Saying Goodbye to Spreadsheets: Treasury4’s Modern Cash Management Solution

90% of finance leaders agree that their key task is to prepare their business for unexpected challenges, according to a recent SAP study. More finance professionals than ever are recognizing the importance of effective cash management and the returns it can provide, including:

- More accurate cash forecasting

- Finding ways to reduce capital costs

- Liquidity planning

- Identifying investment opportunities and eliminating idle cash

With most finance departments relying on spreadsheets, legacy software and outdated architecture for their financial data, achieving effective, integrated cash flow management isn’t easy. The process of implementing a new cash management system is also challenging, but teams that choose wisely can reap the benefits far faster than they might expect.

The top treasury management solutions used by most organizations are built on decades-old technology, inflexible and contain built-in barriers that require users to pay extra just to use their own data for specific processes

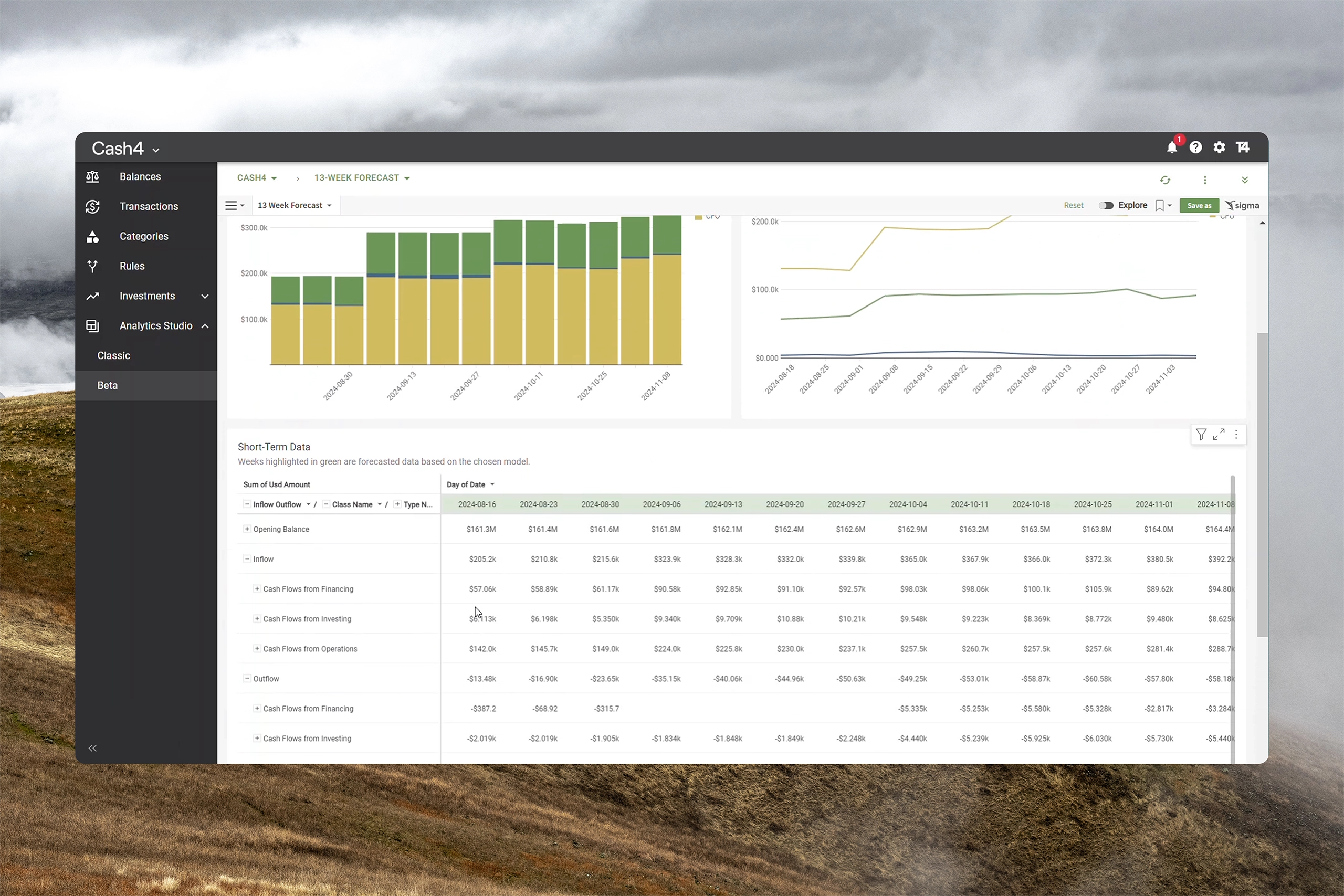

Cash4 is an automated, secure, entity-driven solution for global cash management. It enables treasury professionals to better understand, manage, and forecast their organizations' cash flow. Cash4 can simplify your cash flow management, including reporting and forecasting. And best of all, you can implement it in just a couple of weeks.

Read on to discover some of the key benefits of adopting Cash4 as your cash flow management solution and how it can help your finance team plan effectively for any contingency.

Near Real-time data integration

Conducting any kind of data analysis requires high-quality data to begin with — and financial data is no exception. Obsolete information is one of the primary contributors to poor quality data in finance. Without up-to-date data on transactions, your reporting and cash forecasts will be unreliable and inaccurate.

A cash management system that enables data integration ensures that you always have updated cash flow data. Furthering the value proposition of integrated data are APIs which enable self-service retrieval of updated balance and transactional data by your treasury platform from your banking partners when you need it and not based on any pre-defined schedule. These API integrations offer reliability and timeliness unmatched by the file-based communication often found with legacy cash management solutions.

User-friendly interface

Because as finance professionals we have spent so long relying on disparate spreadsheets with inputs from scattered sources to complete our day-to-day work, manual processes powered by outdated software have become the norm for treasury. The rest of the workforce, however, have graduated from twenty-tab spreadsheets to automated dashboards and data analytics software that can generate a customized report with the effort of just a few clicks.

This is what Cash4 offers to finance teams: a simple, intuitive solution that lets everyone, — regardless of their technical proficiency with pivot tables — search, manage, and forecast cash flows. Cash4’s built-in dashboard reporting offers at-a-glance visibility into your financial data, powered by automated flow categorizations. These delivered reports can easily satisfy most finance departments’ reporting needs, and any alterations or adjustments to reports can be made by finance users with no IT support.

Customizable reporting features

Here’s one of the most frustrating scenarios that finance professionals face on a too-regular basis: you need a report for a specific project, such as a look into the all the cash inflows in one line of business, but your cash management software can only provide the report if it includes the entire organization, or includes all transactions instead of just inflows. The inflexible nature of legacy systems often forces users back into spreadsheets.

Generating reports with custom settings is key to helping finance teams get fast answers to specific questions. For finance leaders, dynamic reports can save days of work when it comes to making strategic decisions for the organization at large. With Cash4, you can adjust your reports by any category and create advanced reports for decision making, taking into account numerous dimensions in addition to generating standard statements of cash flow for finance leadership. All reports can also be copied or customized easily to meet specific needs, providing a fast and accurate alternative to offline reports from extracted data via bank portals.

Compliance and security

Data leaks are nightmare scenarios for every business and department. Poorly secured financial data can leave your organization susceptible to disastrous losses. Finance teams have historically been rigorous in keeping their treasury data secure, and it’s more important now than ever to keep those standards up as fintech becomes steadily more regulated and audited for security lapses.

Cash4 provides the following security and compliance measures:

- Industry-standard encryption protocols to secure your data transfers

- Role-based access to data, making sensitive information inaccessible to unauthorized parties without delaying day-to-day work with extra hoops and barriers

- Dual control that requires approvals for manual updates to sensitive fields

- Built-in audit tracking to monitor all changes

A single source of truth

Even for finance teams that have long moved past spreadsheets to Treasury management systems, disparate and siloed data can be commonplace. If different stakeholders are working from different information, confusion and chaos can ensue — not to mention the consequences arising from decisions made with unreliable financial data.

World-class cash management software such as Cash4 guarantees a single source of truth for all cash flow data. It enables monitoring the complete journey of a cash flow, instilling greater assurance in users regarding the certainty of the flow as it advances through the system. Tracking the life cycle also prevents duplication, facilitating better decision-making.

Get reliable cash flow visibility today with Cash4

Change is the only constant, and today, change happens faster than ever. Arm your finance team with the cash management solution in the market that can provide accurate, reliable insights into your cash flow for contingency planning, forecasting, investment planning, capital cost management, and more. With Cash4, your finance team will get:

- Unlimited users on the platform

- Fast and painless onboarding with world-class support

- The ability to cancel your plan any time

- Automated, rule-based categorization

- Interactive cash flow reports

Request a demo to discover how Cash4 can transform the way you manage cash, fast.