Information Hub

Filter and Explore

Cash4 Provides An Advanced Forecasting Solution: A Fact Sheet

Equip Your Treasury Team With Precise AI/ML-Driven Tools Read the Fact Sheet

Read MoreEffective Legal Entity Management: Revolutionizing Corporate Treasury with Entity4

The Importance of Legal Entity Management Treasury practitioners navigate a complex world of legal entities,…

Read MoreHow to Choose the Right Cash Management Software for Your Treasury Team: The Buyer’s Guide

Transform Your Treasury Our buyer’s guide is designed to help you choose the right cash…

Read MoreEnable Efficient Liquidity with Payments4: A Fact Sheet

Create a Seamless Process Between Cash Positioning and Money Movement Read the Fact Sheet

Read MoreManage Your Cash Flows with Cash4: A Fact Sheet

Automate The Collection and Reporting of Cash Data with Cash4 Read the Fact Sheet

Read MoreSolve Legal Entity and Bank Account Management With Entity4: A Fact Sheet

Unify Your Data and Create A Single Source of Truth with Entity4 Read the Fact…

Read MoreTransform Your Treasury Operations with Treasury4: A Fact Sheet

The Centralized Treasury Platform Designed by Experts, for Experts Read the Fact Sheet

Read MoreThe Evolution of Treasury KPIs: 6 Metrics That Matter in 2025

Business and financial landscapes are constantly evolving-and with them, the function of the treasurer’s office. …

Read More5 Key Trends in Legal Entity Management and Compliance in 2025

As we enter 2025, several new trends are taking shape in the world of legal…

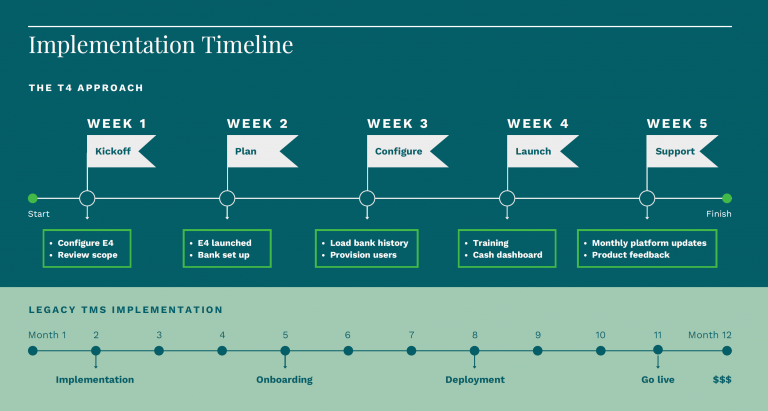

Read MoreQuick Implementation of Treasury Software Without Spending Hefty $$$

Treasury management is the backbone of an organization’s financial health. The treasury team is responsible…

Read More