9 Reasons to Integrate Your Cash Management System with an Entity-based TMS

Most businesses operate with some version of a treasury management system (TMS) — even if it’s a collection of spreadsheets. While these systems help teams track and manage transactions and cash flow, they don’t offer any systems to monitor the bank accounts and other legal entities connected to those transactions. In this post, learn how integrating these two vital sources of information can transform and optimize treasury and finance tasks for both staff and leadership.

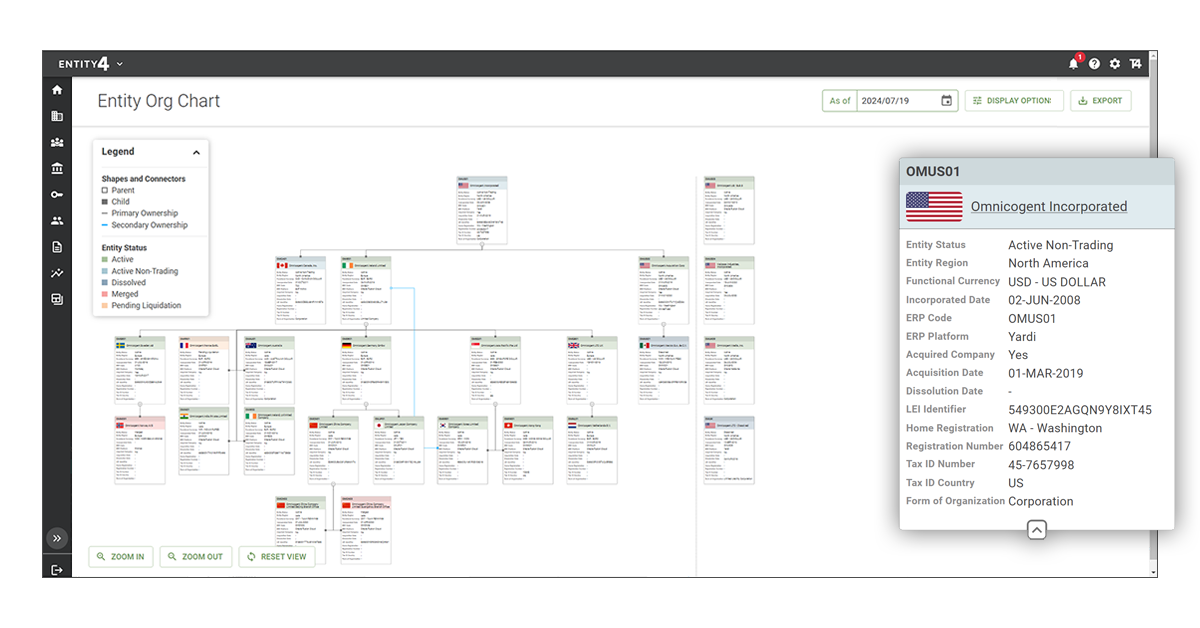

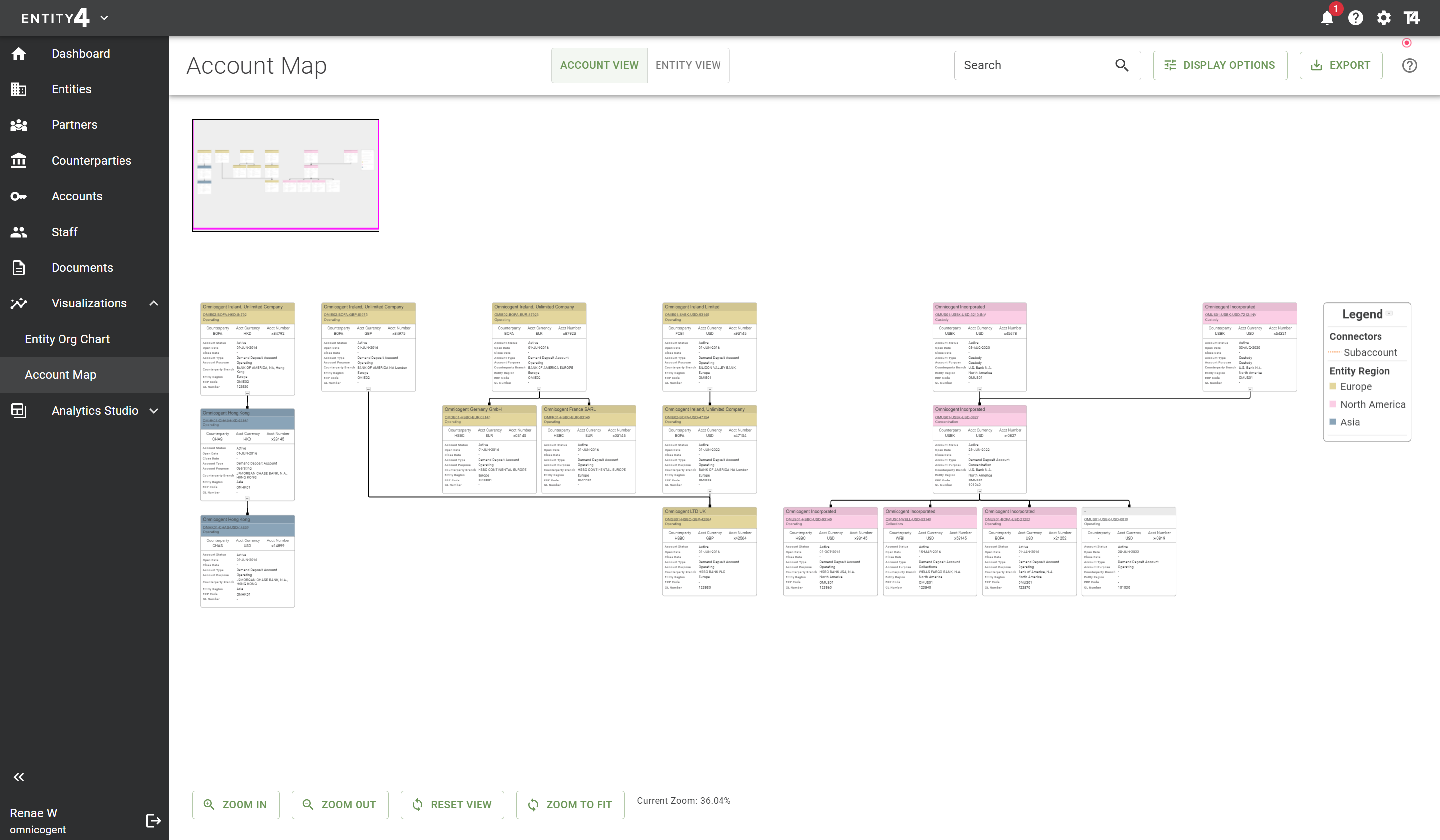

#1: Create a Central Repository for Your Legal entities and Bank accounts

Integrating legal entity and bank account management within a TMS creates a powerful centralized repository for all treasury and finance-related data. This consolidation streamlines operations by ensuring that critical information is readily accessible to all relevant departments. By housing data in a single system, organizations can eliminate silos and reduce the risk of discrepancies that often arise when multiple systems are used.

This integration also enhances visibility into the organization's financial structure, enabling better decision-making and risk management. With a comprehensive view of all entities and accounts, treasury can more effectively manage liquidity, optimize cash positions, and identify potential areas for improvement in the company's financial operations.

#2: Keep Data Accurate and Reliable with Regular, Automatic Updates

A single system for housing entity and treasury information allows treasury, finance, legal, and tax departments to work from the same set of data, fostering greater collaboration and reducing errors. For example, when legal entity details are updated, those changes are reflected across all connected systems, ensuring that treasury has the most up-to-date information for cash management and forecasting. Similarly, bank account data synchronized across departments enables more accurate financial reporting and tax compliance.

This integration also enhances visibility into the organization's financial structure, enabling better decision-making and risk management. With a comprehensive view of all entities and accounts, treasury can more effectively manage liquidity, optimize cash positions, and identify potential areas for improvement in the company's financial operations.

#3: Make Regulatory Compliance Easier than Ever

An entity-based TMS significantly enhances regulatory compliance efforts. This integration is crucial when managing multiple legal entities and bank accounts across various jurisdictions, each with its own complex regulatory requirements. An integrated system serves as a single source of truth, maintaining accurate and up-to-date records for all entities and accounts.

A consolidated TMS and legal entity system provides robust audit trails, tracking changes and approvals for all financial activities. It simplifies the process of generating reports required by different regulatory bodies, ensuring consistency and accuracy across all submissions. The system can be configured to automatically flag potential compliance issues, such as unusual transactions or breaches of exposure limits, allowing for prompt investigation and resolution.

This system also facilitates the implementation of standardized processes across all entities, ensuring uniform adherence to compliance protocols. It enables treasury teams to easily monitor and manage signatory rights, account permissions, and other critical controls across multiple jurisdictions. This comprehensive oversight minimizes the risk of non-compliance, reducing the potential for fines, reputational damage, and other regulatory penalties.

#4: Keep Sensitive Financial and Legal Data Secure

An entity-based TMS significantly reduces the risk of data breaches by centralizing sensitive information in a single, secure system. This consolidation eliminates the need for multiple databases or spreadsheets, which can be vulnerable to unauthorized access or human error. Instead, all critical financial and legal data is stored in one robust platform with advanced security measures.

The integrated system typically offers sophisticated security features, including role-based access controls. These permissions ensure that employees only have access to the specific information necessary for their roles, minimizing the risk of internal data breaches or accidental exposure of sensitive data. For instance, a treasury analyst might have access to cash flow data but not to legal entity documentation, while a legal team member might have the opposite permissions.

Moreover, centralization allows for more effective monitoring and auditing of data access and changes. The system can log all user activities, creating a detailed audit trail that helps detect and investigate any suspicious behavior. This approach is crucial for maintaining data integrity and complying with data protection regulations.

#5: Reduce Busywork and Repetitive Tasks for Treasurers

A combined TMS and entity management system streamlines key workflows and routine tasks, significantly enhancing operational efficiency. Processes such as updating signatories or managing Know Your Customer (KYC) documentation become more fluid and less time-consuming. The system can automate notifications for expiring documents, renewal processes, and update information across all relevant departments simultaneously.

This automation reduces manual data entry and the associated risks of human error. It also accelerates processes that traditionally require multiple touchpoints and approvals. For example, onboarding a new bank account or modifying entity details can be executed more swiftly through predefined workflows. By automating these routine tasks, employees are freed from repetitive administrative work, allowing them to focus on more strategic activities that add greater value to the organization and increase overall productivity.

#6: Collaborate Better Between Departments

With just one system to track financial and entity information among multiple departments, team members can reliably collaborate without wasting time on data transfers and information requests. This unified system enables different teams to access relevant information without the need for constant requests and follow-ups.

For example, when preparing for a tax audit, the tax team can directly access up-to-date financial data, bank account details, and entity structures without having to request this information from the treasury department. This self-service capability not only saves time but also reduces the risk of miscommunication or delays.

Similarly, when the legal team needs to review the financial implications of a potential merger, they can easily access consolidated financial data and entity relationships. This seamless information sharing fosters a more cohesive working environment, breaking down silos and enabling more informed decision-making across the organization.

#7: Empower Leadership with Accurate Data for Improved Decision-making

Integrating legal entity and bank account management with treasury management software empowers corporate leaders with comprehensive, real-time insights for more informed decision-making. This unified system provides a holistic view of the organization's financial structure and performance across all entities and accounts.

When evaluating the financial health of different entities, leaders can quickly access consolidated reports showing key performance indicators, liquidity positions, and risk exposures. For cash flow planning, the system offers accurate forecasts based on up-to-date data from all sources, enabling more precise working capital management.

In strategizing for growth, executives can leverage the integrated data to identify opportunities for optimization, such as streamlining entity structures or consolidating bank relationships. The system's ability to generate detailed analytics and scenario modeling supports strategic decisions on expansions, mergers, or divestitures, ensuring leaders understand potential financial impacts across the organization.

#8: Find Financial Discrepancies, Outliers, and Patterns Faster to Reduce Risk

Adopting an entity-based TMS enhances a company's risk management capabilities, enabling swift adaptation to changing market conditions. This comprehensive system provides real-time visibility across all entities and accounts, allowing treasurers and leadership to quickly identify patterns and outliers in financial data. With consolidated information at their fingertips, risk managers can more effectively monitor exposure across different currencies, counterparties, and jurisdictions. The system's advanced analytics tools can help detect anomalies that might indicate fraud or market shifts, enabling proactive risk mitigation.

Integrated data also supports more accurate and reliable forecasting. By incorporating historical data, current market trends, and entity-specific information, the system can generate sophisticated financial models. These forecasts help leadership anticipate potential risks and opportunities, supporting more agile decision-making in volatile market conditions.

#9: Reduce Redundancies and Related Costs

An entity-integrated TMS eliminates the need for multiple systems and spreadsheets, significantly reducing data entry duplication and other redundancies. This consolidation streamlines operations by providing a single source of truth for all financial and legal entity data. By centralizing information, companies can cut down on operational costs associated with maintaining and reconciling multiple systems. Using this platform reduces the time spent on manual data entry and cross-checking information across different sources, enhancing overall efficiency.

This type of TMS minimizes the risk of errors that often occur when data is manually transferred between systems or updated in multiple locations. Automated data synchronization ensures that all departments work with the most current and accurate information, reducing the time and resources spent on data validation and error correction.

Ready to see these benefits in your treasury, finance, and legal departments? Treasury4 is the first entity-based treasury management software, built by and for finance professionals who know first-hand how effective entity management can transform a business. To learn more, request a demo today.