The Power of Banking APIs with Treasury Management Software

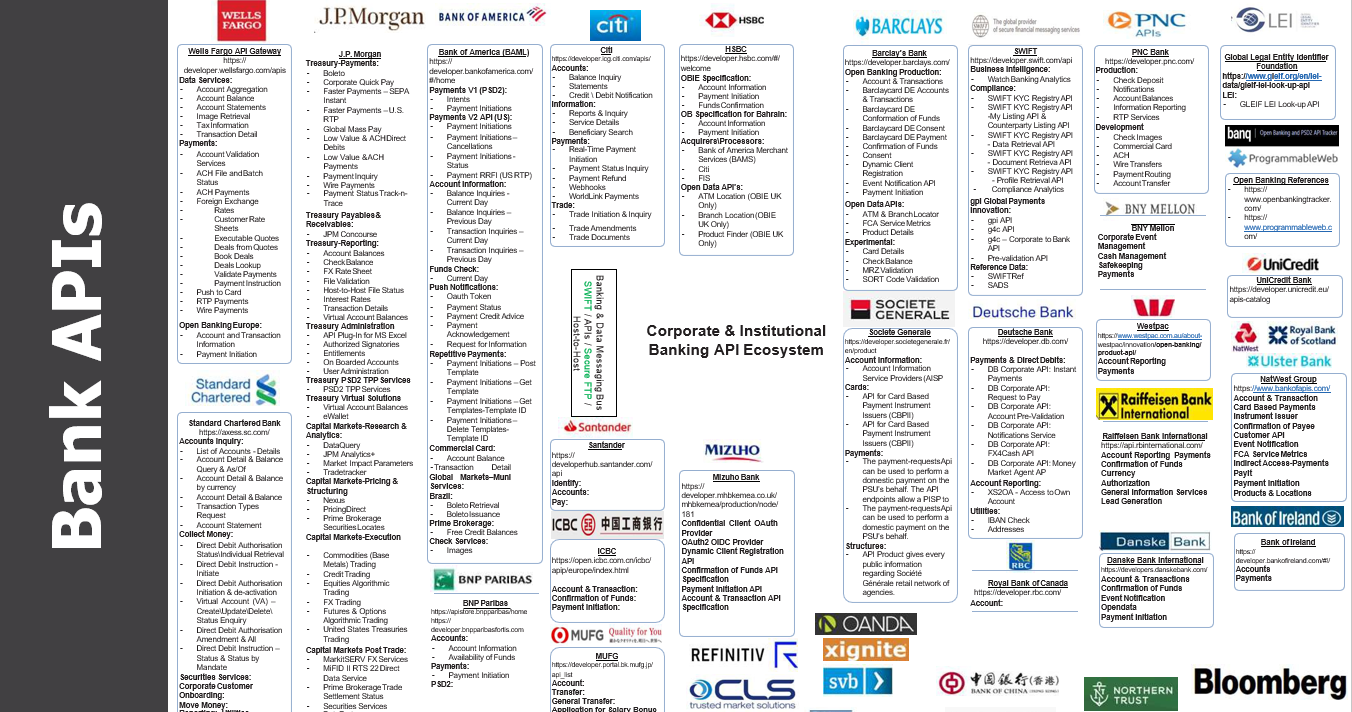

Banking APIs have revolutionized modern treasury management by enabling seamless integration and real-time data connectivity between banks and corporate treasury systems. These APIs serve as secure digital bridges, allowing treasurers to access account information, initiate transactions, and manage cash positions across multiple banks through a single location.

In the past, treasurers relied on manual processes, which were time-consuming and prone to errors, or file-based data exchanges, which could only occur based on an agreed-upon schedule with the bank, rather than as needed. APIs have transformed this landscape by providing protocols for direct communication between banking systems and treasury management software. This integration allows for automated data retrieval, transaction processing, and reporting, significantly improving operational efficiency.

Banking APIs enable treasurers and their modern treasury management solutions with:

- Comprehensive visibility: APIs enable on-demand access to account balances, transaction details, and intraday movements across multiple banks.

- Enhanced security: APIs offer robust authentication and encryption protocols, reducing the risk of fraud and unauthorized access compared to traditional file-based methods.

Challenges of Traditional Banking Connectivity Methods

Traditional banking connectivity methods that don't utilize APIs often hamper efficient treasury management, as they rely on manual or scheduled processes and disparate systems, leading to numerous inefficiencies and risks.

Manual processes

Manual data entry and file transfers are among the most time-consuming and error-prone aspects of traditional banking connectivity. Treasury staff must frequently log into multiple banking portals, download account statements, and manually input data into spreadsheets or treasury management systems (TMS). This tedious process introduces a high risk of human error, with typos, misplaced decimal points, or incorrect data entries that lead to significant financial discrepancies and poor decision-making. Moreover, the time spent on these manual tasks reduces the ability of treasury teams to focus on more strategic activities.

Data accuracy

The lack of reliable, up-to-date visibility into banking data and positions is another major drawback of traditional methods. Without API connectivity, treasurers often work with outdated information. Without access to current account balances, transaction details, and cash positions, treasury teams can end up with suboptimal cash management, missed investment opportunities, and potential liquidity risks.

Data consolidation

Consolidating data from multiple banking relationships presents a formidable challenge when using traditional connectivity methods. Companies often maintain accounts with several banks for various purposes, such as different geographical regions or specific financial products. Without APIs, aggregating this information into a unified view requires extensive manual effort and custom integration work.

The Power of API Connectivity for Treasury Teams

Connecting your treasury management solution to banks via API can significantly transform treasury operations, offering a range of powerful capabilities that streamline workflows and enhance decision-making. This integration brings numerous advantages to treasury teams, revolutionizing how they manage financial data and execute transactions.

Accurate, reliable data

One of the primary benefits of connecting your bank accounts to your treasury management system via APIs is access to accurate, up-to-date banking data. Through API connections, treasury teams can instantly retrieve up-to-date account balances, transaction details, and payment status across multiple banking relationships. This real-time visibility eliminates the need for manual data validation and provides treasurers with a comprehensive, current view of their financial position.

Automated data ingestion

Automated ingestion of data into the treasury system is another crucial advantage of API connectivity. Instead of manually downloading and importing bank statements, the system can automatically pull this information directly from bank servers, helping treasury teams save time and reduce the risk of data entry errors. Treasury teams can configure the system to update at regular intervals or on-demand, ensuring that they always have the latest financial information at their fingertips.

Execute transactions within your TMS

Perhaps one of the most transformative capabilities is the ability to execute transactions directly via API. This feature allows treasury teams to initiate payments, transfers, and other financial transactions from within their treasury management system with the same level of confidence as bank portals as a result of the immediate confirmation provided with APIs. By eliminating the need to log into separate banking portals or use file-based payment methods, API-driven transactions increase efficiency and reduce the potential for errors. Treasurers can even implement real-time payment capabilities where they are supported by their banks.

Improved cash management

With real-time data and transaction capabilities enabled by banking APIs, treasury teams can monitor their cash position, transfer excess funds into investment accounts, or to other accounts requiring funding in a timely manner with confidence. This level of automation and control allows for more effective liquidity management and optimized use of cash resources across the organization.

Key Benefits of API Integration for Treasury Teams

API integration offers numerous key benefits for treasury teams, transforming their operations and capabilities. These benefits collectively enable treasury teams to operate more efficiently, make better-informed decisions, and contribute more strategically to their organization's financial success.

Increased operational efficiency and productivity

- Automate manual data entry and reconciliation tasks

- Streamline workflows for cash management and reporting

- Reduce time spent on routine activities, allowing focus on strategic initiatives

- Quickly execute transactions and financial operations

Improved cash visibility and forecasting capabilities

- Real-time access to account balances across multiple banks

- Up-to-date transaction data for accurate cash positioning

- Enhanced ability to predict future cash flows and liquidity needs

Enhanced accuracy and control over treasury data

- Eliminate manual data entry errors

- Improved data integrity and consistency in financial reporting

- Automated data validation and error checking processes

Up-to-date insights for strategic decision-making

- Timely identification of investment opportunities and risks

- Rapid response to market changes and financial events

- Data-driven approach to treasury management and financial planning

Overcoming API Limitations and Challenges

While banking APIs offer significant advantages, treasury teams may encounter certain limitations and challenges in their implementation and use. Understanding these potential issues and developing strategies to mitigate them is crucial for successful API integration.

One common limitation is inconsistent data formats across different banks. Despite efforts to standardize APIs, variations in data structures, field names, and transaction codes can complicate data integration. This inconsistency may require additional mapping and transformation efforts to normalize the data within the treasury management system.

API outages or performance issues present another challenge. Like any technology, APIs can experience downtime or slow response times, potentially disrupting treasury operations that rely on real-time data and transaction capabilities.

To mitigate these risks, treasury teams can:

- Develop a comprehensive API monitoring system: Implement tools to track API performance, detect issues proactively, and alert treasury staff to potential problems before they impact operations.

- Implement robust data validation processes: Develop automated checks to verify the accuracy and completeness of API data — if possible, by comparing data from different APIs to validate one another and identify fraud. Identifying any differences between changes in the balance and the net change of all transactions helps track potential fraud or missing data.

- Manual downloads: Maintain alternative channels for accessing banking data and executing transactions, such as manual downloads. This ensures business continuity during API outages.

The TMS plays a critical role in consolidating and normalizing API data. A well-designed TMS can act as a central hub, integrating data from multiple banking APIs and presenting it in a standardized format. This consolidation simplifies reporting, analysis, and decision-making processes. Leveraging a TMS that also provides an open data architecture, such as Cash4, can eliminate the data silos that typically form.

Key functions of the TMS in API data management include:

- Data mapping and transformation to align inconsistent formats

- Automated scheduling of API data retrieval and updates

- Error handling and exception management for API-related issues

- Centralized storage and archiving of historical API data

By leveraging the capabilities of their TMS and implementing robust risk mitigation strategies, treasury teams can overcome API limitations and maximize the benefits of this technology. This approach enables them to create a more resilient and efficient treasury operation that can adapt to the evolving landscape of banking connectivity.

The Future of Banking and Treasury Connectivity

The future of banking and treasury connectivity is increasingly centered around open banking principles and widespread API adoption. This shift is driving a fundamental change in how financial data and services are accessed and utilized.

Open banking initiatives are expanding globally, promoting API frameworks that enable secure data sharing between banks and authorized third parties. This trend is accelerating API adoption among financial institutions and corporate treasuries alike. To keep pace with this evolution, treasury departments recognize the need for agile, API-enabled technology. Modern treasury management systems are being designed with API connectivity at their core, allowing for seamless integration with multiple banks and financial service providers.

APIs are also enabling new capabilities like embedded banking, where financial services can be integrated directly into non-financial applications and platforms. This opens possibilities for more streamlined treasury processes, such as real-time payments within enterprise resource planning systems or automated investment of excess cash through AI-driven algorithms.

Want to see Banking API's in action? Book a demo with us