Overcoming Common Challenges of Cash flow Forecasting

If you were to view almost any industry poll of CFOs and corporate treasury teams about their top challenges, you’d see that challenges of cash flow forecasting is consistently in the top 3 concerns for treasury professionals.

According to a study by Censuswide, nearly half (49%) of financial executives are concerned inaccurate cash flow data is negatively impacting their organization’s business decisions.

And according to a study by EY-Parthenon of 2,400 global firms, from 2017–2023, 47% underperformed their free cash flow forecast (with 36% underperforming by more than 10%).

So, why are problems with cash flow forecasting so prevalent? And, more importantly, how can treasury teams overcome them to make better, more strategic financial decisions?

Let’s find out.

The challenges with cash flow forecasting

Despite its critical importance, cash flow forecasting comes with several significant challenges for corporate treasury teams.

As a result, “[cash flow forecasting] can sometimes feel as much art as it is science,” says Ed Barrie, chief product officer of Treasury4.

Here are some of the most pressing issues:

- The scale of the data

Cash flow forecasting involves a massive ecosystem of data. You must incorporate ERPs, bank statements, investment portfolios, FX exchange rates, payroll, invoices, and much more to get an accurate forecast.

Building out the universe of data can feel like an overwhelming prospect, leaving many treasurers wondering where they should even begin.

As a result, many companies underutilize forecasting tools due to difficulty in integrating data from multiple sources.

And that leads to the next challenge.

- Siloed and erroneous data

All too often, critical financial data is stored on various spreadsheets owned by different departments and entities.

This can present several issues.

For one thing, these spreadsheets require manual updating, which is not only inefficient, it can lead to outdated or erroneous data.

For another, the data must be collected and combined, which—again—can make it difficult to get a full picture of every pertinent data point, lead to data discrepancies, and delay important decisions.

And even if you do utilize technological tools, they can come with their own set of challenges—which brings us to our next point.

- Building a data history

Cash flow forecasting is never done—it’s a constant process that evolves and builds upon prior data.

That means without a robust historical record, forecasting models lack the necessary foundation to improve accuracy over time.

Unfortunately, building your data history in forecasting tools can be a long, arduous process. With many treasury solutions, it can take weeks, if not months, to import all the various data and connect to your banking portals.

As Randy Devita, Treasury4’s vice president of customer success, says, “It’s like, every day, taking a bucket of water and throwing it in an empty pool.”

What’s more, it’s not enough to simply build the history—you must also enrich the history. Many treasury solutions limit your ability to categorize transaction history, so the data can lack critical context to accurately forecast cash flow going forward.

- Ability to adjust data

Too often, forecasting technology doesn’t allow for data flexibility. This can be problematic, as treasurers need to be able to configure and customize their data to enable a clearer long-term picture.

For instance, if there are outliers in the data that aren’t relevant to the company’s outlook, the ability to exclude those data points from the model is critical to developing an accurate forecast.

Fortunately, with the right tools, treasury teams overcome these challenges to enhance their cash flow forecasting capabilities.

The best tools to enhance your forecasts

There are multiple technological solutions available to simplify cash flow forecasting—but not all solutions are created equal.

Here are some key considerations when selecting the best tool to suit your needs:

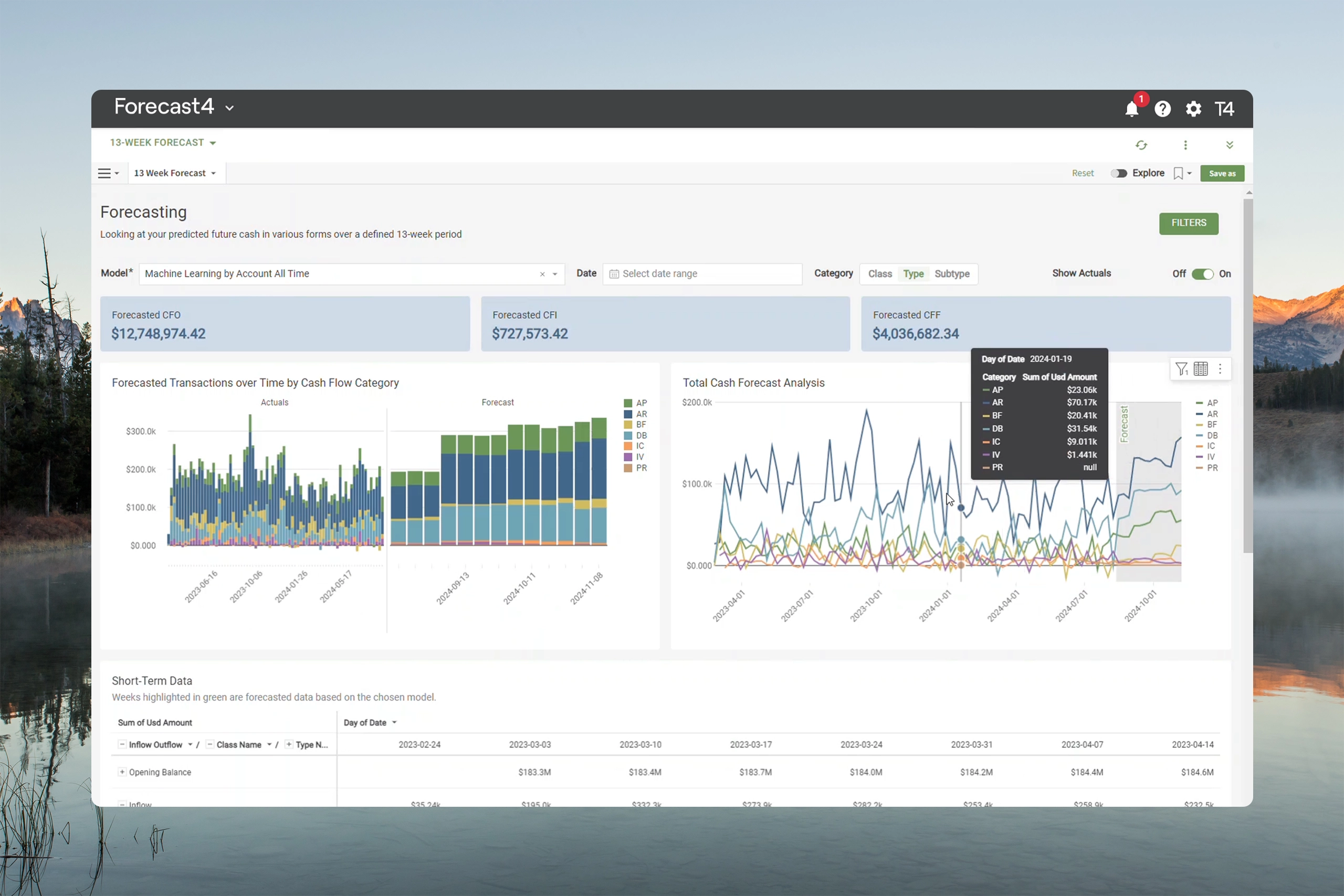

1. Statistical models and machine learning

For organizations lacking deep historical data, statistical models offer a more straightforward forecasting method. These models are particularly useful for new accounts or general cash flow trends.

On the other hand, machine learning (ML) capabilities offer several benefits for more complex patterns, including the ability to:

- Detect seasonality and transaction patterns

- Identify gaps in transaction frequency (e.g., payroll cycles that don’t follow weekly trends)

- Differentiate between debits and credits, ensuring accurate cash flow projections

Treasury4’s system enables users to mix and match ML and statistical models, ensuring flexibility and precision.

Plus, unlike traditional “black box” AI models, Treasury4 provides full transparency into how forecasts are generated, allowing treasurers to trust and validate the data.

2.Customization

There’s no one-size-fits-all solution for cash flow forecasting. Every organization has unique needs and data points to consider.

Look for solutions that allow you to:

- Manually override forecasts if machine-generated data doesn’t align with expectations

- Exclude one-time transactions that could distort future projections

- Apply multiple forecasting models to different cash categories (e.g., ML for payroll, statistical models for accounts receivable)

- Refine categorization rules for transactions to improve predictive accuracy

3.Data integration and categorization

Your treasury data system should allow all incoming data to be stored, categorized, and analyzed in real time. It should also be able to integrate data from multiple sources, such as:

- Banking partners and statements

- Investment platforms

- ERP systems

- General ledger data

The key to improving forecasting accuracy lies in how this data is categorized and leveraged.

Treasury4 applies a hierarchical categorization model that enables treasurers to track each transaction’s impact on operating and free cash flow. This structured approach helps organizations quickly analyze cash inflows and outflows, leading to better strategic decision-making.

What’s more, Treasury4’s system integrates data with much more efficiency than many other solutions.

“We've seen customers here at Treasury4 onboard up to two years of history within two days,” says Devita.

4.Real-time reporting and automated alerts

Look for reporting and analytics capabilities that allow you to:

- Customize reports based on entity, currency, region, or account type

- Schedule automated reports to be emailed to key stakeholders

- Set alerts for critical cash flow events, such as low account balances

- Compare actuals vs. forecasts to refine model accuracy over time

This level of visibility and automation ensures treasury teams can act proactively rather than reactively, minimizing financial risks.

5.Data security

Security is paramount when handling sensitive financial data. Select a solution that ensures scalability, compliance, and data segregation. For instance, with Treasury4, each customer has a separate transactional database, eliminating data-commingling risks.

A new era for treasury forecasting

As cash flow forecasting remains a top priority for CFOs and treasury teams, leveraging an advanced, scalable, and data-driven solution like Treasury4 can be the key to reducing forecasting errors, improving liquidity management, and driving financial stability.

Treasury4 is redefining cash flow forecasting by merging machine learning, statistical models, and user-driven customization into one powerful platform. By addressing historical data limitations, automating transaction categorization, and providing real-time analytics, Treasury4 empowers treasurers to make more informed, strategic financial decisions.

To learn more or schedule a demo, visit Treasury4.com.