Quick Implementation of Treasury Software Without Spending Hefty $$$

Treasury management is the backbone of an organization’s financial health. The treasury team is responsible for optimal cash flow, risk management, and operational efficiency. However, quick implementation of treasury software often feels like an uphill battle. Legacy systems demand months, if not years, of customization, integration, and training—not to mention exorbitant costs.

In today’s fast-paced business world, such lengthy processes are not just inconvenient; they’re unsustainable.

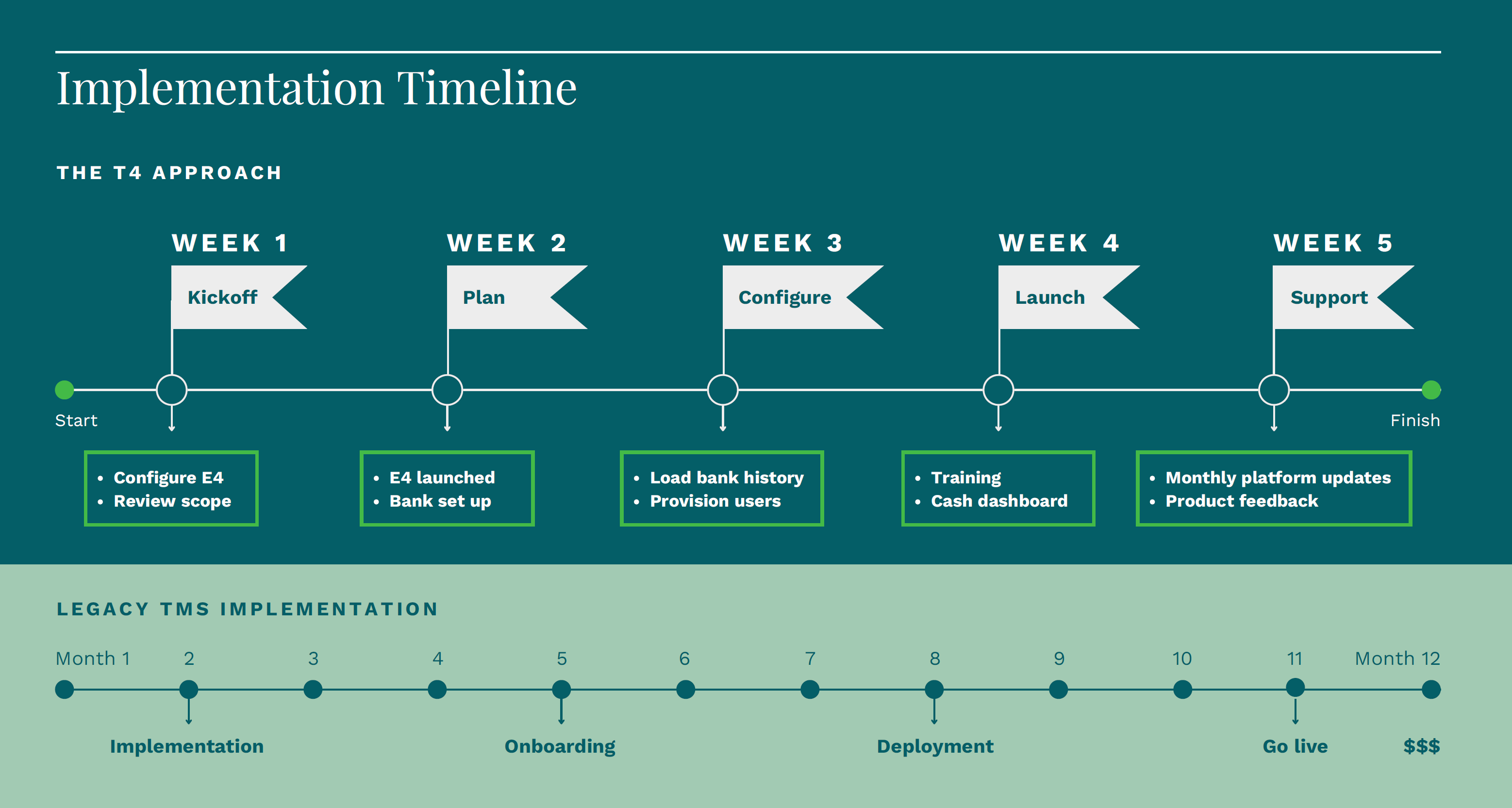

That’s why companies are turning to modern solutions like Treasury4, a modern, cloud-based treasury management system (TMS). The Treasury4 platform can be implemented in as little as 2 weeks, a stark difference to the 12-plus months required by traditional systems.

With a focus on speed, cost efficiency, and value, Treasury4 is redefining how organizations approach treasury technology upgrades.

This guide explores the importance of quick implementation, the steps to achieve it, and how Treasury4 makes it all possible—without sacrificing quality or performance.

Why Quick Implementation of Treasury Software Matters

In the financial ecosystem, timing is everything. The speed at which you can implement and start using treasury software directly affects several critical areas of your business, including:

1.Cash Flow Visibility

When your treasury system is outdated or inefficient, gaining accurate insights into your cash flow becomes a guessing game. The longer you wait for new software to be operational, the more you risk making decisions based on incomplete or outdated information. Quick implementation ensures real-time visibility into your cash positions—enabling smarter, more confident financial decision-making.

2.Operational Efficiency

Traditional implementations often require significant downtime as existing processes are overhauled. This disruption can ripple through your organization, causing inefficiencies that affect everything from payroll to supplier payments. A fast deployment minimizes these disruptions, allowing your team to hit the ground running with minimal interruption to daily operations.

3.Cost Efficiency

Prolonged implementations don’t just take time—they eat into your budget. Delays often result in unexpected expenses, from additional consulting fees to productivity losses. Treasury4’s rapid deployment model saves money by streamlining processes and delivering value sooner.

4.Competitive Advantage

In a competitive market, agility is key. Being able to adapt quickly to changing financial landscapes gives your organization a critical edge. By implementing a treasury solution rapidly, you can respond to market opportunities faster than competitors who are bogged down in months-long setups.

Key Steps for Fast and Cost-Effective Implementation

Achieving quick and cost-effective implementation of treasury software requires strategic planning and execution. These key steps ensure success:

Step 1: Define Clear Objectives

The foundation of any successful implementation is a clear understanding of your organization’s needs.

What do you hope to achieve with your new treasury system? For example, some of your priorities might include:

- Real-time cash insights

- Automated processes

- Centralized control of treasury operations

Take the time to involve key stakeholders—such as the treasury, finance, and IT teams—in defining these goals. The more precise your objectives, the smoother the implementation process.

Step 2: Choose the Right Partner

The choice of TMS provider can make or break your implementation journey. Look for a partner with:

- A proven track record of fast deployments

- Extensive industry experience to address common treasury challenges

- A customer-centric approach to ensure your needs are prioritized

Treasury4’s industry expertise and focus on rapid implementation make it an ideal choice for businesses looking for top-tier solutions and fast deployment.

Step 3: Leverage Pre-Built Integrations

One of the biggest hurdles in implementing treasury software is connecting it to existing systems like ERP platforms and various banking portals.

Treasury4 simplifies this process with pre-built integrations that reduce complexity and save time. So, instead of requiring custom coding for integration, Treasury4’s platform ensures you’re up and running quickly, without any IT involvement needed.

Step 4: Collaborate on a Clear Plan with Outcomes

A well-defined step plan is essential for staying on track. Work closely with your vendor to outline:

- Milestones and deliverables

- Roles and responsibilities for both your team and the vendor

- Specific outcomes and dates for those outcomes

By fostering open communication and collaboration with your treasury solutions provider, you can avoid roadblocks, ensure everyone is aligned on expectations, and meet your goals with ease.

Best Practices for a Smooth Implementation

To make your implementation as easy as possible, consider the following best practices:

1.Start Small

Begin with a pilot phase to focus on a high-priority solution/outcome, such as account management or cash positioning or payment processing. This allows you to test the system, iron out any issues, and demonstrate value before scaling to the entire organization.

2.Engage Key Stakeholders

Early buy-in from decision-makers is crucial. Involve them from the outset to gather input, address concerns, and ensure they feel invested in the system’s success.

3.Prioritize Core Features

Treasury software often comes with a wide array of features, and trying to adopt them all at once can be overwhelming. Focus on the core functionalities that align with your immediate needs and goals, such as cash visibility and reporting. You can expand to incorporate additional features once your team is comfortable with the basics.

4.Monitor Progress

Track key performance indicators (KPIs) throughout the implementation process to ensure milestones are being met. Regular check-ins with your vendor can help address challenges and keep the project on schedule.

The Treasury4 Advantage: Speed, and Simplicity

Treasury4 stands out as a leader in quick implementation of treasury software. Here’s what sets our approach apart:

1.Pre-Configured Workflows

Treasury4’s system comes with built-in workflows designed to meet the needs of modern treasury teams. These workflows reduce the need for extensive customization, enabling faster deployment without compromising on functionality or requiring IT oversight.

2.Intuitive User Training

Training is often a bottleneck in traditional implementations, with teams spending months learning complex systems. Treasury4 prioritizes simplicity, offering user-friendly interfaces and streamlined training programs. This ensures your team can start using the system confidently within days.

3.Immediate Value Delivery

With delivery in as little as two weeks, Treasury4 enables organizations to start realizing benefits almost immediately. From improved cash visibility to easier payment processes, the ROI begins long before traditional systems would even be up and running.

4.Cost Savings

Legacy systems often come with hidden costs, from consultant fees to extended project timelines. Treasury4’s efficient implementation process minimizes these expenses, providing a more budget-friendly and higher-quality solution.

Real-World Example: Treasury4 in Action

Before 2021, small but fast-growing cryogenics company NWR managed their treasury entirely via spreadsheets. As the company scaled, however, this process became inefficient. NWR’s finance team decided to adopt Treasury4 as their treasury management platform.

NWR now saves up to two hours per day on its cash reconciliation process, and up to an hour on regular renewals and license registration processes. When new entities are added, their org chart is automatically updated, eliminating a previously manual process and saving the team additional time.

Conclusion

In the modern treasury landscape, speed and efficiency are critical. Traditional software implementations, with their long timelines and high costs, no longer meet the demands of today’s businesses. Treasury4 offers a game-changing alternative, delivering quick implementation of treasury software, cost saver and transformative results.

By choosing Treasury4, organizations can revolutionize their treasury operations in just 2 weeks, ensuring they stay ahead in an increasingly competitive market. Ready to modernize your treasury processes without the hefty price tag? Treasury4 is your trusted partner for success.