Selecting a Cloud Treasury Management System: Checklist and Q&A with Industry Experts

In today’s modern treasury landscape—where companies are looking for efficient, scalable ways to manage global cash flow, liquidity, and financial risk—traditional treasury management system(TMS) no longer cut it.

Instead, finance leaders are moving toward cloud-native treasury management solutions. Unlike traditional TMS, these cloud-based platforms provide access to real-time financial data, streamline workflows, and improve decision-making.

But which cloud TMS is right for your organization?

In this Q&A, industry experts will offer insights into cloud treasury management and how to select one to meet your treasury’s needs.

Let’s dive in.

What is a cloud treasury management system, and why is it important?

A cloud TMS is a digital solution hosted on a cloud platform designed to centralize and automate treasury operations. Unlike traditional on-premises TMS, a cloud-based TMS offers flexible access through any device with internet connectivity.

This shift to cloud technology allows companies to access their treasury systems from multiple locations and avoid the costly infrastructure of on-premise setups.

What’s more, cloud TMS update automatically, ensuring instant access to the latest features and security enhancements.

Core benefits

- Flexibility: Cloud TMS can be accessed anywhere with an internet connection, making them ideal for global operations and remote teams and allowing for easy scalability.

- Cost efficiency: Moving treasury management to the cloud often reduces IT overhead, eliminating expenses related to physical servers, software maintenance, and upgrades.

- Real-time data access: Cloud TMS offer near-real-time data in one centralized platform, empowering treasury teams to make quicker, data-driven decisions and improve cash forecasting accuracy.

What questions should I ask about a prospective cloud treasury management system?

There are several factors you’ll want to consider when selecting a cloud TMS for your organization. Here are five critical questions you’ll want answered by the TMS provider you’re considering to gauge whether the platform is the right fit for you:

1.How does the cloud TMS enhance real-time cash visibility?

Cash visibility is essential for organizations to forecast liquidity needs accurately and make informed financial decisions.

The cloud treasury management system should enable near-real-time cash visibility and flexible reporting where data across regions and entities is instantly accessible. As cash flows across subsidiaries and currencies, the platform should ensure that treasury teams have the most current view of cash positions, bank balances, and forecasts.

“Moving to APIs to retrieve banking data provides direct access centrally across multiple banks. No longer limited by file delivery schedules, treasury can proactively retrieve updated data across all their accounts,” says Mitch Thomas, director of solutions engineering at Treasury4.

2. What security and compliance features do the cloud TMS offer?

As cloud TMSs handle large volumes of sensitive data, strong security and compliance features are essential to avoid costly breaches and regulatory penalties. A secure cloud TMS should offer strong encryption protocols, multi-factor authentication, and role-based access to protect data from unauthorized users.

Additionally, compliance with financial regulations, such as Know Your Customer (KYC), anti-money laundering (AML), and GDPR, is crucial. Treasury teams should verify that a cloud TMS provider complies with these requirements and stays updated with regulatory changes.

“When dealing with banking data, security is of paramount importance. Cloud offerings allow more frequent security updates and better security platform-wide,” says Thomas.

3. Can the cloud TMS support our growing needs and integrate with other systems?

Scalability and integration capabilities are critical considerations when selecting a cloud TMS. As businesses expand, their treasury requirements become more complex, and the TMS should be able to grow with them.

The system should also offer integration with ERP, CRM, and other financial systems to centralize all data, enable the easy exchange of information across departments, and reduce the need for manual data entry.

"Designed to not require IT involvement today or in the future is core to the Treasury4 solution being a value driver from day 1, and it allows the platform to continue to adapt with your business over time to help you grow, scale, and expand,” says Thomas.

4. What level of customization and flexibility does the platform offer?

No two treasuries have the same operations. The ideal TMS should offer customizable features to accommodate your organization’s unique needs. For instance, customizable reporting and user dashboards allow treasury teams to tailor the system to their specific KPIs.

“With growing availability of API data sources, real-time insights across banks and other financial systems enables modern cloud platform users to maximize the value treasury data can bring to their bottom line,” says Thomas.

5.What are some key considerations for selecting a cloud treasury management system?

In addition to the questions above, you’ll want to keep these factors in mind when you’re choosing a cloud treasury management system:

Top features to consider:

- Ease of use: The TMS should be intuitive and user-friendly, enabling treasury professionals to perform tasks without extensive training.

- Analytics and reporting: Advanced analytics tools empower finance teams with data insights for informed decision-making.

- Vendor support: Reliable customer support is essential for troubleshooting, implementation, and ongoing assistance.

"Usability and configurability of new treasury tools is of paramount importance. Encouraging users to take ownership of the solution and enabling their creativity to configure dashboards and reports to fit their needs sets the foundation for a system of action,” says Thomas.

Common pitfalls to avoid:

- Neglecting integration capabilities: A lack of integration can lead to data silos and inefficiencies. Ensure that the TMS integrates well with your existing systems.

- Overlooking scalability: Failing to assess whether the TMS can scale with organizational growth may lead to costly upgrades later.

- Underestimating compliance requirements: Compliance is critical for treasury teams. Ensure the TMS meets regulatory standards in all operational jurisdictions.

"A modern treasury platform that can be deployed in weeks provides immediate ROI to your team. An added benefit of this approach is flexibility for your system to change and adapt as your business changes and grows over time—without new projects or additional IT budget,” says Thomas.

Checklist for decision-makers:

Keep this checklist handy when you’re evaluating your cloud TMS options to help you determine if it will meet your needs:

The TMS offers:

- Timely cash visibility across all entities

- Robust security and compliance protocols

- Integration with ERP, CRM, and other financial systems

- Onboarding approach and timing

- FX risk management

- Customization capabilities (reporting, dashboards, etc.)

- Ease of use and scalability

- Strong analytics capabilities

- Vendor support

"Decisive action to improve key processes should be the priority. We often deprioritize today’s needs over tomorrow’s wants, delaying improvements to key processes that could bring true value today,” says Thomas.

How a Cloud TMS Helped These 2 Companies

1.NWR Inc.

For years, NWR, a fast-growing cryogenics company, relied on manual, on-premises spreadsheets to manage its treasury operations. As the company scaled, the system became increasingly inefficient.

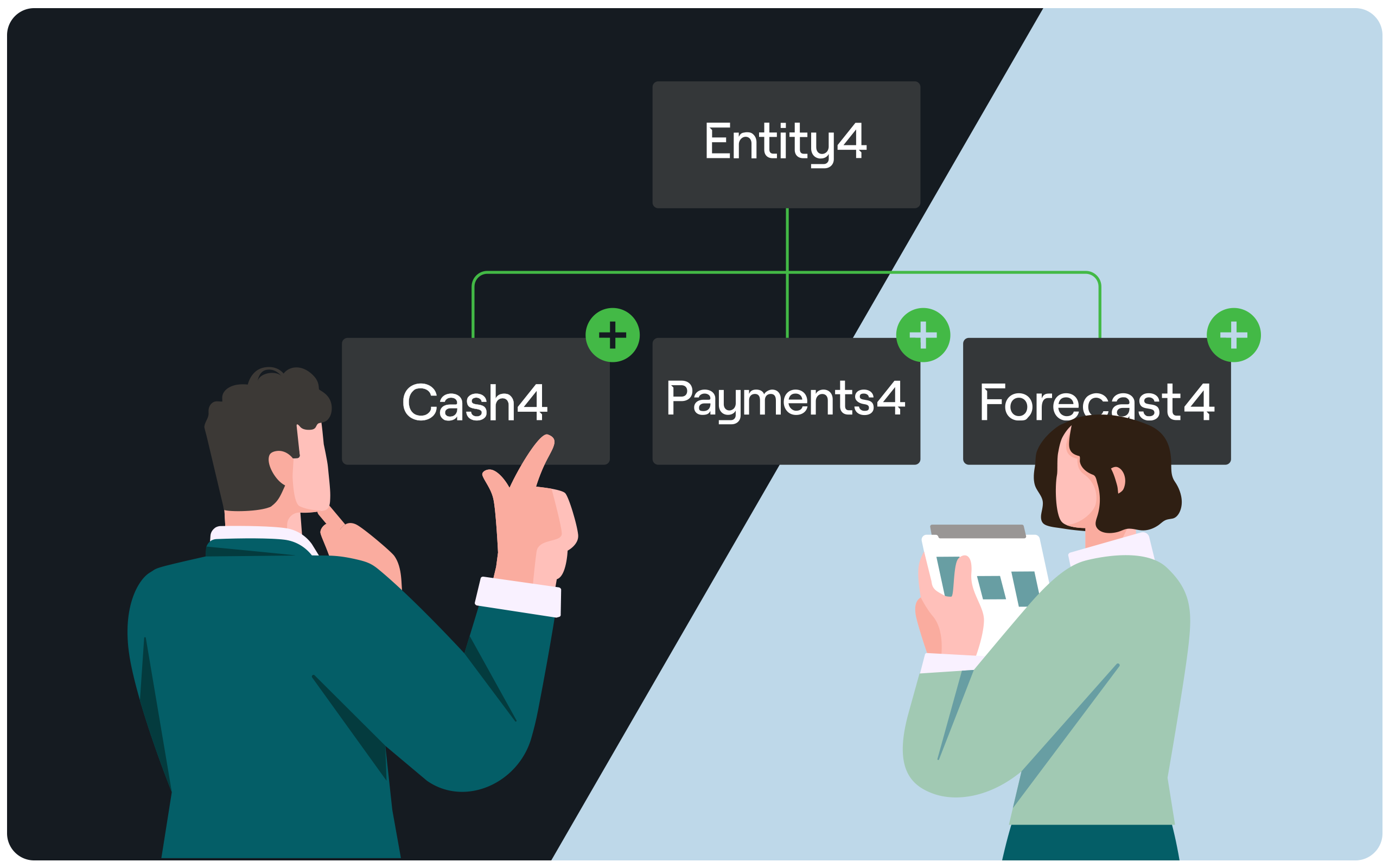

The finance team decided to implement Treasury4 to improve operational efficiency. Once NWR adopted Treasury4, its daily cash reconciliation process became about two hours shorter thanks to Cash4’s automated updates.

Meanwhile, Entity4 helped the team save an hour monthly on renewals and licenses. Entity4 also eliminated the painstaking process of updating the finance org chart with new entities.

NWR’s finance leadership also stopped needing to give employees direct access to the company’s bank accounts to do their daily work. Instead, employees now have role-based access to the Treasury4 platform.

Chief Financial Officer Savannah Reilly says, “It’s sped up the process for making financial decisions. Looking at cash flow on a more rapid time frame helps us make better decisions.”

2. Global enterprise customer

With approximately 6,000 employees spread across more than 50 countries, one global firm’s treasury processes had grown increasingly complex.

The team’s data was often cumbersome and difficult to track. As the company scaled, reliable data became more challenging to acquire and maintain.

Gaining accurate, timely visibility into their accounts was necessary to mitigate operational and credit risks and reduce bottlenecks.

The treasury team chose to implement Treasury4.

Within one quarter, the team was able to fully transition their spreadsheet-based system to Entity4, enabling them to easily track and manage all their data, including beneficial owners, tax IDs, registrations, registered agents, counterparties, bank accounts, subaccounts, signatories, officers, directors, documents, and more.

“When I look something up in Entity4, I know it’s accurate. There’s a sense of comfort in knowing we have control in the structure and the data we have,” says the company’s senior director of treasury.

By eliminating data silos and gaining control over their accounts, Treasury4 has enabled the organization to mitigate the risks of operating in 50-plus countries and make better strategic decisions.

Conclusion

In today’s dynamic financial landscape, cloud treasury management systems have become essential for organizations seeking efficient, secure, and scalable ways to manage liquidity, cash flow, and risk. By asking the right questions and understanding the core capabilities of a cloud TMS, finance leaders can select a solution that meets their strategic objectives and drives operational efficiency.