Built for Treasury.

Engineered for AI.

Know where your cash is, spot risks early, and move faster with a secure platform where your data stays yours.

All Systems Go

AI-powered, data-structured, and ready to run the enterprise

Connected Systems

Protected Data

Accurate Forecast

Intelligent Reporting

Bring it together

Turn fragmented bank and ERP data into a single source of insight.

- Sync real-time balances and transactions through direct APIs

- Map entity structures to your master data systems

- Enrich and return forecast data directly into your ERP

Ready for modern treasury: API-first, cloud-native, and built to scale.

Defeat risk

Keep sensitive treasury and entity data secure, structured, and under your control.

- Single-tenant architecture means your data is fully isolated—never shared, never co-mingled

- AI/ML without risk of contamination

- Feed only clean data into models and decisions

- Always-on visibility and compliance alignment

Bring fragmented bank and ERP data together in one place—finally.

Plan ahead

Built-in AI learns from your past transactions to surface timing changes, improve accuracy, and keep forecasts aligned with real business activity.

- Flexible ML modeling on any accessible historical data

- Tag and categorize cash flows for precise trend analysis

- Detect forecast drift early and improve accuracy over time

Your data, your database. Private by design, secure by default.

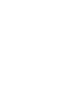

Visualize data

Built-in Sigma means interactive dashboards and real-time analytics right out of the box. No integrations, no waiting on BI teams.

- Machine learning tracks cash flow changes and flags unusual activity

- Transactions are categorized to operating, investing, or financing flows

- Trends and anomalies surface automatically, no manual prep needed

- Forecast with a level of granularity and temporal precision

All Systems Go

AI-powered, data-structured, and ready to run the enterprise

Where we’re going,

we need clean data

Think LEGOs, not glue. Treasury systems must be structured, secure, and built to scale. Treasury4's cloud-native, API-connected platforms create clean data flows that fuel AI, improve control, and enable treasury to lead with insight.

Cash4

A real-time liquidity engine that connects banks and ERPs, giving treasury full visibility while structuring transactions for reporting, compliance, and AI forecasting.

Entity4

Entity4 is your system of record for banking and legal structures, with comprehensive bank account management and treasury visibility to stay audit-ready.

Payments4

Payments4 brings order to global payments with approvals, automation, and audit trails so every transaction is traceable and compliant.

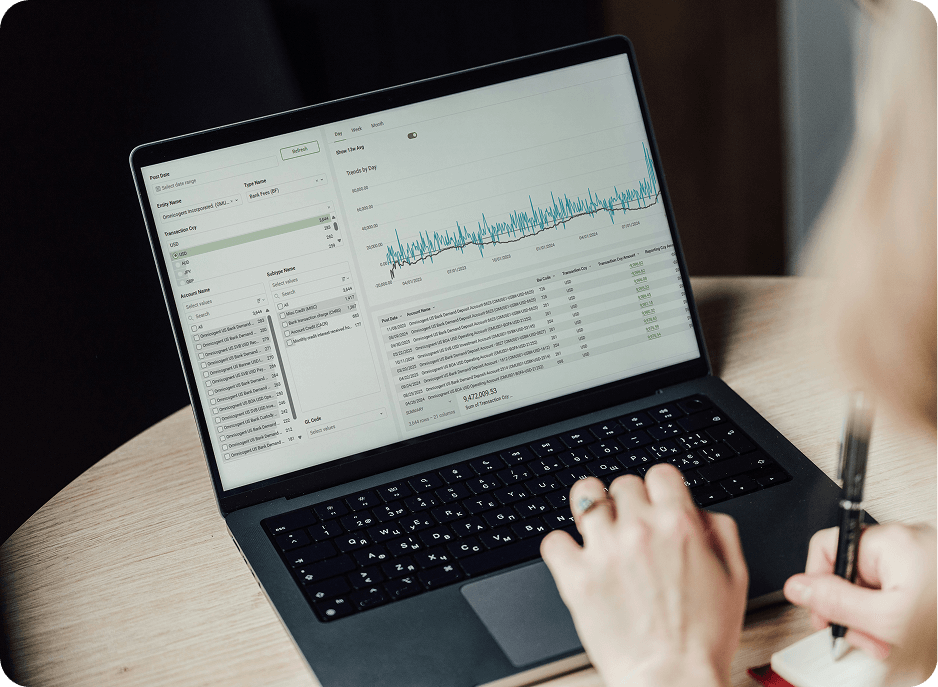

Made by the ones who’ve reconciled at midnight

Built by practitioners who’ve led global treasury teams, Treasury4 gives every treasury role clean data, real insight, and zero guesswork.

For Practitioners

Too much time goes into collecting, reconciling, and cleaning cash data before real work can begin. Treasury4 automates the manual steps, so you can focus on delivering insights—not fixing spreadsheets.

Spend less time fixing data and more time delivering insights.

For CFOs

Get the full picture of liquidity: where cash sits, how it’s moving, and what’s available to deploy. With real-time visibility, reliable reporting, and trusted forecasts, you can make decisions without delays, guesswork, or spreadsheet noise.

Step back and see your true liquidity: real-time, reliable, decision-ready.

“The primary goal was to have a single source of truth, to have a system of record that’s reliable and easy to use. With an infrastructure like the one Entity4 provides, we can easily pull reports and show internal audit our processes and systems, which was hard to do with spreadsheets.”

VP Global Treasury and Legal, Treasury

Treasury4 is a great option for any size company to get set up for success with their cash. Cash is king and small-mid size companies rarely get a program that fits within their budget that helps them manage their cash wisely.

Savanah Reilly, Chief Financial Officer at NWR

With Treasury4's cashflow reporting, we’re no longer coming from this reactive response and the reporting allows us to take a proactive approach to working capital

Chris Blow, Senior Director of Treasury at Twilio

Go live in weeks, not months

Legacy treasury systems drag out implementations for months, sometimes over a year. Treasury4 was engineered differently: API-first, cloud-native, and designed for speed. That means you can move from kickoff to audit-ready reporting in as little as 5 weeks.

WEEK 1

Kick-off

Configure Entity4,

review scope

WEEK 2

Plan

Entity4 launched,

bank set up

WEEK 3

Configure

Load bank history,

provision users

WEEK 4

Go-live

Training, cash

dashboard

WEEK 5

Support

Monthly updates,

product feedback

How It Works

Treasury4 connects your most important data—cash, payments, and entities—so you can stop reconciling spreadsheets and start making moves.

Explore the interactive demo to see how it all fits together:

It’s fast, secure, and built by treasury pros who’ve been in your shoes. Explore the Product Tour to see what clean, connected, decision-ready treasury looks like.

Who uses Treasury4? The best in the game

Spreadsheets, silos, and fire drills cripple treasury performance for most. Consistently working from clean, connected data solves this.

Without Treasury4:

From scattered spreadsheets to connected data, see the Treasury4 difference.

With Treasury4:

Spreadsheets, silos, and fire drills cripple treasury performance for most. Consistently working from clean, connected data solves this.

Without Treasury 4:

- Cash Visibility: Scattered across banks and ERPs

- Forecast Accuracy: Manual spreadsheets, late data

- Compliance Readiness: Audit fire drills, chasing docs

- Stress Levels: Up

With Treasury 4:

- Cash Visibility: Real-time across accounts, entities, and currencies

- Forecast Accuracy: AI-powered, transaction-level precision

- Compliance Readiness: Audit-ready, single source of truth

- Stress Levels: Down

From scattered spreadsheets to connected data, see the Treasury4 difference.

Checklists, playbooks, and tools that work

A treasurer is only as good as their tools. Sharpen skills, stay informed, and deliver more impact with practical checklists and guides to grow your career and make treasury the business driver it’s meant to be.

Get Out of Cleanup Mode: 10 Forecasting Fixes That Take Treasury from Reactive to Strategic

Checklist: Is Manual Reporting Slowing Down Your Cash Strategy?