Why You Should Treat Legal Entity And Other Non-Financial Data Like Financial Data

Steve Helmbrecht

No two organizational structures are equal. Every organization has a distinctive legal entity structure. This can include parent entities, subsidiaries, partnerships, limited liability companies, joint ventures, and other related entities.

It’s critical for key players to get a centralized view of this information to understand how their organization is structured—and how the various entities and financial accounts relate and interact with each other.

But that’s often easier said than done—particularly as organizations grow and become more complex.

In many organizations, entity information is stored in numerous spreadsheets—but these static documents aren't well equipped to handle the dynamic nature of corporate structures.

Today, we’ll examine why you should reframe the way you think about your entity data – and why looking at it in the same way you look at your financial data – can be a game changer for your organization.

Let’s start with why it’s time to say goodbye to spreadsheet-based entity management.

Why Spreadsheet Tracking Falls Short

Organizations are constantly changing—new entities are formed or acquired, others are dissolved, and key personnel come and go.

A static spreadsheet can struggle to keep up with these changes; it requires manual data entry—leading to inefficiencies, errors, outdated data, and gaps in information.

So, what should you do instead?

A Financial Approach to Legal Entity and other Non-Financial Data

One of the best ways to keep track of your organizational structure is to think of it the same way you would your financial data—and employ a similar system that can track transactions, activities and balances, both current and historical.

You have your ERP to keep track of your financial transactions and balances, compare historical data, and drive decision-making.

Having a similar tool to maintain a complete (and evolving) picture for your non-financial data is just as important.

Take compliance, for example.

Compliance is a moving target. New regulations and reporting requirements are introduced regularly—and companies must adapt quickly.

That means having systems in place that can track and manage compliance-related information, like tax identification numbers, registration renewals, filing deadlines, FBAR reporting and more.

Without a structured database and reporting, it’s much more difficult to find and update necessary data. You need a standardized system that puts all the necessary data at your fingertips. That way, you can make sure you have all your ducks in a row to stay compliant.

And compliance isn’t the only consideration. This fuller picture of your data also allows you to compare historical data points, relay critical information to key stakeholders, get clearer insights, and make more informed and strategic decisions.

The question is what system should you use?

Register to attend our Summer Release session on August 12th

How a modern, Entity-based TMS can help your Entity Management Process

When you think of a TMS, you probably think of a tool that tracks your cash holdings and transactions.

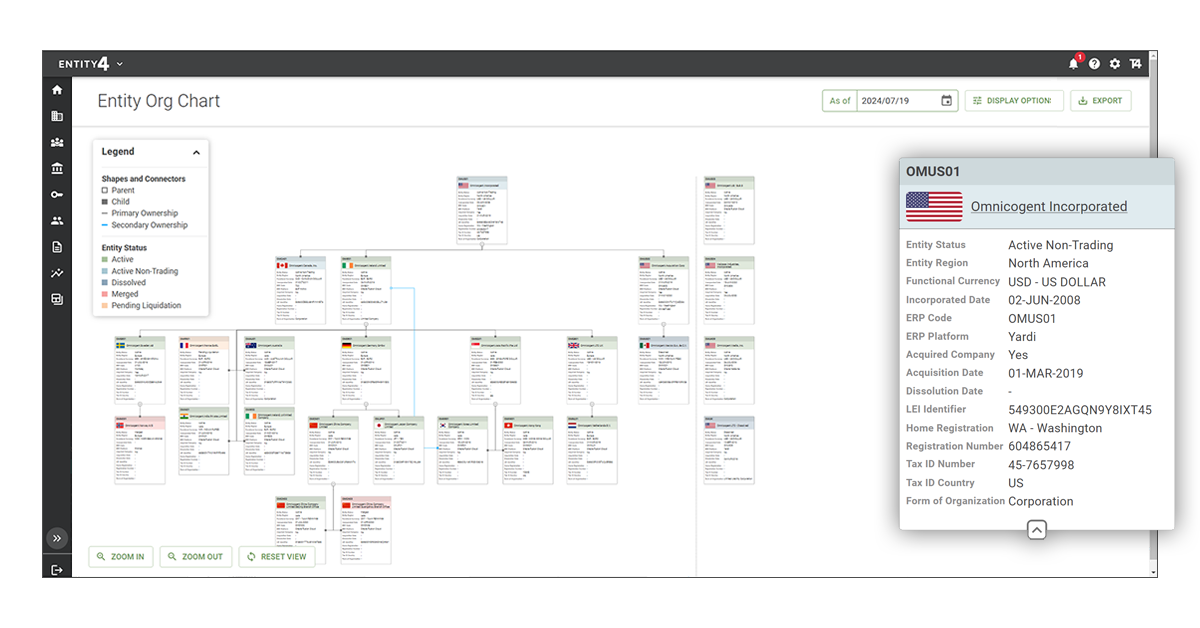

But Treasury4’s platform can help you with entity management, as well—and give you a dynamic, comprehensive picture of your entire organization. This not only allows treasurers to track financial data, but it also enables other departments, such as legal and tax, to access and manage the information they need.

By keeping all this data in a single, central repository, organizations can ensure that all stakeholders have a clear, full view of the company’s health across the board.

Centralizing non-financial data allows owners to update the data in a single location and stakeholders to be able to refer to and utilize that data with confidence.

In today’s rapidly evolving business and technology landscape, it’s also important to consider what your data needs will look like down the line. Put simply, your TMS and entity management system should also be able to easily adapt to future changes.

For example, carbon reporting and climate-related regulations are likely to become increasingly important in the years to come.

Where will that information be maintained? You'll need to be able to track these new requirements and integrate them into your compliance management processes.

Another example: Data is already a driving force of business success—and it will only become more valuable as time goes on. The ability to ingest, process, and analyze data quickly will be a key competitive advantage.

Machine learning and AI will play a vital role in the future of data collection and analysis. Leveraging these cutting-edge technologies will be critical in helping you gain meaningful insights, improve the accuracy and speed of your reporting, and identify emerging trends.

But the effectiveness of these tools depends on the quality of the underlying data. By implementing a system that standardizes and consolidates data—both financial and non-financial—you can ensure you have a solid foundation for data-driven decision-making.

Consolidate, Curate, and Understand your legal Entity and Non-Financial Data

Treasury management is no longer just about tracking cash flows and managing bank accounts. It’s about gaining a 360-degree, centralized view of an organization’s overall structure and health, ensuring compliance, and leveraging data to drive strategic decisions.

The companies that rise to the top will be those that embrace a comprehensive and collaborative approach that integrates cash management, entity management, and cutting-edge technology.

If you’re still relying on spreadsheets to manage and track your corporate operations, it’s time to consider a change.

Spreadsheets are limited in their ability to provide a comprehensive view of an organization. And spreadsheets lack the easy visibility needed to go back in time and answer historical questions about non-financial data.

They are also prone to errors, difficult to update, and lack the collaborative features needed in today’s fast-paced, dynamic business environment.

A modern entity management system like Entity4 is a much better alternative. By providing a 360-degree, centralized view of the organization, Entity4 allows companies to manage critical operational information across departments, gain deeper insights, and make more informed decisions.

"By implementing a system that standardizes and consolidates data—both financial and non-financial—you can ensure you have a solid foundation for data-driven decision-making."

Steve Helmbrecht, CEO at Treasury4

About Steve Helmbrecht

Steve Helmbrecht is President and CEO of Treasury4. From 2015 to 2018, Steve was CEO of Lakeside Capital Group, a privately held investment firm. From 2005 to 2014, Steve was CFO of Itron, Inc. (NASDAQ: ITRI), a world-leading technology and services company dedicated to the resourceful use of energy and water, with over 7,000 employees and revenues exceeding $2 billion. From 1993 to 2000, Steve was with SS&C Technologies, Inc. (NASDAQ: SSNC), a leading financial technology company, including over three years (1996-2000) in London as SVP International, where he grew SS&C’s international operations and customer base.

Steve is a board member at Washington Trust Bank and W.T.B. Financial Corporation and serves on the Board of Regents at Gonzaga University. He has a BA in Accounting from the University of Washington and a Master of Taxation from the University of Denver.