5 Key Trends in Legal Entity Management and Compliance in 2025

As we enter 2025, several new trends are taking shape in the world of legal entity management and compliance—and treasurers must be prepared to adapt.

Driven by digital transformation, changing regulations, and an evolving global business environment, legal entity management and compliance have never been more complex—or more critical.

Staying ahead of these developing trends is crucial for maintaining agility, operational efficiency, and regulatory compliance. By anticipating these changes, you can help your organization avoid costly missteps and capitalize on opportunities to enhance operations.

In this article, we’ll explore the top trends developing in legal entity management and compliance in 2025.

Trend 1: Digital Transformation in Entity Management

The digital revolution is reshaping how organizations manage their legal entities in several ways.

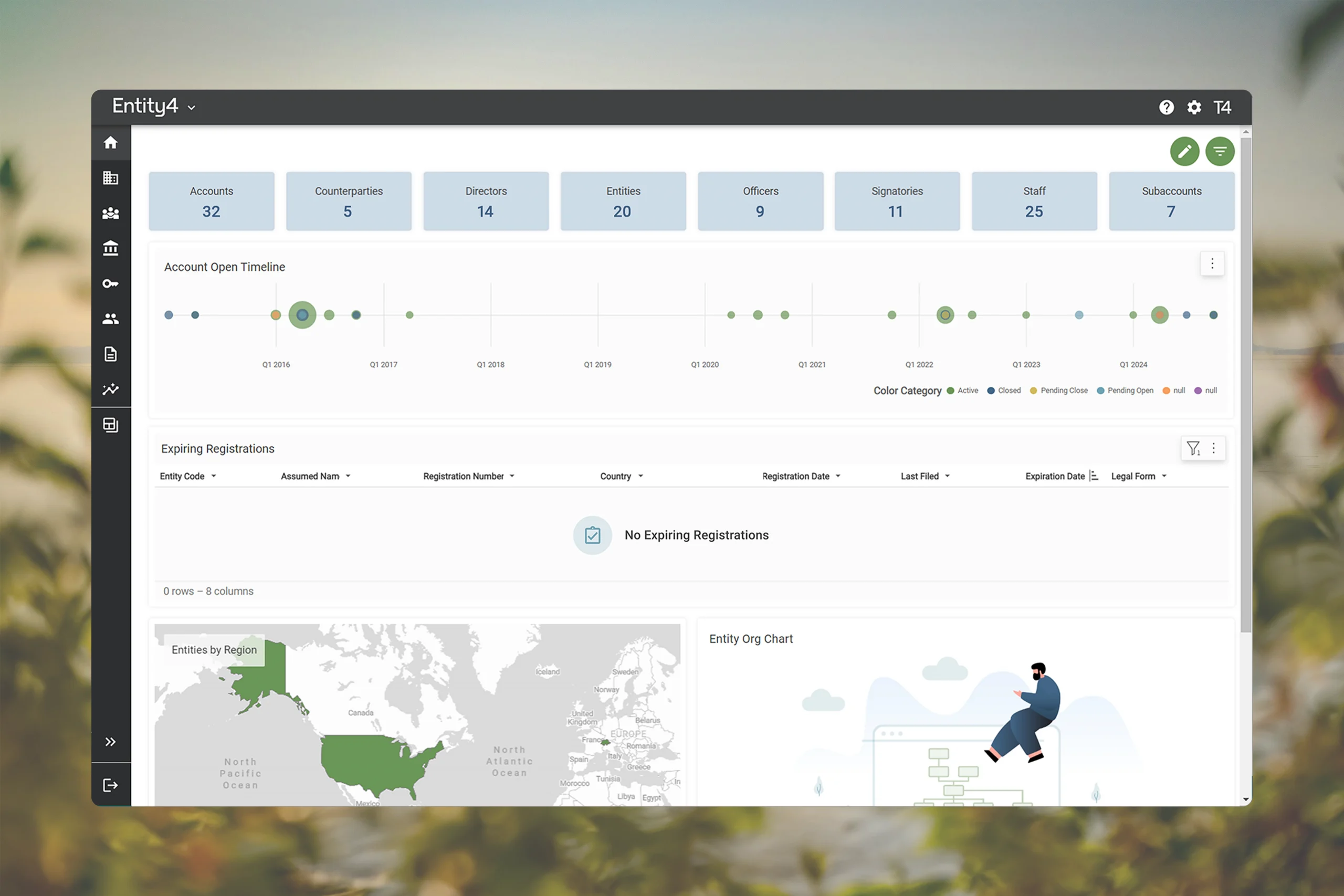

- Modern software platforms: In 2025, the adoption of advanced software platforms is no longer a luxury—it’s a necessity. Legal entity management tools, such as Entity4, are designed to address the growing complexity of managing intricate legal entity structures and the associated compliance requirements.

- Automation: Modern entity management platforms are also leveraging automation to reduce manual workloads and eliminate errors. For instance, tasks like filing annual returns, updating corporate records, and maintaining compliance calendars can now be automated, freeing up valuable time for legal and compliance teams to focus on more valuable tasks.

- System integration: Integrating entity management tools with ERP, finance, and compliance systems is creating a more holistic approach to entity management by ensuring that data is easily accessible and accurate across departments.

A multinational corporation managing hundreds of global subsidiaries could previously spend weeks preparing for audits. Modern entity management technologies, like those mentioned above, simplify this process by allowing for greater accuracy and agility.

Trend 2: Growing Regulatory Complexity and Globalization

While globalization has opened new markets for businesses, it also means that those organizations must navigate constantly evolving, jurisdiction-specific laws and regulatory requirements.

From tax regulations to sustainability and ESG requirements to data protection laws, staying compliant across multiple jurisdictions requires constant vigilance.

For instance, the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States have set high standards for data privacy within their specific regions.

Meanwhile, local nuances in corporate governance, such as reporting formats or filing deadlines, can vary widely by jurisdiction.

To address these challenges, centralized legal entity management platforms have become more critical than ever. Centralized systems ensure stakeholders can track regional requirements from one location and that all records are up to date, reducing the risk of non-compliance.

Another emerging trend is closer collaboration between businesses and regulators. Organizations are leveraging technology to provide real-time updates to regulators, fostering greater transparency and trust. Centralized legal entity management platforms are also beneficial for tapping into and sharing data.

Trend 3: Enhanced Data Security and Privacy

In an era where more organizations than ever are experiencing data breaches, ensuring the security and privacy of sensitive entity data is paramount.

New data protection regulations are on the horizon in various jurisdictions, making it imperative for organizations to stay ahead of compliance requirements. For example, stricter penalties for non-compliance with privacy laws are expected, emphasizing the need for proactive measures.

Legal entity management platforms can help companies stay compliant with data security regulations and protect critical information.

For instance, role-based access features ensure that only authorized personnel can view or edit sensitive information. This prevents unauthorized access, limiting the potential for breaches. It also allows employees to access role-specific tools so they can continue to do their jobs without sacrificing data security.

Advanced systems also provide audit trail functionalities, which record every action taken within the platform. This feature is invaluable during regulatory audits, as it allows organizations to demonstrate compliance and trace any irregularities back to their source.

Trend 4: Advanced Reporting and Compliance Monitoring

Comprehensive reporting capabilities are poised to be a game-changer in legal entity management this year. As businesses grow and expand across borders, maintaining transparency has become more important than ever for stakeholders and investors. Advanced reporting tools are helping enhance this transparency.

Dashboards and visual data representations offer a bird’s-eye view of compliance metrics. These tools allow stakeholders to monitor the status of filings, renewals, and other critical tasks in real time, enabling prompt, data-driven action when needed.

For instance, a dashboard might highlight discrepancies between legal entity structures and bank account setups, helping teams address issues before they escalate.

Organizations are also using advanced reporting tools to strengthen governance frameworks. By analyzing historical data, businesses can identify patterns and implement preventative measures to mitigate future risks.

Trend 5: Talent and Expertise Challenges

The legal and compliance sectors face a growing skills gap. As regulations become more intricate, the demand for professionals who can navigate these complexities is outpacing supply.

We’re seeing several trends emerge in how organizations are addressing this need:

- Upskilling teams: Many organizations are investing in training programs to enhance the skills of their existing workforce. Employees with knowledge of the latest regulations and technologies are better positioned to handle evolving challenges.

- Leveraging technology: Advanced tools are also playing a pivotal role in addressing the industry talent shortage. By automating routine tasks, these systems reduce the need for “human power” and allow qualified professionals to focus on strategic activities.

- Partnering with experts: Some organizations are turning to external consultants or legal process outsourcing providers to supplement their in-house capabilities. These partnerships provide access to specialized expertise without the need for specialized employee training.

Looking Ahead: The Future of Legal Entity Compliance

The above trends indicate a clear trajectory toward more efficient, transparent, and secure legal entity management practices. As organizations embrace these changes, we’re seeing treasury teams embrace several key strategies:

- Adoption of innovative tools: Leveraging modern entity management platforms, like Entity4, ensures that organizations can keep all their records centralized and up to date, stay ahead of regulatory requirements, and improve operational efficiency.

- An emphasis on collaboration: Close partnerships with regulators, consultants, and internal teams foster a culture of compliance and adaptability.

- Invest in people: Upskilling initiatives and external expertise provide the human capabilities to navigate an increasingly complex landscape.

Legal entity management and compliance are at a crossroads in 2025. From digital transformation and regulatory complexity to data security and talent shortages, the trends shaping this field reflect the dynamic nature of global business operations.

As we move forward, the message is clear: Organizations that embrace innovation and leverage advanced tools will lead the way in building resilient, compliant, and future-ready enterprises.