How Legal Entity Management Can Transform KYC Regulation Compliance and Optimize Client Onboarding

Ed Barrie

In my decades of experience in treasury professional, handling KYC regulations and smoothing the client onboarding process were some of the greatest challenges I encountered — in large part due to the siloed and disparate nature of legal entity data. Gathering relevant entity information is vital to both processes, but with the data spread between various individuals and teams across departments, it becomes far more arduous and time-consuming than it should be.

The Complexities of KYC Regulations

Several years ago, when I worked at a large public company, I was responsible for foreign bank account reporting (FBAR) and had to manage the issuance and renewals of legal entity identifiers (LEIs). I inadvertently let the LEI lapse for a legal entity, which delayed a tax refund from a foreign government of over $1 million. I did not thoroughly manage the company’s data and maintain the Know Your Customer (KYC) requirements of having an active LEI to complete a cross-border payment, which cost the company significant time and delayed the receipt of money.

KYC regulations are ever-changing. Many of them were created to prevent money laundering and terrorist financing after the events of 9/11. Some requirements pre-date this as well, dating from the global financial crisis where regulators needed look-through capabilities on the underlying exposures that financial institutions had with counterparties.

Since then, regulations and complexity have only increased, leading corporates and financial institutions into perpetual, costly, and painful KYC compliance.

The industry has made attempts to centralize and standardize KYC, but with limited success because it is hard to have a single global standard and develop a centralized data repository when there is no single universal standard of what’s required. There is no single standard around KYC data requirements because of the following:

- The regulatory guidance is less than clear in some jurisdiction

- The requirements vary by jurisdiction

- Financial institutions make judgements and interpretations on what the regulators are asking for

- Financial institutions have their own specific requirements

There is significant risk with noncompliance for corporates and financial institutions including:

- Continued increase of costs and friction

- Increased potential regulatory penalties

- Continued increase in complexity of compliance

- Lack of entity management within the organization (for example, not being registered in a state or province, or inadvertently letting registrations lapse)

- Impact on business opportunities and revenue by not being able to get bank accounts open in a timely manner

- Tax risk from not understanding transaction flows, especially cross border flows between entities

- Emerging ESG and sustainability data reporting requirements which all tie back to the legal entity

How to Optimize KYC Regulation Management with Technology

Corporations need to invest in people, processes, and technology to manage the underlying genome, including legal documents. They need to be able to collaboratively share data with banking partners efficiently, and they need a way to provide active notifications when that data changes.

Banks in turn need to be able to consume that in a systematic way and share their own updates back with the corporate in a medium other than email. Email is far too manual, unsecure, and untimely to effectively manage such complex compliance processes.

Corporations need to invest in people, processes, and technology to manage the underlying genome of legal entity data. I see a future in which KYC requirements are managed with a centralized golden copy of all the most current data in a system with a full audit trail, historical tracking, and an active alerting system which sends notifications to all relevant parties so they in turn can update their systems and action those changes accordingly.

The system would also integrate the underlying dataset with relevant legal documents circulated for digital signature and stored long-term. This would ensure that these documents leverage data and workflow automation throughout the compliance process, rather than manually completed.

For years, banks have asked a lot of questions of their customers. The tides are shifting, and customers are starting to ask a lot more questions of their banks. KYC requirements will continue to increase, but they are not the root cause of the friction and frustration between corporations and their banking partners.

At the heart of this friction is the lack of managing data productively, in an active and collaborative process. Corporates and financial institutions could communicate and share data, including active updates and changes, in a straight-through process, by managing their legal entity data effectively.

Register to attend our Summer Release session on August 12th

How Entity-Related Data Silos Slow Client Onboarding

Few corporations are happy with the client onboarding experience because of the friction and repeated requests for data and documents. Financial institutions — such as banks, insurance companies, merchant processors, and asset managers — are held accountable by regulators and subject to fines or other penalties if their information is incorrect, even though they’re often the last ones to be notified when entity data changes, resulting in risk-averse institutions that are challenging to work with.

Businesses also don’t usually have a singular owner for entity-related data. This data is often owned, managed, and dispersed across multiple teams and individuals. The treasury department is responsible for collecting relevant data and communicating it with their banking and financial services partners.

When underlying source data changes, it is often not communicated in a timely manner to internal stakeholders, and these updates reach external partners like banks and financial institutions even later, creating financial risk for both the businesses and the banks.

Gathering and sharing up-to-date entity challenge is an arduous process. Entity data includes underlying legal documents such as articles of incorporation, bylaws, banking resolutions, and tax certificates, for which banks need to validate the entity, what the entity is authorized to do, and who on the entity’s behalf is empowered to bind it to certain transactions or services.

Consider the different places data exists external from your organization and your banking partnerships:

- Business registries such as the Secretary of State registries

- The GLEIF organization for LEIs

- Credit and entity reporting bureaus

- Other emerging data sources

So, how do we remove friction and increase straight-through processing? Is it possible to ensure higher quality data exchange and have a system for active notifications between parties when source data changes?

What would it look like for corporations and their banking partners to have a more connected, continuous, and collaborative relationship?

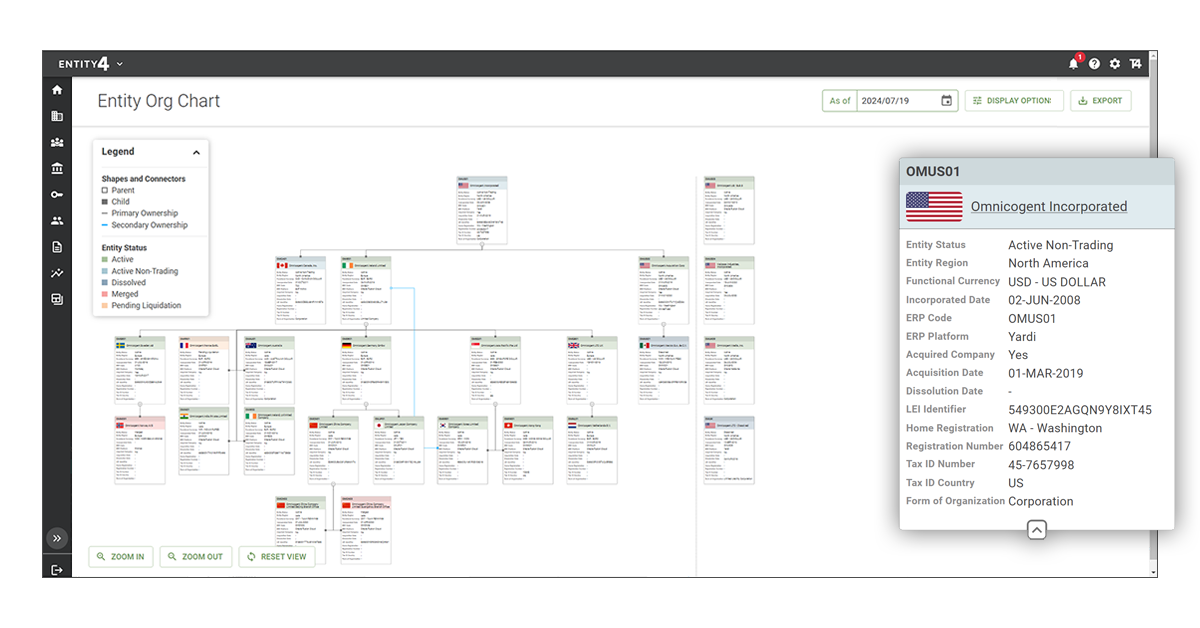

These are the questions we set out to answer in building Treasury4, the first entity-based treasury management software. Treasury4’s first product, Entity4, is built to help office of the CFO, treasury, legal, tax, accounting, and other departments that share a single repository and source of truth for entity-related data and documents.

Request a demo to learn more about Entity4 and how it can transform your KYC compliance and client onboarding processes.

"It can become overwhelming to ensure data is updated across all sources to maintain KYC compliance."

Ed Barrie, Chief Product Officer at Treasury4

About Ed Barrie

Prior to cofounding Treasury4, Ed spent six years at Tableau Software and Salesforce.com, and was responsible for building Tableau's award-winning treasury where Ed and his team earned the Treasury & Risk 2020 Alexander Hamilton award for Technology Excellence, Treasury Today 2018 Adam Smith Award for the category of Harnessing the Power of Technology as a result of driving advanced cash, payments and investment analytics as well as a 2019 Adam Smith Highly Commended Award for Best Card Solution.

Ed spent six years at Itron, Inc. as Assistant Treasurer where his team earned the Treasury Today 2014 Adam Smith Award for Best Process Re-engineering Solution for their efforts in implementing world class treasury systems and processes. Prior to joining Itron, Ed spent seven years in Microsoft’s Global Treasury Department with responsibility for treasury systems, including the company’s SWIFT implementation and treasury operations. Ed earned a Bachelor of Arts in Economics from Eastern Washington University.