The Treasury4 Story: Part 2

Ed Barrie

The road map that has become Treasury4 came from the experiences and roles I have had over my career in corporate treasury.

It all started with my time at Microsoft, when I was trying to understand their systems and data flows.

We were using multiple different systems, including integrations with SWIFT, SAP, BlackRock Aladdin, FXall, and many other source and destination applications, and I saw how the automation of combining data between systems created value for the organization and how that data could be used to drive analytics for Microsoft.

During my time at Itron, we had similar needs and were stitching together various systems to have a real time treasury platform where we could see across the company, including bank account balances and transactions, payments, deal settlements, foreign exchange exposures, hedge coverage ratios, and daily bank account reconciliation to the GL to name a few.

We received tremendous value from that data and from automating between systems which resulted in a Treasury Today 2014 Adam Smith Award for Best Process Reengineering Solution.

Building a Treasury Platform

Then at Tableau Software, I had the opportunity to build a treasury platform from scratch. First, I needed to understand all the systems and data that I would need to work with to paint the picture for Tableau including:

- Legal entities

- Banking partners

- Bank accounts

- Account signers

- Cash balances and transactions

- Cash investments

- Foreign exchange exposures

- Source of FX accounting rates

It was at this role where I discovered the value of data visualization.

By using visualizations and dashboards, we could bring these data sets together in new, visually compelling ways to drive insights and outcomes for the organization — because data for data’s sake is unhelpful unless you have a strong foundation.

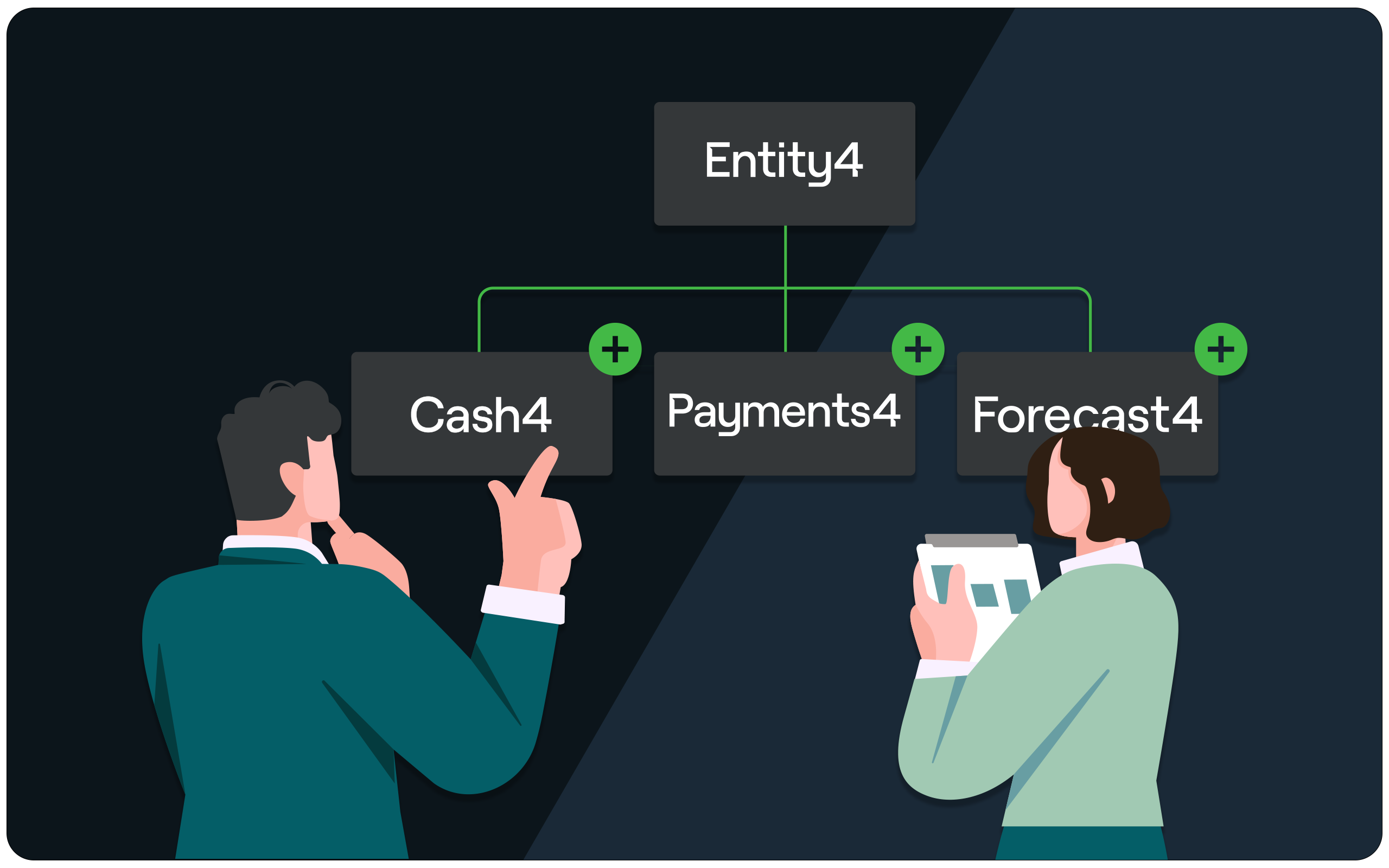

The Importance of Legal Entity Management

A significant portion of data in treasury and finance is anchored to individual legal entities.

Understanding the intersection of entities and other financial data is crucial because entities own bank accounts, have foreign exchange exposure, initiate and receive payments, and have compliance requirements.

Every entity also has required supporting legal documents that go into client onboarding and KYC documentation for banking partners.

Legal entity management is the basis of everything that happens in treasury — along with the entire finance function.

The entity dataset is dynamic, but once you have a firm grasp on your entities, then you can layer other data on top to drive greater insights.

After legal entities, the vision extended into cataloging what the overarching treasury ecosystem looks like with its many components: all of the different systems, the different technology vendors, and the many different types of data—ERP, tax, HR, investments, foreign exchange, banking, merchant processing, trade services, and corporate card, to name a few.

The Treasury4 Vision

Those experiences became the building blocks for Treasury4. We wanted to take those ideas of connectivity, integration, data, and automation to paint a picture of the organization and make it understandable, all with an eye on robust security due to the sensitivity of the data.

The challenge comes from creating a collaborative environment for different teams to keep data current and synthesizing the data from multiple systems to create insights as quickly as possible for users. The best software solves problems and creates value for customers based on the collective experience of the people designing and building the software.

I have been in the corporate treasury world since 2002 and I grew up in global, public-traded companies. Treasury4 has been a new opportunity and a natural progression for me, and I am thankful to do that with former colleagues who share the same belief, vision, values, and drive.

Along the way, we have brought in others who could help drive progress as well. It has been a real treat to see each member of our team lean in to help build Treasury4.

And now we have the affirmation and bonus of being joined by the WestCap team. They have embraced our vision because they essentially share the same perspective.

The WestCap team are corporate finance, office of the CFO, and treasury professionals. They understand the need for data, automation, analytics, and visualization.

Further, they understand the importance of a robust security posture around the data. They know firsthand the struggles of organizations, especially treasury, in getting access to and making sense of data.

Most importantly, they can empathize with our customers. The WestCap team comes to our partnership with deep experience as practitioners, having had their own unique challenges in accessing and connecting data, building workflows for workarounds, and creating insights for decision makers.

All of this will augment our strategy, so that we can approach our efforts in a much deeper and broader manner.

Our collective experience is incredibly valuable to how we build our roadmap and ultimately design our software.

Together we will build a much richer platform—a platform built by treasury and finance practitioners for treasury and finance practitioners.

About Ed Barrie

Prior to cofounding Treasury4, Ed spent six years at Tableau Software and Salesforce.com, and was responsible for building Tableau's award-winning treasury.

Ed and his team earned the Treasury & Risk 2020 Alexander Hamilton award for Technology Excellence, Treasury Today 2018 Adam Smith Award for the category of Harnessing the Power of Technology as a result of driving advanced cash, payments and investment analytics as well as a 2019 Adam Smith Highly Commended Award for Best Card Solution.

Ed spent six years at Itron, Inc. as Assistant Treasurer where his team earned the Treasury Today 2014 Adam Smith Award for Best Process Re-engineering Solution for their efforts in implementing world class treasury systems and processes.

Prior to joining Itron, Ed spent seven years in Microsoft’s Global Treasury Department with responsibility for treasury systems, including the company’s SWIFT implementation and treasury operations.

Ed Barrie

Treasurer & Chief Product Officer

Gain an unparalleled, multi-dimensional view of your financial position with Treasury4’s entity-based approach