dynamic financial landscape, building a strong treasury tech stack is paramount for organizations aiming to stay ahead. Entity4 solves many of the challenges treasury teams face by consolidating fragmented data, automating compliance processes, and providing real-time insights for better decision-making.

And as businesses expand and financial regulations become more complex, a centralized platform like Entity4 is an essential tool for staying competitive and mitigating risk.

Schedule a demo today to see how Entity4 can transform your treasury tech stack and optimize your workflow.