Payments4: A Complete Treasury Solution

As financial operations become more complex, treasury teams face growing challenges in managing payments.

Traditional payment processes often fall short of addressing these challenges. Outdated systems lack the transparency, speed, and security required to manage low-volume, high-value transactions—leading to inefficiencies, manual errors, and increased fraud risks.

Modern treasurers need modern solutions.

That’s where Payments4 comes in.

Payments4 is a comprehensive solution for treasury teams that handle sensitive, high-stakes financial transactions. Built to secure high-value payments, Payments4 delivers improved visibility, control, and compliance over outdated systems.

Let’s explore how Payments4 can refine payment workflows for treasury teams, enhancing efficiency and strategic financial management.

The Unique Needs of Treasury Payments

In treasury, the payment landscape is distinctly different from the high-volume, lower-value transactions of other departments. Treasury transactions are often fewer in number but significantly higher in value. Because of that, these payments require heightened security to protect against errors and fraud.

The stakes are particularly high when large sums are moved across borders or used for strategic investments, making real-time visibility, security, and control essential.

Traditional payment systems are ill-equipped to meet these needs. Legacy software and outdated workflows can be cumbersome, prone to manual errors, and unable to keep up with stringent compliance requirements.

Payments4 addresses these challenges by offering features that prioritize accuracy, security, and adaptability for high-value transactions. Each function within Payments4 has been meticulously designed to enhance visibility, control, and efficiency while minimizing risk.

Let’s take a closer look at some of Payment4’s specific solutions.

Key Features of Payments4

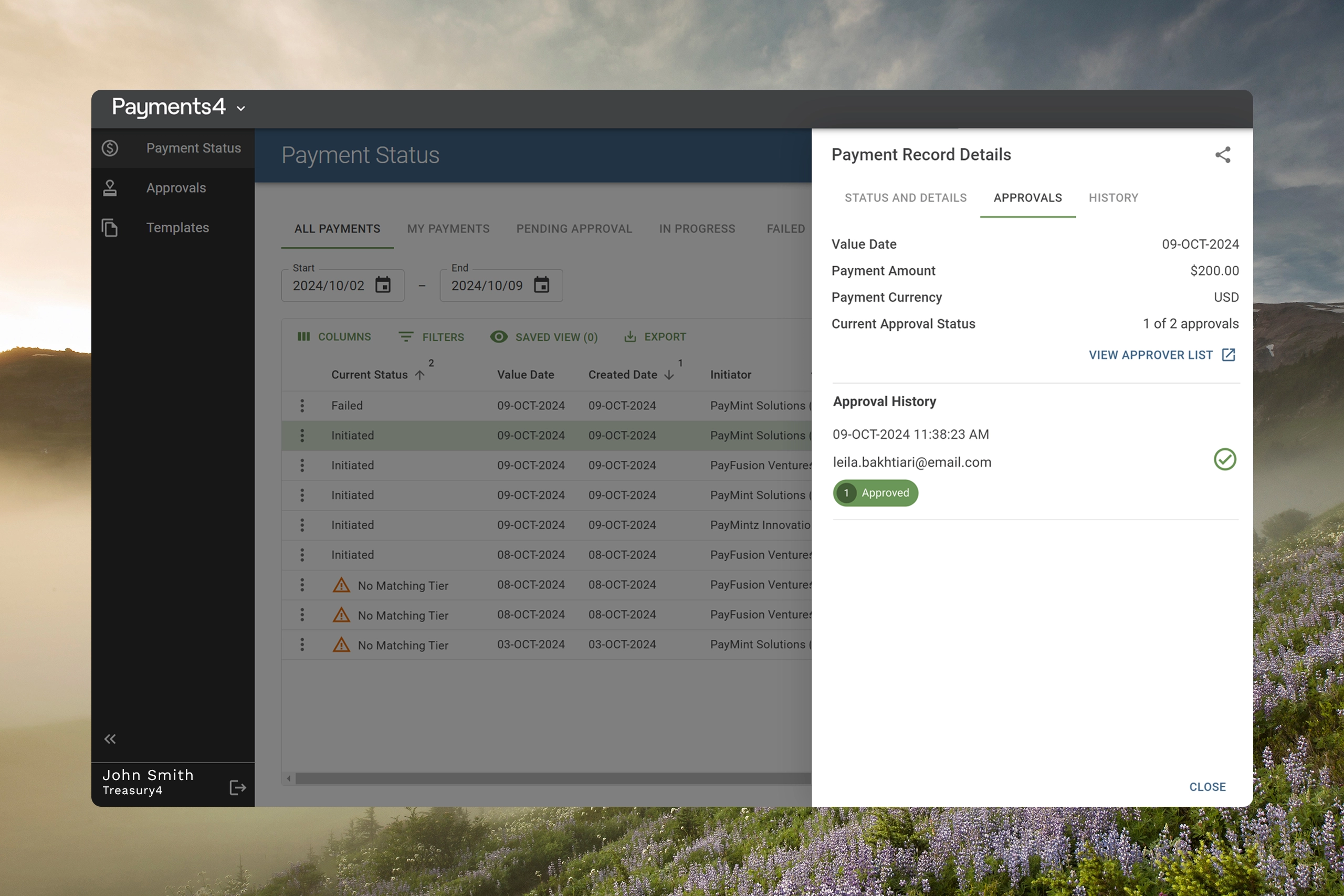

Real-Time Visibility and Control

One of the defining features of Payments4 is real-time visibility. When it comes to treasury management, having instant access to transaction updates is crucial for making informed decisions quickly. Payments4 offers real-time tracking of payment flows, which enables treasury teams to monitor and respond to the latest financial data as it becomes available. This transparency supports better strategic decision-making and ensures compliance with internal and external policies.

Real-time visibility also plays a critical role in troubleshooting issues as they arise. Treasury teams can identify and address errors and discrepancies immediately, rather than waiting for batch updates or monthly reports. This saves time and reduces the potential for significant issues to go unnoticed.

Automated Workflows and Approvals

With automated workflows and customizable approval tiers, Payments4 significantly reduces the need for manual tasks.

Treasury teams can tailor workflows based on specific scenarios or risk levels, ensuring that high-value payments receive appropriate attention. They can also automate routine tasks, such as generating payment approvals or following predefined compliance checks. Reducing reliance on manual workflows improves accuracy and frees up treasury teams to spend on higher-value tasks.

Customizable approval tiers are particularly beneficial for treasury teams that handle numerous regions, divisions, or multi-departmental transactions, where differing levels of authorization and users are often required. Automated workflows streamline these processes, reducing delays and ensuring only

Templates for Recurring Payments

For routine payments, Payments4’s payment templates save time and improve consistency. These templates allow treasury professionals to create structured, error-free payment instructions once and reuse them as needed, reducing the likelihood of errors.

They also eliminate the need to enter transaction details repeatedly—lowering the risk of inconsistencies or oversights.

Enhanced Liquidity Management

Payments4 doesn’t just handle payments—it connects directly to your treasury’s broader financial planning objectives. By linking payment data with cash position monitoring, Payments4 provides treasury teams with real-time updates on cash availability and liquidity. This connection is essential for liquidity management, as treasury teams need to ensure they have enough cash on hand to cover obligations and seize strategic opportunities.

When treasury professionals have immediate access to their liquidity status, they can make informed decisions on whether to defer or expedite payments, redirect funds, or invest surplus cash. Payments4’s liquidity management capabilities support a proactive approach to cash flow and strengthen overall financial planning.

Advanced Security and Compliance

The high-value nature of treasury payments makes security a top priority. Payments4 incorporates advanced security protocols and compliance features to safeguard sensitive transactions. Security measures include encryption, multi-factor authentication, and continuous monitoring to detect suspicious activity.

By embedding robust security protocols, Payments4 reduces the risk of unauthorized access and potential fraud, which is particularly critical in treasury environments handling high-stakes transactions.

In addition, Payments4 includes built-in compliance tools to ensure that treasury teams adhere to regulatory standards, both locally and internationally.

Compliance support is crucial for cross-border transactions, where rules can vary significantly across jurisdictions. Payments4’s regulatory safeguards streamline compliance checks, minimize risk, and help treasury teams avoid costly penalties due to regulatory oversights.

The Benefits of Integrating Payments4 into Your Treasury Operations

Payments4 offers significant benefits for treasury operations.

For one thing, with all your data centralized on a single platform, it consolidates the many moving parts of your payment workflow and eliminates the need to log into bank portals daily. This allows you to access and analyze your transaction data efficiently.

Not only can Payments4 handle traditional payment rails for things like wire payments, it can also leverage modern RTP payment rails to execute urgent payments instantly at a fraction of the cost—offering the best of both worlds.

The platform also mitigates the risk of human error by reducing manual workflows. Automated features allow you to shift focus away from routine administrative tasks to higher-level strategy. This creates more agility to respond to changing financial conditions and new regulations.

Read the fact sheet for payments >>

Scalability and Adaptability for Modern Treasury Teams

Some of Payments4’s greatest strengths are its scalability and flexibility. As businesses grow, so do their financial requirements. Payments4’s infrastructure is designed to scale alongside your organization, adapting to increasing transaction volumes, complexity, and regulatory demands. Whether managing domestic transactions or handling intricate cross-border payments, Payments4 supports a wide range of treasury operations.

Plus, with a modular design, Payments4 can be tailored to meet specific organizational needs, integrating with existing systems and accommodating new workflows as business requirements evolve.

Conclusion

For treasury teams navigating the complexities of high-value transactions and cross-border payments, Payments4 is a secure, efficient, and adaptable solution. With features that emphasize real-time control, automated workflows, enhanced security, and scalability, Payments4 empowers treasury professionals to improve their processes, manage risk, and make more strategic and agile decisions.

Payments4 also supports business growth and changes in the treasury landscape. Utilizing Payments4 as part of your treasury operations ensures your team is equipped to handle the evolving challenges of payment management.

To learn more, meet with a treasury expert.