The Digital Transformation of Treasury: From Static Reports to Dynamic Insights

The treasury function has historically been defined by static reporting—in other words, periodic snapshots of financial data that offer a backward-looking view of an organization’s financial health. Digital transformation of treasury is inevitable in this day and age.

Businesses are grappling with volatility, regulatory shifts, and globalization, making static reports an outdated tool in an increasingly dynamic world. To meet these challenges, treasury teams are moving toward dynamic, real-time insights that empower proactive decision-making.

This shift is being driven by digital transformation and the adoption of treasury management systems (TMS) such as Treasury4, which provide the tools needed for high-growth companies to gather deeper, more useful data.

In this article, we’ll examine the downsides of static reporting in a modern treasury environment, why dynamic data is critical for strategic decision-making, and how modern tools are supporting treasurers in gathering these insights.

The Limitations of Static Reporting in Treasury Management

Static reporting is characterized by fixed, periodic financial reports—typically gathered manually from separate sources. While this method has been the backbone of treasury for decades, its shortcomings are becoming increasingly apparent:

- Delayed decision-making:

Static reports often rely on data consolidated from multiple sources after the fact. By the time decisions are made, the financial landscape may have already shifted, leaving organizations unprepared for emerging challenges or opportunities.

- Manual data consolidation:

Treasury teams frequently spend countless hours gathering data from disparate systems, including enterprise resource planning (ERP) tools, banking platforms, and spreadsheets. This manual process is not only time-consuming but also prone to errors, leading to inaccuracies in reporting.

- Inflexibility in financial planning and forecasting:

Static reports provide a rigid, retrospective view of financial health, which doesn’t account for sudden changes in market conditions, cash flow needs, or currency fluctuations. This lack of adaptability hampers effective planning and forecasting.

What is digital transformation of treasury?

The transition away from traditional static reporting to dynamic financial insights represents a major step forward in treasury operations. Instead of fixed, historical data, dynamic insights provide real-time, actionable data that treasury teams can use to respond to changes as they happen.

Key features of dynamic insights include:

- Real-time analytics:

Unlike static reports, dynamic insights leverage real-time data to offer up-to-date financial metrics. This ensures treasury teams always have an accurate understanding of their financial position so they can make better, more informed decisions.

- Advanced reporting tools:

Customizable dashboards and predictive analytics allow teams to identify trends, anticipate risks, and make strategic decisions.

- Scenario planning capabilities:

Dynamic systems enable treasury professionals to model various scenarios, from changes in interest rates to shifts in market conditions. This allows treasurers to prepare for a variety of outcomes.

- Proactive cash flow management:

By providing a complete, centralized picture of cash inflows and outflows, dynamic tools empower treasury teams to optimize working capital and liquidity management.

Key Benefits of Digital Transformation for Treasury Teams

Transitioning from static reporting to dynamic insights offers several significant benefits, including:

- More strategic decision-making:

Access to real-time financial data enables treasury teams to make faster, better-informed decisions. Whether it’s seizing a unique market opportunity or mitigating a risk, the ability to act quickly is invaluable in today’s volatile financial environment.

- Risk mitigation:

In the 2024 State Of Risk Oversight Report, 65% of executives noted a “significant increase” in operational risks over the past five years. And 77% said their organization had experienced some level of “significant operational surprise” over the same time frame.

Dynamic insights can combat unforeseen risks by providing a detailed view of liquidity positions, currency exposures, and counterparty risks. This heightened visibility enables proactive risk management, reducing the likelihood of major fallout.

- Enhanced efficiency:

Automation eliminates (or at least substantially reduces) the need for manual data aggregation, freeing treasury professionals to focus on strategic activities. This efficiency translates to cost savings and higher productivity. In fact, data shows that financial teams can save 30–40% of their time with automated digital tools.

- Improved collaboration:

A centralized view of financial data enhances coordination across departments, such as finance, compliance, and operations. This alignment ensures that decisions are based on a shared understanding of the organization’s financial health.

The Role of Treasury Management Systems (TMS) in Enabling Digital Transformation

Modern treasury management systems are the cornerstone of dynamic financial insights. They consolidate data from multiple sources, automate workflows, and provide advanced analytics capabilities.

Modern TMS can provide:

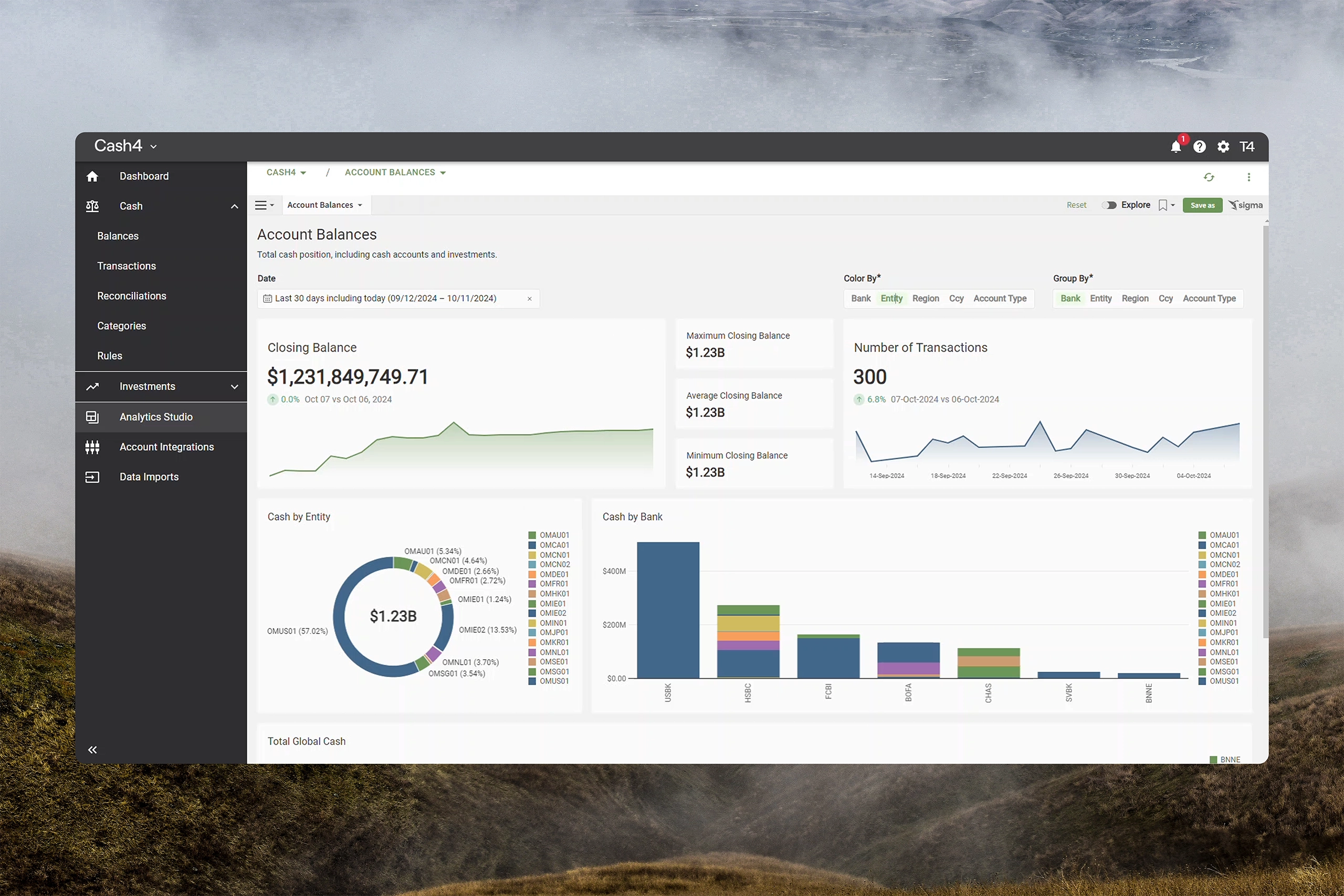

- Real-time cash visibility:

A modern TMS offers a unified view of cash positions across entities, accounts, and currencies, empowering treasury teams to optimize liquidity.

- Customizable reporting dashboards:

With intuitive dashboards, users can tailor reports to meet specific organizational needs, such as compliance reporting and performance tracking.

- Seamless integration:

Modern platforms integrate with existing systems, such as ERP and banking platforms, ensuring data consistency and accessibility. APIs further enhance this integration, automating data flows for real-time updates.

How Treasury4 stands out:

Treasury4 is designed to help high-growth companies modernize their treasury operations. Its platform combines real-time cash visibility, customizable dashboards, and predictive analytics, allowing teams to focus on strategy rather than processes. By simplifying complex workflows, Treasury4 enables treasury professionals to deliver greater value to their organizations.

Steps to Transition from Static to Dynamic Reporting

Shifting from static reports to dynamic insights requires a structured approach. Consider these steps to make the process easier:

- Assess current reporting limitations:

Begin by identifying inefficiencies in existing processes. Understand where delays occur, what data is missing, and how inaccuracies impact decision-making. - Adopt a modern TMS:

Choose a platform like Treasury4 that aligns with your organization’s needs. Look for features such as real-time analytics, integration capabilities, and user-friendly interfaces. - Train your team:

Equip treasury professionals with the skills needed to leverage new tools effectively. Training should focus on interpreting data, using analytics tools, and adopting a data-driven mindset. - Foster cross-functional collaboration:

Work with other departments, such as finance and compliance, to ensure everyone is aligned on organizational goals and strategies. A shared understanding of the data fosters better decision-making. - Continuously optimize:

Regularly review and refine your reporting processes to ensure they continue to meet evolving organizational needs.

The Future of Treasury Lies in Dynamic Insights

The evolution from static reports to dynamic insights is more than a technological upgrade—it’s a strategic paradigm shift. As businesses face increasing complexity and uncertainty, the ability to adapt quickly and confidently will determine success.

Dynamic insights offer a level of visibility and agility that static reports simply cannot match. By embracing digital transformation and leveraging tools like Treasury4, treasury teams can unlock greater efficiency, mitigate risks, and drive strategic decision-making.

The future of treasury lies in its ability to harness the power of real-time data. Organizations that prioritize this shift are not just keeping pace with the times—they’re setting themselves up for long-term success.