How to Reduce Your Cash Reconciliation Process to Minutes Per Day

Of all repetitive processes that most treasurers are familiar with, cash reconciliation is by far the most time-consuming, according to the Process Automation in Accounting and Finance study completed by the IMA. What’s worse: because reconciliation is often such a manual process, the end result can be riddled with errors. In fact, nearly a third of financial service organizations identify mistakes from manual processes as the biggest challenge in data reconciliation.

Accurate cash reconciliation is key for any organization’s financial well-being. Your cash flow and transaction data is crucial to help treasurers and finance leaders understand your cash position, catch evidence of fraud, meet regulatory and compliance requirements, and more. If your organization’s cash reconciliations are often inaccurate, reducing the amount of manual labor involved can have a significant positive impact on the business.

With technology that automates the cash reconciliation process, your team can access accurate, reliable reconciled cash flow data across all accounts at a glance.

Understanding Cash Reconciliation

Cash reconciliation is the process of comparing and matching the cash transactions recorded in a company's operations records with the actual cash balances in bank accounts, petty cash reserves, and other cash sources. It is a crucial aspect of financial management that ensures the accuracy and integrity of an organization's cash records.

Accurate cash reconciliation is critical for businesses for several reasons. It helps detect errors, discrepancies, or irregularities in cash transactions, enabling timely correction and preventing potential financial losses. Cash reconciliation also serves as a powerful tool for fraud prevention by identifying unauthorized or suspicious cash movements and safeguarding the company's assets. It's also essential for accurate financial reporting, as it ensures that the cash balances reported in financial statements accurately reflect the company's actual cash position.

Despite its importance, manual cash reconciliation can be a time-consuming challenge, with many sources of errors and delays. These include:

- Human error: Any manual process is likely to have a few mistakes. Because cash reconciliation is repetitive and time consuming, however, this accounting process tends to be especially susceptible to data entry, transposition, and omission errors.

- Disparate data and differing formats: When your cash flow data is stored on various bank portals and formatted in differing formats — the task of reconciliation becomes more complicated and prone to inaccuracies.

- Status reporting: This and other administrative tasks often take up far too much time, which is usually better spent doing the actual reconciliation process.

- A lack of standardization: Organizations that lack consistent reconciliation procedures across departments and teams, as well as unreliable ERP data with differing formats and protocols, have more errors in cash reporting and trouble implementing internal controls and audits.

The Role of Cash Management Software

Cash management software can greatly enhance the cash reconciliation process by leveraging advanced technologies and automated workflows. Below are some of the key components of cash management technology:

- Data integration: Cash flow and transaction data from all your various accounts are consolidated onto one centralized platform, reducing the need for manual data entry and lowering the risk of human error.

- Categorization: The way transaction data is categorized often differs from bank account to bank account, and your ERP. Standardizing each transaction’s categories can be a time-consuming manual process, but an effective cash management solution automates it.

- Automated rule-based matching: The process of matching and reconciling cash transactions based on pre-defined rules and criteria is fully automated. Treasurers can customize rules to align with your organization’s specific requirements and practices to ensure accurate and consistent reconciliation across all accounts and transactions.

- Real-time processing: Cash transactions are processed and reflected on your dashboards immediately, providing up-to-date visibility into your cash position whenever you need it. This eliminates delays in reconciliation and financial reporting and facilitates leaders’ ability to make more informed decisions.

- Reporting and audit trails: Cash management software improves transparency and enables better compliance with regulatory requirements and internal controls. This technology makes it easy to maintain detailed records of all cash transactions, reconciliation processes, and adjustments.

The Benefits of Cash Management Software for Cash Reconciliation

Cash management technology offers numerous benefits for streamlining and enhancing the cash reconciliation process, making it more accurate, efficient, and insightful. Here are some key advantages:

Improved accuracy

One of the primary benefits of cash management technology is its ability to reduce human error during the reconciliation process. By automating the matching of transactions between an organization's books and bank statements, these systems minimize the risk of manual data entry mistakes or oversight. Advanced rule-based matching algorithms ensure that transactions are accurately reconciled, improving the overall integrity of financial records.

Efficiency

Manual cash reconciliation can be a tedious and time-consuming task, particularly for organizations with high transaction volumes. Cash management software automates a significant portion of the reconciliation process, significantly reducing the time required for this critical task. This allows finance teams to redirect their efforts towards more strategic initiatives, such as financial analysis, forecasting, and decision-making.

Fraud detection

Cash management software incorporates robust fraud detection capabilities, enabling organizations to quickly identify and investigate discrepancies or irregularities in cash transactions. By continuously monitoring and reconciling transactions, these systems can flag suspicious activities, such as unauthorized withdrawals or duplicate payments, helping to prevent and mitigate the risk of fraud.

Cost savings

Implementing cash management technology can lead to substantial cost savings for organizations. Automation reduces the need for manual intervention, potentially minimizing the required headcount in finance and accounting departments. Additionally, by improving accuracy and reducing errors, these systems can help organizations avoid costly financial misstatements, penalties, and fines associated with inaccurate reporting.

Real-time insights

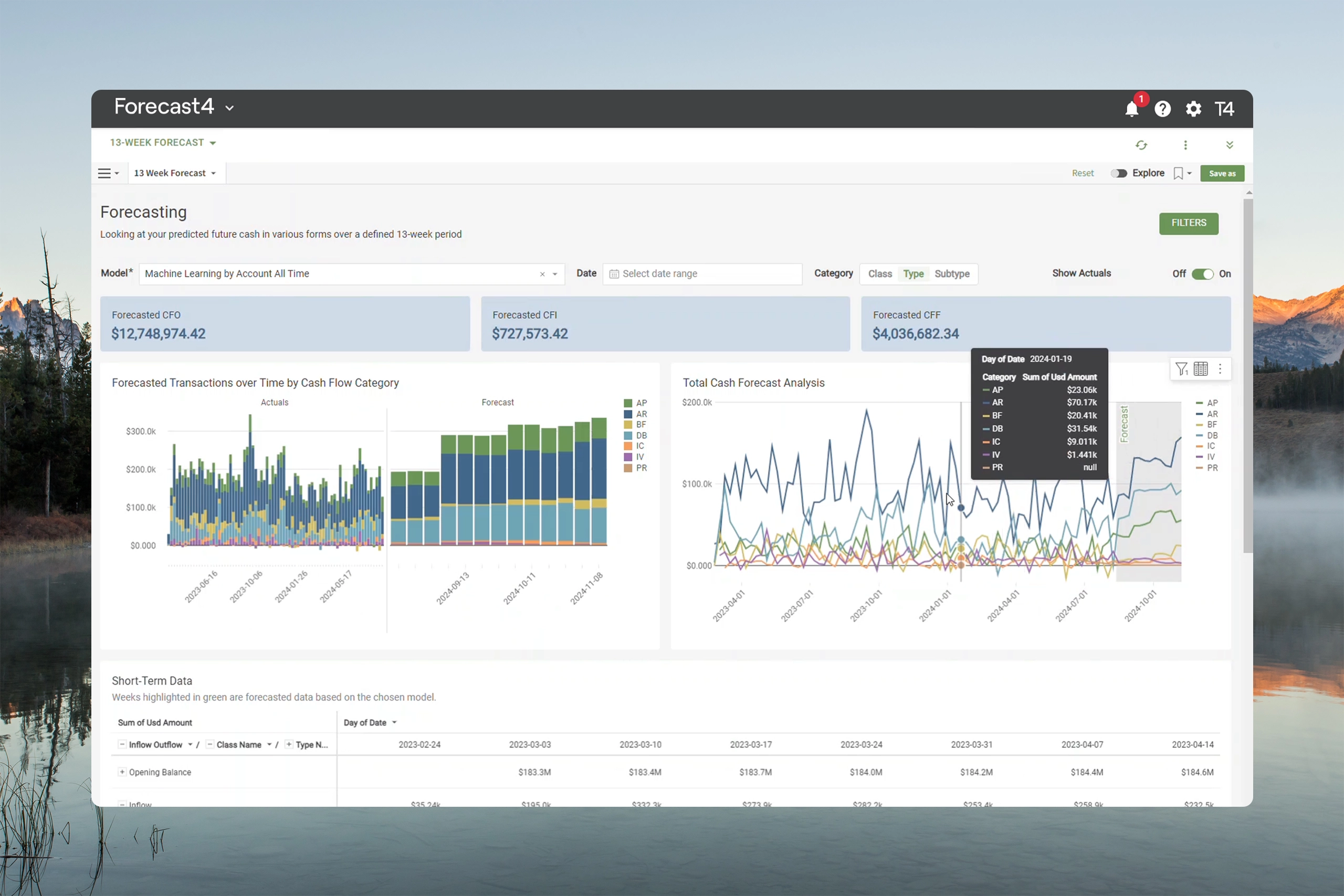

Cash management software provides real-time visibility into an organization's cash position by continuously processing and reconciling transactions as they occur. This real-time data access enables finance teams to make informed decisions based on the most up-to-date information, enhancing their ability to manage cash flows, identify potential liquidity issues, and optimize financial forecasting and budgeting processes.

How to Implement Cash Management Software for Cash Reconciliation

Implementing cash management software for cash reconciliation purposes can streamline financial operations and provide valuable insights. Here's a brief step-by-step guide to help you get started.

- Assess your needs: Thoroughly evaluate your current cash reconciliation process, identifying areas of inefficiency, manual effort, and potential sources of errors. This assessment will help you understand the specific pain points and requirements that the new cash management software should address. Consider factors such as transaction volumes, the complexity of your cash flow, and the number of bank accounts and other cash sources to be reconciled.

- Choose the right solution: With a clear understanding of your needs, research and evaluate various cash management software solutions in the market. Look for tools that offer robust reconciliation capabilities, including automated transaction matching, rule-based reconciliation, and integration with your existing systems. Consider the software's modernity, scalability, user-friendliness, and reporting features. Additionally, assess the vendor's reputation, customer support, and track record in your industry.

- Integrate your new software with existing systems: Seamless integration with your existing Enterprise Resource Planning (ERP) and accounting systems is crucial for efficient data exchange and accurate financial reporting. During the selection process, prioritize solutions that offer pre-built integrations or robust APIs that allow for seamless data synchronization. This integration will ensure that cash transactions are consistently recorded across all systems, reducing the risk of discrepancies and duplicated efforts.

- Customize your software for your specific requirements: While cash management software solutions often come with pre-configured settings and workflows, it's essential to customize the technology to align with your specific business needs and reconciliation processes. Work closely with the software vendor or your internal IT team to configure rules, workflows, and reporting templates that match your organization's unique requirements. Customizing your solution will ensure that the software seamlessly integrates with your existing processes and provides the most value to your finance team.

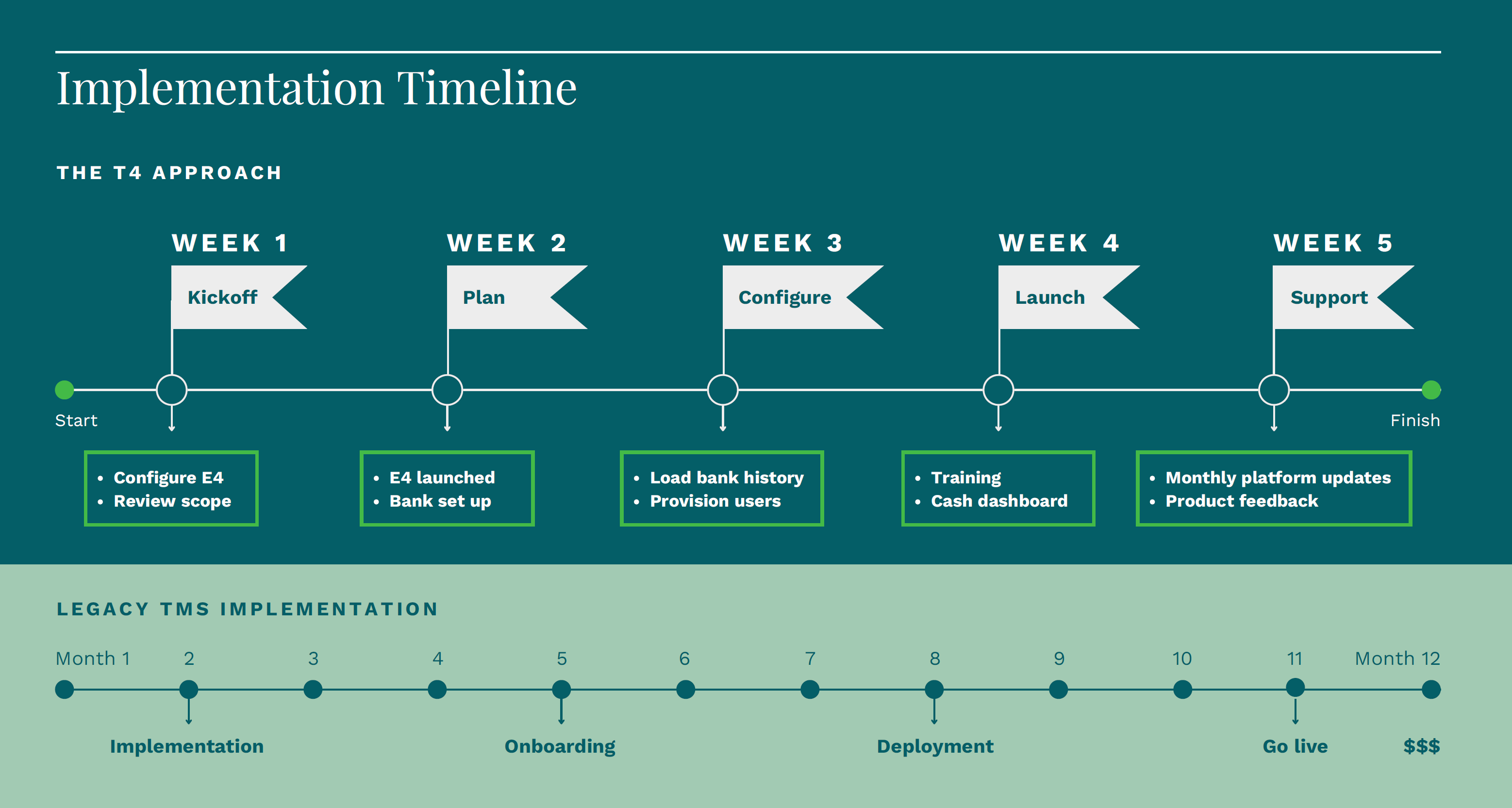

With a modern cloud based system, like treasury4 , get up and running in a few days and not months.

The Right Cash Management Software for Your Cash Reconciliation Needs

When NWR, a fast-growing cryogenics company, implemented cash management software to replace their spreadsheet-based treasury and accounting system, the team all but eliminated their daily two-hour cash reconciliation process. Their new system, Cash4, now enables the NWR treasury team to:

- Better manage 30+ bank accounts

- Easily register licenses and track renewals

- Quickly get comprehensive visibility into their cash position

To learn how Cash4 can benefit your organization, request a demo today.