Modernizing Treasury: The Hidden Costs of Sticking with Legacy Tools

Legacy Treasury Tools get the job done … for the most part. What does it take to get there and what are you missing out on? Is there enough value in modern tools to motivate early adoption?

The Long Road of Legacy Technology

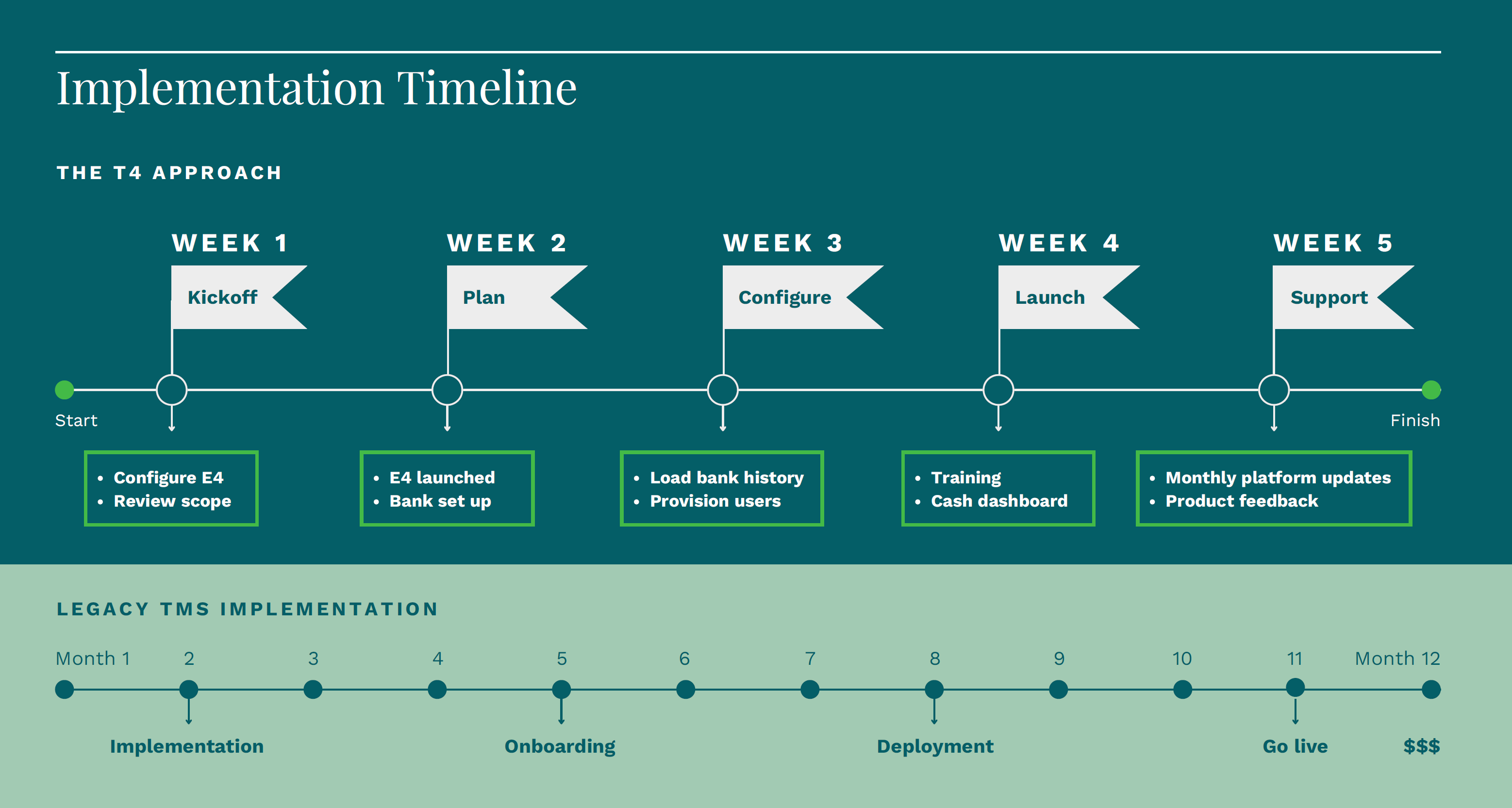

Legacy treasury tools are built to be flexible, but that flexibility comes at a cost. Setting up a new treasury management system (TMS) involves a long road of blueprinting, designing, gathering requirements, and implementation.

The flexibility offered by most legacy systems is powered by blood, sweat, some tears, and often comes at a significant cost. This process also takes numerous months or even years to complete, depending on the scope. For far too long, this has been the norm.

A Refreshing Approach with Modern Treasury Tools

With modern tools, this road is clearer. With banks, there is always some level of uncertainty, as their motivation often depends on who the client is. This deviation, however, is single digit weeks rather than multiple months as seen with legacy platforms. Key relationship banks are often the first to get connected and at the end of the day, these are the banks that bring the greatest value.

This means that while the integrations are in progress, treasurers can begin using a modern treasury management system immediately and start getting value. Most users even find that using the new system alongside their legacy processes for the week or two of transition to be interesting and informative as they can clearly see the improvement.

Reporting in these modern tools is flexible, allowing for real use of these modern platforms. This flexibility empowers users to embrace modern reporting tools, automating numerous manual processes that used to require periodic downloads and manual manipulation via spreadsheets even with a legacy treasury platform.

Furthermore, these modern tools allow for custom reporting owned by treasury users without input from IT, so the business can action adjustments to standard reports and make necessary tweaks to truly embrace these systems and maximize value.

Modern treasury tools vary with what functions are live for customers. Often, FX, debt and investment offerings are provided later. Given that these new platforms are typically built to integrate, this information can be integrated from various sources, including ERP, accounting, or treasury systems to provide a complete picture of cash even when source data comes from various sources.

Choosing to implement a modern TMS is not an easy decision for many who have dealt with manual processes and numerous spreadsheets to perform treasury operations, particularly those who have been burnt by aggressive timelines and missed milestones with other technologies.

Embracing modern technology, growing with the provider as they build out their platform, and being a trailblazer is a leap of faith in many ways. When treasury teams take the leap, however, they can reap the following benefits:

- Early adopter pricing

- Input on new products and participation in key user groups

- Nearly immediate time to value for your new solution

- No more paying for things you can’t use or haven’t set up

- Tools built for better decision making and the modern banking world

About Treasury4

Evaluating established legacy tools against new treasury platforms can be challenging. Treasury4’s founders, who are former practitioners, have created both a platform and licensing model to enable easy decision-making and risk reduction. Treasury4’s modern TMS provides near immediate adoption of the system for operations.

The platform was built with treasury and finance needs in mind. Our customers are involved in discussions on roadmap and functionality, and have the flexibility to adopt the system with unlimited users and the ability to activate and try new modules — as well as the option to cancel or re-activate at any time.

All this combined with a world-class support team that provides white glove service to guide teams through setup and maximize their use of the system.